2022 in review: End of the party?

Fundraising favours the few; deployment becomes progressively slower as investors agonise about valuations, macro prospects, and financing costs; sponsor-to-sponsor deals prop up exits

Asia fundraising: The Sequoia show

With LPs increasingly reluctant to commit, Sequoia Capital's bumper fundraising effort highlights the gap between haves and have nots

Sequoia Capital has raised USD 11.7bn across its China, India, and Southeast Asia strategies over the past 12 months. This is more than any other manager in the region that achieved a final close on a PE or VC fund – BPEA EQT came second, closing its eighth pan-regional vehicle on USD 11.2bn. It also amounts to 12.6% of commitments to all US dollar-denominated funds in Asia year-to-date.

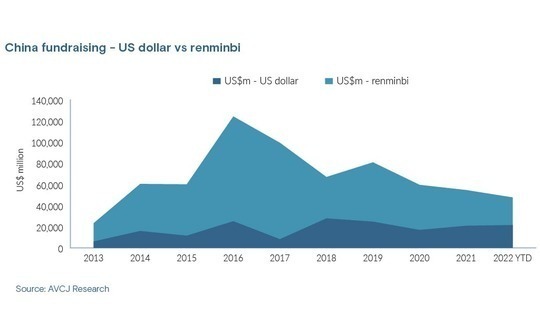

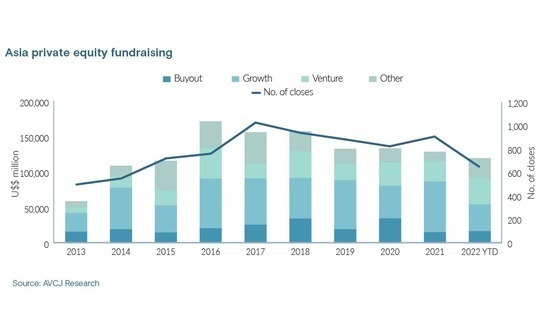

There has arguably never been a clearer demonstration of the widening gap between managers that raise capital with consummate ease and those that struggle to raise any money at all. Asia-based funds have attracted USD 119.7bn as of mid-December 2022, down from USD 128.8bn in the full 12 months of 2021. The annual average for the preceding eight years is USD 138.3bn.

Strip out the renminbi-denominated funds and the picture doesn't look so gloomy. The total of USD 92.6bn narrowly exceeds those of 2021 and 2020. Yet the number of partial and final closes is at an eight-year low of approximately 400. This compares to just over 700 in 2021 and just 700 in 2020.

Approximately USD 21.5bn has been committed to US dollar China funds, beating last year's total despite LPs holding back on private equity generally for overallocation and macroeconomic reasons and on China specifically because of geopolitical, regulatory, and zero-COVID-19 policy concerns.

However, about USD 0.40 of every dollar raised went to Sequoia. Include Qiming Venture Partners, which closed its latest US dollar fund on USD 2.5bn, and the share surpasses USD 0.50.

Stories abound of China fundraising challenges. FountainVest Partners, having hit the hard cap on each of its three previous funds, took 20 months to close its fourth just above target on USD 2.9bn. BAI Capital launched its debut fund in 2020 and looked set for the hard cap of USD 750m until fate intervened, the process was put on hold for six months, and a final close of USD 700m came in July.

The likes of Genesis Capital and BA Capital are said to have suspended or slowed their fundraising processes, while Legend Capital and Joy Capital are among those to modify their expectations.

It is no easier on the renminbi side, despite a widely held belief that local currency is the best option when investing in areas like semiconductors and deep technology, given companies are most likely to list domestically and founders might be wary of the regulatory implications of taking offshore funding. Around USD 6.7bn has gone to renminbi funds in 2022, down from USD 8.3bn in 2021.

China's share of overall Asia fundraising – including renminbi – has fallen to 40% from 48% in 2021. Its decline, in percentage terms, isn't more dramatic because fundraising region-wide has struggled.

Within Asia, only two major jurisdictions – Australia and India – have raised more in 2022 than they did in 2021, although Southeast Asia is could feasibly join them by year-end.

Australia was boosted by BGH Capital closing its second fund on AUD 3.5bn (USD 2.4bn), the largest sum ever raised for an Australia and New Zealand-focused private equity vehicle. However, the total is also somewhat skewed by a couple of large infrastructure and renewable energy funds.

India and Southeast Asia continue to ride the tech wave. India saw a slew of pre-IPO funds raised by wealth managers like IIFL Asset Management and Kotak Private Equity as well as sizeable fundraises from traditional VCs such as Lightspeed India Partners and Elevation Capital. In Southeast Asia, Jungle Ventures, Insignia Venture Partners, East Ventures, and Openspace Ventures were all active.

And then there is the Sequoia connection. The firm's Southeast Asia team, previously an extension of the India business, raised USD 850m for its first standalone fund. Meanwhile, the latest India vintage, comprising venture and growth funds, closed on USD 2bn, up from USD 1.35bn in 2020. The Sequoia share of overall India fundraising? A somewhat more modest 19%.

Investment: The Ukraine effect

External pressures have contrived to slow the pace of investment and encourage GPs to seek shelter in tangible assets and developed markets

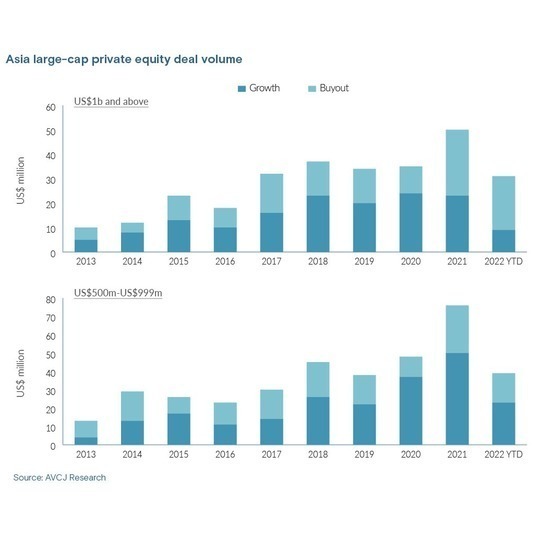

Timing is everything in private equity. Of the 31 USD 1bn-plus private equity deals announced in Asia this year, two-thirds came in the first half of the year, prior to the most significant deteriorations in macroeconomic performance and mounting concerns about inflation. Five predate the outbreak of war in Ukraine and another five were disclosed in the first quarter.

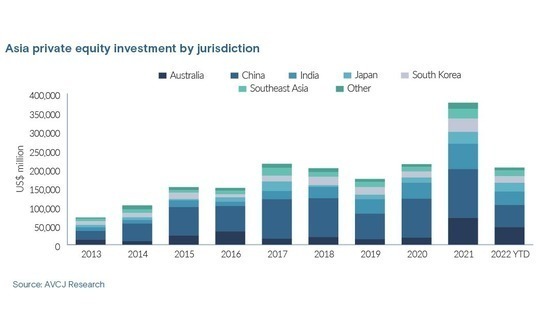

The first three months of 2022 were relatively buoyant: USD 75.9bn was deployed in Asia, well short of the record levels of activity in the second half of 2021 but on par with the average for the previous eight quarters. Investment sunk to USD 49.7bn in the second quarter and USD 42.2bn in the third, the lowest level seen since the immediate fallout from COVID-19 in early 2020.

GPs have, by most accounts, slowed their pace of investment as the year has progressed and there's no shortage of reasons why: global macro concerns; uncertainty tied to China's zero-COVID-19 policies; increased cost and limited availability of financing; and expectations that assets could become available at lower valuations in the new year when private market valuations finally correct.

The number of USD 1bn-plus buyouts hasn't fallen substantially – from 27 to 22 – but capital put to work in these deals is down by more than half at USD 50.9bn. In the growth space, USD 45.6bn went into 23 transactions of USD 1bn or more in 2021. Those totals have fallen to USD 15.9bn and nine in 2022. Deal volume is off by a similar magnitude for growth investments of USD 500m-USD 999m.

Reduced large-cap growth-stage activity is a consequence of substantial selloffs of global technology stocks earlier in the year, which shook confidence in private market valuations and raised questions as to when late-stage investors might expect to see liquidity events. There have been approximately 70 deals in Asia of USD 500m or more. One-third qualify as growth-stage and only 10 are technology.

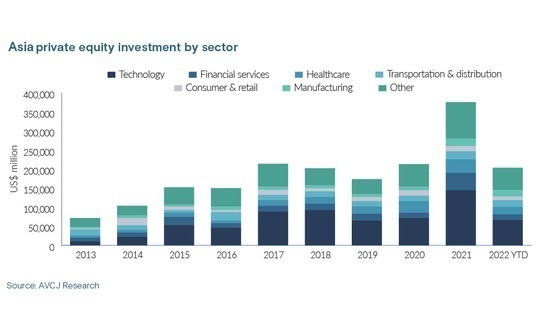

Moreover, there has been a noticeable shift towards the perceived stability of more tangible assets and developed markets. Of the 20 largest investments so far this year, excluding energy and utilities, seven involve manufacturing, two are logistics operators, two are retail chains, and two are telecom. The largest is The Blackstone Group's acquisition of Crown Resorts, a hotel and casino operator.

The latter two sectors have seen the smallest drops in investment, year-on-year. The robustness of manufacturing is most striking. Since 2013, financial services and healthcare have each received about 1.8x the capital targeting this sector. Yet in 2022, manufacturing accounts for 8.5% of the market, up from 5.3% in 2021. This compares to 7% for financial services and 9.8% for healthcare.

Australia accounts for 10 of the region's 30 largest deals, including two of the top five. In addition to Crown Resorts, there have been sizeable deals involving telecom, healthcare and pet healthcare, and financial services assets. Seven of the top 30 and four of the top 10 have been in Japan. Carve-outs are a significant theme, with the likes of Olympus, Hitachi, and Seven & i Holdings selling assets.

Growth-stage tech: Moderation mode

The comedown has impacted India, Southeast Asia, and China alike, although the latter is seeing traction in growth deals beyond technology

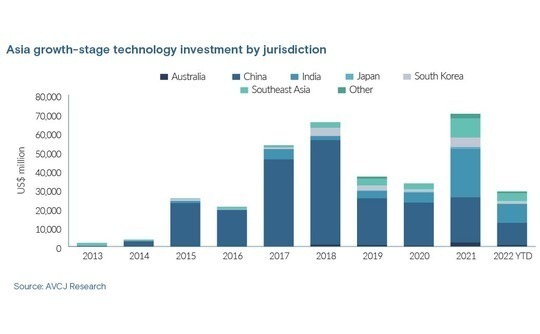

Growth-stage technology investment in Asia has, inevitably, taken a substantial hit. China is down more than 50% year-on-year at USD 11.8bn, but the country has nevertheless regained its position as the region's largest market. This is because the surge in activity that saw growth-stage deals reach a record USD 70.1bn in 2021 was driven by India and Southeast Asia. Both have slowed significantly.

India pipped China with USD 25.6bn last year, up from just USD 5.2bn in 2020. Southeast Asia rose from USD 2.8bn to USD 10.2bn. Fast forward to 2022 and Asia growth-stage technology investment stands at USD 29bn, of which India and Southeast Asia have contributed USD 9.9bn and USD 4.3bn.

There are more encouraging signs in early-stage technology, where the slump from USD 47bn to USD 33.4bn in 2021 is largely a result of China investment falling by half to USD 10.7bn. India and Southeast Asia have seen smaller declines; Japan and South Korea have posted increases.

AVCJ Research has records of 307 growth-stage technology deals, down from more than 500 in 2021. Of these, 28 amounted to USD 300m or more. China is responsible for the two largest: a USD 4.7bn commitment to Changxin Memory Technologies, a semiconductor foundry also known as Innotron; and a USD 1bn round for Shein, a fashion e-commerce platform popular outside of China.

However, Byju's is no longer the fresh-faced poster child of Indian technology. It has deferred plans for an IPO and – like its major industry peers – announced significant job cuts in recent months as part of efforts to tighten up unit economics and push towards profitability. Additional pressures come in the form of students returning to physical classrooms and post-pandemic screen fatigue.

Some of these challenges are specific to market segments, but they point to broader concerns about high-cash-burn business models and poor sightlines to profitability amid a more challenging capital-raising environment. In Southeast Asia, for example, Openspace Ventures raised its debut growth fund but observed that delayed IPOs, down rounds, and industry consolidation loom large.

Amid the focus on China's growth-stage technology demise, what doesn't get captured is the switch towards sustainability and policy-driven investments. Cleantech and electric vehicle (EV) value chain – not just carmakers but also manufacturers of batteries, smart cockpits, and increasingly, specialist semiconductor chips – are key components.

Growth-stage semiconductor deals, which do fall under technology, amount to USD 6.6bn year-to-date, up from USD 3.1bn in 2021. Cleantech, which does not, peaked at USD 3.9bn last year and has seen less activity in 2022. EV makers, meanwhile, have received USD 5.4bn this year, of which USD 3.3bn is classified as growth stage. This compares to USD 2.5bn for early and growth deals in 2021.

There is one mega-deal: GAC Aion, an EV brand under state-owned automaker GAC Group raised USD 2.5bn from a host of renminbi funds, many of them government-linked. This is not an isolated case, with similar slates of investors backing EV units of Changan Auto, SAIC Motor, Dongfeng Auto, and Geely. There has even been a suspected state-backed bailout of independent EV maker Letin.

Monetising managers: M&A to IPO

Liquidity events involving investment managers are a rarity in Asia. Three were promised in 2022, with the Baring Asia-EQT tie-up grabbing the headlines

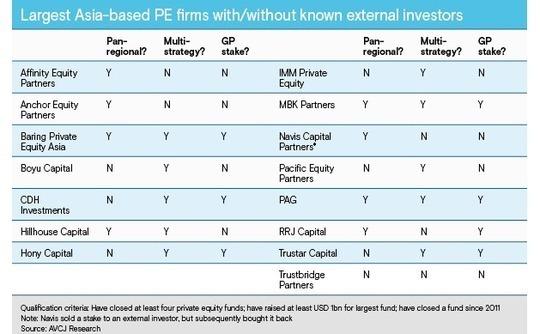

There were three significant liquidity events involving the management entities of Asian private equity firms in the first quarter of 2022 – each of which has implications for the "fund of firms" strategy that has taken off globally but remains underpenetrated in Asia.

In January, MBK Partners sold a 12% GP stake to Dyal Capital Partners, a unit of US-based alternative investment firm Blue Owl that buys interests in third-party managers. The North Asia-focused buyout firm, which has more than USD 24bn in assets under management across buyout and special situations funds, was said to have earmarked part of the proceeds for seeding new investment strategies.

Only two other large-cap pan-regional managers have participated in similar transactions: Affiliated Managers Group (AMG) bought 15% of Baring Private Equity Asia (BPEA) for USD 187.5m in 2016 and The Blackstone Group acquired 19.99% of PAG for USD 400m in 2018. Both investors seemed set for exits in 2022, although the year will end with one deal closed and the other still pending.

In March, BPEA agreed to plug itself into EQT, a manager that has been on an expansion drive ever since its own IPO in 2019. EQT's initial plan was to pursue organic expansion in Asia. After concluding this would take too long, the firm found a willing partner in BPEA, now called BPEA EQT.

The EUR 6.8bn (USD 7.2bn) deal saw EQT get 100% of BPEA's management company and entities that control its funds, plus the right to a share of carried interest from certain existing and all future Asia funds. BPEA's management and AMG received EUR 5.4bn in EQT stock and EUR 1.5bn in cash. Jean Eric Salata, BPEA's CEO, is now the largest individual shareholder in EQT.

AMG received USD 1.1bn in cash and stock. Based on BPEA's EUR 17.7bn in fee-paying assets under management (AUM) across private equity, real estate, and credit when the EQT deal was announced, the firm's AUM has risen 5x since AMG invested. It's valuation has risen 6x.

Salata explained that he was motivated by the prospect of being part of "something that has a shot at being number one in the world" in an increasingly competitive industry. "You need to be a global scale player that has real sector capability, real global insights, access to global talent, and the ability to drive businesses on a global basis," he added.

Mid-cap buyout has been primed as the first of multiple strategies EQT pursues in Europe and North America that will be rolled out in Asia. The firm also has venture, large-cap buyout, and life sciences funds, as well as a long-dated impact vehicle.

Blackstone must wait longer to realise its investment in PAG. Within a fortnight of BPEA and EQT announcing their merger, PAG filed for an IPO in Hong Kong – the first time a private equity firm has targeted this exchange. However, unfavourable market conditions mean it has moved no further.

PAG tells a similar asset accumulation story. Its AUM across private equity, credit, and real assets has grown 6x to USD 50bn in the past decade – and USD 29.6bn of those assets are fee-paying. PE is the second-largest asset class with USD 16.9bn as of year-end 2021 (USD 9.5bn of it fee-paying). The firm's three founders together own more than 50% of the firm's management entity.

Much was made, at the time, about the potential liquidity events involving other private equity firms in the region, given the spate of investment and IPO activity in this space globally. However, few managers native to Asia would appear a good fit for the global fund of firms players based on depth, breadth, and longevity of business.

Exits: Liquidity, if it's available

With most paths to liquidity blocked by gun-shy strategic investors and challenging capital markets, sponsor-to-sponsor deals came to the fore

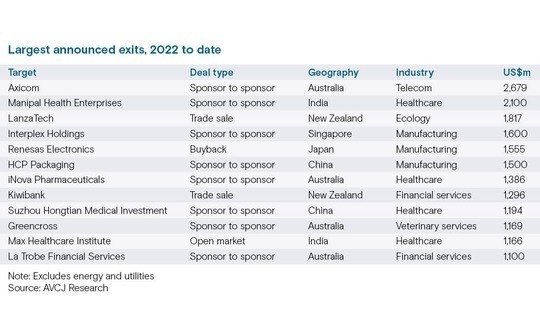

Sponsor-to-sponsor sales were one of the Asia exit stories of 2021 as deal flow surged nearly fourfold to USD 45.8bn on the back of abundant dry powder, buyer-friendly financing terms, and a general sense of exuberance coursing through the market. The joie de vivre quickly fizzled out in 2022, but sponsor-to-sponsor activity remains an integral part of the market.

Last year, exits reached an all-time high of USD 171.3bn, with USD 110.2bn in trade sales, USD 8.7bn in sales through IPO, and USD 5.6bn in open-market deals. Each has plummeted in 2022, reaching USD 37.4bn, USD 542m, and USD 2bn, respectively. Overall exit events have fallen from 650 to 360.

Yet the sponsor-to-sponsor segment has seen a more modest decline to USD 28.4bn. Last year, it accounted for 27% of overall exits. This year, it makes up 41% of the USD 70.1bn transacted to date.

It remains a concentrated part of the market. Twenty of the 43 exits worth USD 300m or more – excluding energy and utilities – are sponsor-to-sponsor deals, according to AVCJ Research. This includes 14 of the top 20. Together, they account for two-thirds of the total deal value in the space.

In short, these are businesses around which private equity investors can build familiarity and conviction, and also likely secure acquisition financing on agreeable terms. However, it is telling that 14 of the 20 sponsor-to-sponsor deals closed in the first half of the year.

Most PE firms will take liquidity wherever they can get it at this point in the cycle. However, one of the other themes of 2021 – GP sells asset to itself rather than to a rival GP – has faded. Hahn & Company closed the largest single-asset continuation fund to date, raising USD 1.5bn for Korea's Ssangyong C&E, but this and several other deals launched last year when conditions were different.

Multi-asset continuation funds – which offer discounts to net asset value and diversity, where single-asset deals do not – have come more into focus as the balance of power swings towards secondary investors as solution providers to GPs struggling with exits. IPOs are certainly not the answer.

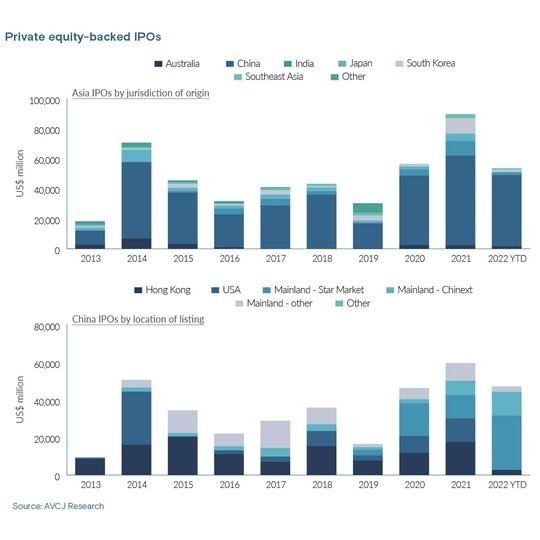

Private equity-backed companies have raised USD 53.5bn through nearly 270 offerings so far this year, down from 380 IPOs and USD 89.6bn in proceeds in 2021. But those are not the key data points. Rather, 88% of the money has been raised by Chinese companies and 83% of it comes from mainland exchanges. In 2021, half the Chinese IPO proceeds came from overseas.

There have been some eye-catching offerings by PE-backed companies in other jurisdictions – such as GoTo in Indonesia and Delhivery in India – but they remain few and far between.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.