North Asia

Samsung Ventures backs Japan tourism operator

Samsung Ventures has led a group of Korean investors in a Series B round for H2O Hospitality, which claims to be Japan’s largest vacation rentals provider.

Portfolio level HR: Human traffic

Private equity firms in Asia are paying more attention to recruitment at the portfolio level, in some cases allocating dedicated in-house resources. How is it impacting attitudes towards leadership change?

Advantage-owned Japanese funeral services business to go public

Advantage Partners is set to make a partial exit from Kizuna Holdings Corporation, a Japanese funeral services business it acquired for around JPY2 billion ($18 million) in 2016, through an IPO.

Integral pursues $316m buyout of Japanese software developer

Integral Corporation has won management support for a tender offer for Japanese software development and IT consulting business Mamezou Holdings at a valuation of JPY34.4 billion ($316 million).

Bain pursues $824m buyout of Japan's Showa Aircraft Industry

Bain Capital has submitted a tender offer for Showa Aircraft Industries, a Japanese manufacturer that specializes in paneling for aircraft interiors, that values the business at JPY90 billion ($824 million).

Japan's J-Star agrees IT jobs platform acquisition

Japanese private equity firm J-Star has agreed to acquire Gino, a local IT industry job search platform, for an undisclosed sum.

Japanese professional services marketplace raises $36m

Japanese start-up Minma, which operates P2P jobs and services marketplace Curama, has raised a JPY4 billion ($36.5 million) Series C round led by Nissay Capital, the VC unit of Nippon Life Insurance.

AVCJ Awards 2019: Exit of the Year - Small Cap: Gong Cha

Unison Capital took a Korean game plan global with the Gong Cha bubble tea chain. Attention to local tastes, however, was the key to the enterprise

Fund focus: Korea's midcap buyout space comes into focus

VIG Partners believes its recent $810 million fundraise validates the firm's middle-market strategy and spur the emergence of new domestic GPs in this area

Goldman Sachs, SK back Korea cold chain play

Goldman Sachs and SK Group have committed a combined KRW50 billion ($43 million) to a Korean expansion by cold chain logistics operator Belstar Superfreeze.

Chinese cross-border e-commerce platform raises $48m

Inagora - operator of an e-commerce platform that sells Japanese premium products to Chinese customers - has raised JPY5.3 billion ($48m) from SBI holdings, pharmacy chain Sugi Holdings and Xinjin Holding, the cross-border alternative investment arm of...

Longreach buys another Japanese coffee shop chain

The Longreach Group has made its second foray into Japan’s coffee shop space with an agreement to acquire Chat Noir, operator of more than 190 stores nationwide, primarily under the Caffe Veloce brand.

VIG reaches $810m final close on fourth Korean fund

VIG Partners has closed its fourth Korea-focused fund at $810 million, with approximately half the commitments coming from international investors. This compares to 30% for Fund III, which closed at $600 million in 2017.

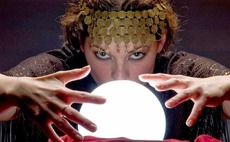

The crystal ball: Predictions for 2020

Industry experts weigh in as a range of macro factors promise to reshape markets across the region. Political, demographic, and scientific variables loom large

Delivery Hero to buy Korea's Woowa Brothers for $4b

Food delivery start-up Delivery Hero has agreed to acquire Korean peer Woowa Brothers in a deal that values the target at $4 billion and will facilitate exits for several private equity investors.

Macro uncertainty to drive increased Korean M&A

Difficult economic and political conditions bode well for the Korean PE industry in the near term, according to Michael Chung (pictured), head of Korea at Morgan Stanley Private Equity Asia (MSPEA).

2019 in review: Falling short

Fundraising, investment and exits in Asia are unlikely to match last year as pan-regional funds take a back seat, large-cap buyouts remain in short supply, growth-stage tech loses its edge, and IPOs flounder

Singapore's Vertex receives $180m for global fund-of-funds

Vertex Ventures, a VC arm of Singapore’s Temasek Holdings, has received commitments of $180 million from Japanese investors for a fund-of-funds that will support its global portfolio of VC vehicles.

Apollo appoints ex-Bain executive to head up Japan

Apollo Global Management has appointed Tetsuji Okamoto, previously of Bain Capital, as head of Japan to lead the buildout of its private equity business in the country.

KKR announces eight promotions in Asia

Chung Ho Park, a member of KKR’s private equity team and co-head of the firm’s Korea business, has been promoted to partner level. A further seven Asia-based professionals, across different strategies, were named managing directors.

Deal focus: One Store brings service to videogaming

A freshly spun-out private equity arm of SK Securities is helping Korea’s One Store break up a local monopoly in mobile videogame marketing.

Japan's J-Star closes fourth fund at $443m

Japanese private equity firm J-Star has closed its fourth middle-market fund at the hard cap of JPY48.5 billion ($433 million), up from JPY32.5 billion in the previous vintage.

Japan health tech player SmartScan gets $10m Series A

SmartScan, a Japanese medical technology supplier focused on software for diagnostics equipment, has raised a JPY1.3 billion ($10.3 million) Series A round from domestic VCs.

MBK sets $6.5b hard cap for fifth North Asia fund

MBK Partners is looking to become the sixth pan-Asian private equity manager to cross the $6 billion threshold, having set the hard cap for its fifth fund at $6.5 billion.