North Asia

Japan's JGIA targets Wow World take-private

Japan Growth Investments Alliance (JGIA) has won board approval from Tokyo-listed Wow World Group for a take-private that values the business communications technology provider at JPY 6bn (USD 46.4m).

Orchestra to launch debut Korea, Japan blind pool fund

Orchestra Private Equity, a Korea and Japan-focused manager that has to date operated on a deal-by-deal basis, plans to launch its first blind pool fund later this year.

IMM commits $121m to Korea cloud business

IMM Investment is providing KRW 150bn (USD 121m) in Series A funding for Korean cloud computing business NHN Cloud at a valuation of KRW 1trn.

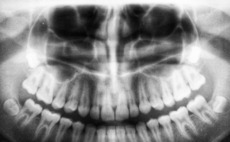

MBK, Unison Korea pursue dental implant buyout

MBK Partners and Unison Capital Korea have launched a tender offer for Osstem Implant, a Korea-based manufacturer of dental implants, that values the company at approximately KRW 2.85trn (USD 2.3bn).

Bain targets $236m buyout of Japan's Impact HD

A Bain Capital-backed take-private of Japanese one-stop field marketing services provider Impact HD, which values the company at approximately JPY 30.7bn (USD 236.3m), has won board support.

Japan's Net Marketing is sold four months after take-private

Net Marketing, a Japanese online advertising and media management business that was delisted following the completion of a successful tender offer by Bain Capital last September, has been acquired by Tokyo-listed marketing analytics player Macbee Planet....

Deal focus: Orchestra seeks the right recipe for KFC Korea

Having secured permission to do sub-franchising and to make alterations to menus and store formats, Orchestra Private Equity believes it can succeed with KFC Korea where others failed

Aramco backs Japan drone start-up

Saudi Arabia’s Aramco, the world’s largest oil company, has invested USD 14m in Japanese drone maker Terra Drone on the back of a JPY 8bn (USD 62m) Series B round.

Partners Group, Pantheon bolster Japan coverage

Partners Group and Pantheon have both strengthened their teams in Japan, with the former appointing Teppei Kawai as country head and the latter promoting Akitoshi Yamada to partner.

Bain & Co appoints new Asia PE practice co-head

Bain & Company has named Sebastien Lamy, who has been with the firm for over 20 years and most recently focused on Asia infrastructure investment, as co-head of its regional private equity practice.

Profile: Elevation Equity Partners' Gordon Cho

Negotiating a spinout while troubled by health issues tested Gordon Cho’s faith and resilience. He feels stronger for the experience and is now looking to make his mark on Korea’s middle market

Deal focus: VIG secures rare airline turnaround opportunity

VIG Partners stepped into the breach when Eastar Jet’s previous white knight bailed. It agreed to recapitalise the airline on obtaining assurances that key licenses and routes remain in place

Labour shortages: Tales from north and south

Australia and Japan are facing extreme labour shortages. In the former, GPs can survive on policy support and emergency manoeuvres. In the latter, fundamental strategy shifts are a more immediate imperative

Japan rocket start-up Interstellar gets $29m Series D

Interstellar Technologies, which in 2017 became the first Japanese company to launch a privately developed space rocket and is currently working on solutions for sending small satellites into orbit, has raised JPY 3.8bn (USD 29.6m) in Series D funding....

GIC, PIF invest $924m in Korea's Kakao Entertainment

Singapore’s GIC and Saudi Arabia’s Public Investment Fund (PIF) have agreed to invest a combined KRW 1.15trn (USD 924m) in Korean internet giant Kakao’s entertainment division.

ICG invests in Korea's Big Mama Seafood

Intermediate Capital Group (ICG) has announced a second deal in three weeks from its fourth Asia fund – which closed last year on USD 1.1bn – with a commitment of undisclosed size to Korea-based Big Mama Seafood.

VIG acquires Korea's Eastar Jet

Korea’s VIG Partners has acquired 100% of local low-cost airline Eastar Jet for USD 117m, citing plans to introduce new aircraft to the fleet as part of a “quick turnaround.”

MBK buys Korea dental scanning player Medit, Unison exits

MBK Partners has agreed to buy Medit, a South Korea-based manufacturer of 3D dental scanners, for a valuation of approximately KRW 2.4trn (USD 1.88bn). The transaction facilitates an exit for Unison Capital’s Korea business.

NSSK exits Japan nursing care provider to Ricoh Leasing

Japan-based mid-market private equity firm NSSK has exited nursing care provider Welfare Suzuran to Ricoh Leasing, a Tokyo-listed leasing and finance company, for an undisclosed sum.

KKR buys Japan's Bushu Pharmaceuticals from BPEA EQT

KKR has agreed to buy Japan-based contract drug manufacturer Bushu Pharmaceuticals from BPEA EQT – formerly Baring Private Equity Asia – for an undisclosed sum.

2023 preview: Japan middle market

Confidence in Japan’s middle market is whipping up new deal flow, new funds, and new exit channels that will play out in 2023. This includes the possible reanimation of a dormant IPO market

Q&A: Bain Capital's David Gross-Loh

David Gross-Loh, a managing director and a founding member of the Asia business at Bain Capital, on expanding into Osaka, targeting large-cap carve-outs in Japan, and the availability of deal financing

2022 in review: End of the party?

Fundraising favours the few; deployment becomes progressively slower as investors agonise about valuations, macro prospects, and financing costs; sponsor-to-sponsor deals prop up exits

Korea's Google-backed Mathpresso raises $70m

Seoul-based education technology start-up Mathpresso has closed its Series C round on USD 70m following an investment of undisclosed size last year from Google.