3Q analysis: Lean times

A flicker in India fails to disguise a miserable quarter for exits; a handful of fast fundraises snap Asia out of its slump; investment gravitates towards developed markets and manufacturing

1) Exits: Yet to ignite

A mini-surge in the BSE Sensex Index in mid-August – it reached a four-month high – prompted a flurry of block trades in India as financial investors capitalised on the opportunity to lock in some gains following a prolonged period of market volatility.

KKR led the way, offloading its remaining 27.5% stake in hospital operator Max Healthcare and generating proceeds of approximately INR 91.9bn (USD 1.15bn). This is said to be KKR's largest-ever exit in India, and the culmination of a five-year journey involving the purchase of a minority interest in Radiant Life Care, a merger with Max Healthcare, and several block trades.

The Blackstone Group followed with an INR 40.4bn partial exit from Sona Comstar, a manufacturer of automotive systems and components. This was also an India combination deal, with Blackstone buying Comstar Automotive Technologies and merging it with Sona BLW Precision Forgings.

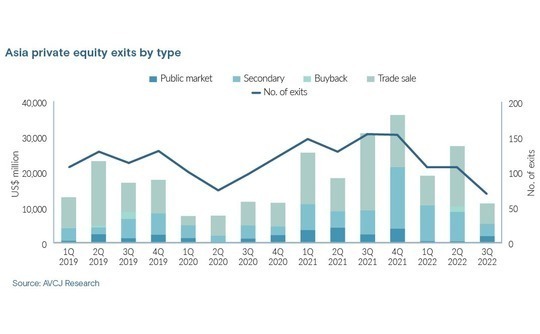

These two relatively large deals helped propel public market exits by private equity firms in Asia to USD 1.9bn in the third quarter of 2022. It is more than the previous two quarters combined – unsurprising, given the level of volatility in the market and still-depressed technology valuations. However, the BSE Sensex was unable to sustain this momentum and soon retreated.

Every other exit type fell sharply between July and September, with overall exits coming in at USD 11.1bn. It is the lowest quarterly total since the global spread of COVID-19 in the first half of 2020 and represents a significant step down from USD 27.3bn in the prior three months, according to provisional data from AVCJ Research.

Only seven deals crossed the USD 500m threshold. Five of them, including the only three to surpass USD 1bn in value, involved Australia and New Zealand-based assets. These two markets accounted for 11 of the top 25 exits for the quarter – a record number – underlining the gravitation of activity towards Asia's developed markets. Emerging economies were represented by just five India deals.

The largest exit was the sale of Australia-based iNova Pharmaceuticals by The Carlyle Group and Pacific Equity Partners to TPG Capital for USD 1.38bn. Two New Zealand financial services deals featured in the top six – Kiwibank, which saw New Zealand Superannuation Fund exit, and Partners Life, which facilitated liquidity events for The Blackstone Group, Waterman Capital, and Maui Capital.

There was also Potentia Capital's sale of its majority position in Australian mining software provider Micromine to a UK-based strategic buyer in a deal worth USD 623m. The private equity firm is said to have generated a 9x return, adding further weight to the Australia B2B technology services thesis.

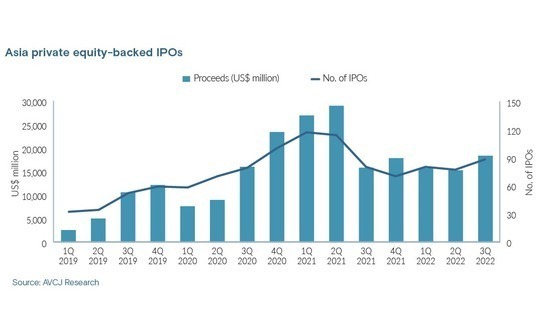

Private equity-backed IPOs came in at USD 19.3bn from nearly 90 offerings, compared to USD 15.3bn from 80 in the previous quarter. Activity continues to be heavily skewed towards China. Mainland exchanges were responsible for 72% of offerings by companies with financial sponsors and 86% of the proceeds. This compares to 60% and 71% in the second quarter.

2) Fundraising: Still polarised

Asia, perhaps now more than ever, is inextricably split between those that raise funds quickly and those that struggle to raise them at all.

According to Jean Eric Salata, CEO of Baring Private Equity (BPEA), the firm "pretty much hit target out of the box" on its eighth pan-regional fund, which closed on USD 11.2bn in September. Having accumulated the USD 8.5bn it set out to raise at short order, BPEA opted to keep the process open longer with a view to broadening its LP base. Of the 180 investors, 70 represent new relationships.

This diversification exercise was disrupted by the Russia-Ukraine war and subsequent sharp corrections in public markets, but BPEA still reached its hard cap after approximately 18 months in the market. The new fund is the second-largest pan-regional vehicle ever raised for Asia.

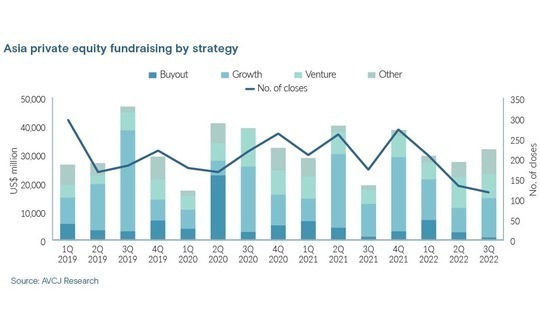

BPEA's contribution to the third quarter fundraising total is only USD 2.7bn, given much of the capital was committed at earlier closes already captured by AVCJ Research. Around USD 31.9bn was raised between July and September, ending the 2022 trend of successive quarterly declines. Speedy fundraises – in some cases left open to accommodate must-have LPs – loomed large.

Sequoia Capital China entered the market earlier this year with its latest collection of funds. In July, it hit the hard cap on each one: USD 480m for seed, USD 900m for venture, and USD 3.6bn apiece for growth and expansion funds (the latter said to replace Sequoia's global growth vehicle). The firm raised USD 3.68bn across three funds in the previous vintage.

Qiming Venture Partners also scaled up for its eighth China fund. Having raised USD 1.2bn in 2020, the firm came back and collected USD 2.5bn, comprising a core pool of USD 1.55bn for early and growth-stage healthcare and technology and consumer deals and a parallel healthcare-only vehicle.

Similarly, Dymon Asia Private Equity (DAPE) extended its fundraising process by two months to include a few key LPs it had been cultivating since the previous vintage. The firm spent about five months in the market, closing its third Southeast Asia mid-market fund on USD 650m in September. DAPE raised USD 450m for Fund II and existing LPs offered to re-up to the same amount.

BAI Capital represents the other extreme, albeit not to the point of failing to close a fund. The firm, formerly Bertelsmann Asia Investments, a captive unit of the eponymous German media company, set its hard cap at USD 750m and there was every expectation of reaching it until China's technology sector became embroiled in regulatory issues last year.

This effectively led to the fundraising process being put on hold for six months. BAI reached a final close of USD 700m – which it said was above the initial target – in July.

Tower Capital also proved there is appetite for first-time funds in collecting USD 379m for its debut vehicle. The firm, which focuses on Southeast Asia and previously operated on a deal-by-deal basis, set out to raise USD 300m. Meanwhile, the likes of Korea's Glenwood Private Equity, Southeast Asia's Insignia Venture Partners, and India's The Fundamentum Partnership all closed sophomore funds.

3) Investment: Solace in stability

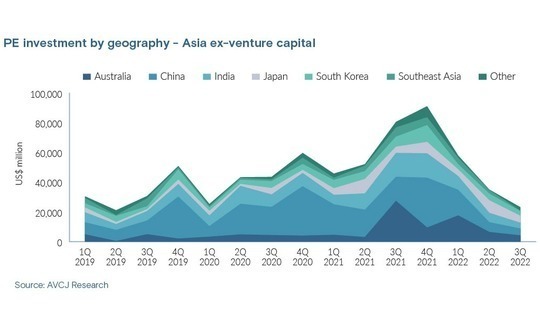

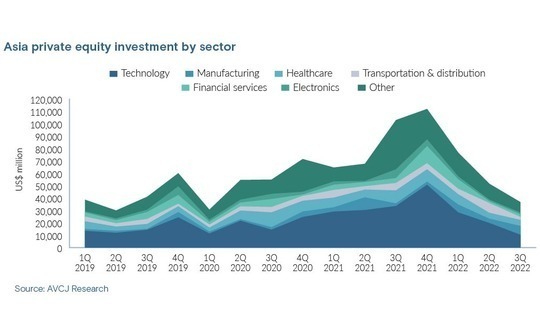

It is suggested that investors seek comfort in the stability of developed markets and tangible assets during periods of economic uncertainty. This may to some extent explain why the likes of Japan, Australia, and Korea proved reasonably resolute and manufacturing became unusually popular during a generally challenging third quarter of 2022.

Private equity investment in Asia reached USD 34.3bn, the lowest quarterly total since the arrival of COVID-19 in early 2020. The USD 51.6bn deployed between April and June was low by recent standards, but the total was shored up by USD 20bn in buyout activity. With GPs across the region highlighting issues like a rising cost of debt, buyouts slumped to USD 11.5bn in the third quarter.

The prolonged slump in growth capital investment continued with USD 17.2bn put to work, down from USD 22.9bn in the prior three months. Venture capital slipped from USD 6.6bn to USD 5.1bn.

Ten of the 15 largest deals took place in developed markets, emphasizing the drop-off in large growth-stage technology deals in China – and latterly India and Southeast Asia – that have underpinned Asia for so long.

Counterintuitively, China reinforced its position as the region's dominant PE force. Investment in the country came to USD 12bn, a small retraction from the previous quarter. India and Southeast Asia saw deal flow of USD 5.5bn and USD 1.9bn, down 48% and 61%, respectively.

In the second quarter, there were seven USD 1bn-plus deals, including one bumper transaction in Japan (KKR's USD 8.8bn tender offer for Hitachi Transport Systems). China was responsible for three of the others. In the third quarter, six investments reached USD 1bn or more: two from Australia, and one each from Japan, Korea, New Zealand, and India.

Japan led the way again with Bain Capital's USD 3bn carve-out of medical device manufacturer Evident from Olympus Corporation. It was followed by Ssangyong C&E, a cement producer Hahn & Company rolled into a USD 1.5bn single-asset continuation fund. Nearly all the 15 largest deals in the quarter were manufacturing, telecom, healthcare, utilities, financial services, or logistics.

The only comparable situation in recent times was the third quarter of 2020 when healthcare investment, likely experiencing a pandemic-related surge, reached 22%. Technology remained slightly ahead at 26%.

Healthcare has since lost some of its popularity. A collapse in public market valuations globally in early 2022 prompted private investment in the space in Asia to collapse from USD 8.3bn in the first quarter to USD 4.8bn in the second. There was little improvement in the third, with investors putting USD 4.9bn to work.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.