Greater China

Deal focus: Well-Link aims to make gaming even more real

China’s Well-Link Technologies raised a Series B extension to support long-term investment and blue sky thinking around the role of real-time cloud rendering in gaming and metaverse applications

China fundraising: Onshore vs offshore

Raising capital for China strategies is difficult right now, regardless of currency, but are geopolitical forces enabling the rise of renminbi-denominated funds at the expense of the US dollar?

Asia PE investment sees significant drop-off in third quarter

PE investment in Asia reached USD 36.8bn in the third quarter of 2022, its lowest level since activity seized up in the early stages of COVID-19, with notable declines in India and Southeast Asia.

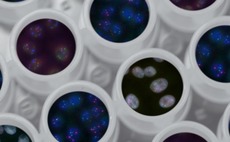

China's VectorBuilder raises $57m Series C

Guangzhou-based gene delivery company VectorBuilder has raised a CNY 410m (USD 57m) Series C round led by Legend Capital, Sui Kai Equity Investment, and Yuexiu Industrial Fund.

China's BA Capital raises $349m for latest renminbi fund

Black Ant Capital, also known as BA Capital, has closed its third renminbi-denominated fund on CNY 2.5bn (USD 349m), with commitments from independent fund-of-funds, government guidance funds, insurers, and corporates.

3Q analysis: Lean times

A flicker in India fails to disguise a miserable quarter for exits; a handful of fast fundraises snap Asia out of its slump; investment gravitates towards developed markets and manufacturing

Q&A: WeRide's Tony Han

Tony Han, founder and CEO of China’s WeRide, on commercialising fully autonomous passenger vehicles, surviving a capital winter, and why universities are vital to the hard-tech revolution

Vision Fund leads Series D for China dental 3D printing player

SprintRay, a China-based 3D printing company that specialises in orthodontics, has raised a USD 100m Series D round led by Softbank Vision Fund 2.

Airwallex raises another $100m, valuation holds steady

Hong Kong-based Airwallex, a cross-border payments provider turned broader financial technology platform, has raised USD 100m in a second extension to its Series E round at a valuation of USD 5.5bn. It comes 11 months after the company secured the same...

Citi, Accel back Hong Kong crypto start-up Xalts

Citi Ventures and Accel have invested in Hong Kong-based Xalts, a start-up founded by former HSBC and Meta personnel, with a view to facilitating digital asset management for institutional investors.

Hillhouse launches China incubation unit

Hillhouse Capital has introduced an incubation strategy that is intended to support China-based start-ups from incubation through the seed stage.

China's Neushen Therapeutics gets $20m pre-Series A

China’s Neushen Therapeutics, a biotech developer focused on central nervous system (CNS) disorders, has raised USD 20m in pre-Series A funding led by local VC firm Lapam Capital.

China silicon supplier Lihao gets $305m Series B

Lihao Semiconductor, a China-based supplier of silicon materials used in solar panels, has raised CNY 2.2bn (USD 305m) in Series B funding from an investor group featuring Oceanpine Capital, V Fund, and Harvest Capital.

Boyu pursues listed Chinese property manager

Boyu Capital is seeking full control of Chinese property management business Jinke Smart Services Group through a cash offer that values the Hong Kong-listed company at HKD 7.83bn (USD 998m).

Temasek leads $40m Series B extension for China's Well-Link

Temasek Holdings has led a USD 40m Series B extension for Well-Link Technologies, a China-based provider of real-time cloud rendering solutions for game developers.

LP interview: Partners Capital

Nearly a decade after establishing a foothold in Asia, Partners Capital has acquired a string of local clients and devised a distinct, middle market-oriented approach to deploying capital in the region

Deal focus: AI integration pays off for Evomotion

With investors going cold on China artificial intelligence, Evomotion has remained popular and profitable by delivering hardware and software to corners of the market that are either overlooked or hard to access

China AI solution provider Evomotion raises $20m

Evomotion, a China-based artificial-intelligence-of-things (AIoT) specialist that supplies software and chips to electronic appliance makers and supermarket retailers, has raised USD 20m in Series B funding.

Gaorong backs China energy storage company

China-based energy storage company WeView has raised CNY 400 million (USD 57m) from a group including Gaorong Capital, Green Pine Capital Partners, and ZhenFund.

China semiconductor player Shangda raises $99m

Chinese semiconductor packaging and testing company Shangda has raised a Series A extension of CNY700m (USD 99m) co-led by three government-backed funds.

Advent acquires China restaurant operator

Advent International has acquired a 60% stake in health food restaurant chain Wagas Group from its founders.

China semiconductor: Casualties of war

Private equity investment in China’s semiconductor industry continues unabated despite intensifying US regulatory action. While start-ups are not explicitly targeted, many are feeling the heat

C Ventures rebrands, hits first close on new fund

C Ventures, a VC firm set up by Adrian Cheng, scion of Hong Kong’s New World Development, has rebranded as C Capital – reflecting steps to diversify into a multi-strategy asset manager – and reached a first close on its latest fund.

China drug developer Worg secures $57m Series B

Worg, a China-based drug developer, has closed a Series B round of CNY400m (USD57m) from five local investors - Jiachen Capital, Longpan Capital, Kaitai Capital, Puhua Capital and Anji Ruixing Capital.