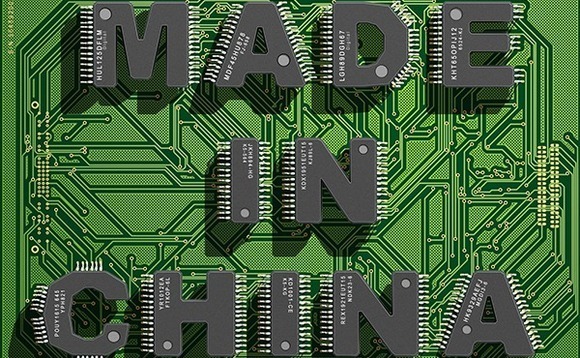

China semiconductor player Shangda raises $99m

Chinese semiconductor packaging and testing company Shangda has raised a Series A extension of CNY700m (USD 99m) co-led by three government-backed funds.

The investors include Guangdong-Macao Semiconductor Industry Investment Fund, Guangzhou Industry Investment Fund, and Jinshi Manufacturing Industry Transformation and Upgrading Fund.

They were supported by Guangzhou-based Shengsong Capital, Shanghai-based Dening Capital, Shenzhen-based Great Wall Fund. The proceeds will go to R&D, production capacity expansion, and domestic substitution of its supply chain.

Founded in 2017, Shangda focuses on chip-on-film (COF) for display driver integrated circuits (ICs). Its key technology was gained from the 2018 acquisition of Flexceed, a leading Japanese company in the field. Shangda had sent 100 staff to Japan for a two-year field study before bringing its technology back to China.

In 2020, Shangda built China's first domestic production line of 8-micrometer COF, with mass production starting last year. Customers including DB HiTek, ILITEK, Toshiba, and Sharp, as well as several domestic IC design companies.

"The global panel production capacity continues to shift to the mainland, and Chinese companies account for more than half of the market. However, the self-sufficiency rate of high-end material supply is less than 10%," said Dan Liu, partner at Guangdong-Macao Semiconductor Industry Investment Fund.

"Shangda breaks through the monopoly of South Korea and Taiwan. We will help it build a COF packaging and testing production line in Zhuhai in the future, becoming an important part of Zhuhai's IC ecological cluster."

China's semiconductor space is thriving against a backdrop of US-China technology decoupling. Investment in the industry hit USD 7.16bn in 2020, up from USD 230m in 2019. It held steady at USD 6.7bn last year, although this doesn't include USD 9.4bn committed to the restructuring of Unigroup. Nearly USD 9.5bn was put to work in the first eight months of 2022.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.