Exits

KKR invests $95m in India's Lenskart

KKR has invested $95 million in Indian eyewear retail leader Lenskart via a secondary transaction that facilitated partial exits of undisclosed size for TPG Growth and TR Capital.

Baring Asia exits SAI Global's assurance business

Baring Private Equity Asia is set to exit a significant part of Australia-based SAI Global, having agreed to sell the standards and assurance services business to UK-listed Intertek Group for A$855 million ($664 million).

China snack maker Weilong raises $549m, pursues HK IPO

China’s leading spicy snack food company Weilong has raised a $549 million pre-IPO round at a valuation of $9.4 billion and filed for a Hong Kong IPO.

James Murdoch launches Asia-focused SPAC

James Murdoch, son of media tycoon Rupert Murdoch, has launched a special purpose acquisition company (SPAC) that will pursue deals in Southeast and South Asia, with a particular focus on India.

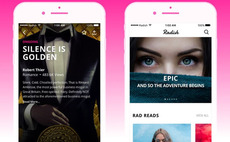

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

China self-driving truck start-up agrees $3.3b SPAC merger

Plus, a China-based autonomous driving technology developer that specializes in trucks, has agreed to merge with a special purpose acquisition company (SPAC) at a valuation of $3.3 billion.

KKR relaunches IPO bid for Australia's Pepper

KKR has returned to the market with Australia-based mortgage and asset finance lending business Pepper Money – a year after a previous IPO failed to get traction – seeking to raise up to A$500.1 million ($394 million).

Carlyle makes $536m realization from India's SBI Life

The Carlyle Group has sold more than two-thirds of its remaining stake in India-listed life insurance company SBI Life for approximately INR39.4 billion ($536 million) via a bulk transaction.

China's ANE Logistics files for Hong Kong IPO

ANE Logistics, a Chinese road freight transportation business backed by Centurium Capital, CDH Investments, and CPE among others, has filed for a Hong Kong IPO.

PE-backed Waterdrop falls on debut after $360m US IPO

Waterdrop, a China-based insurance, medical crowdfunding and mutual aid platform, fell 19% on its New York Stock Exchange debut following a $360 million IPO.

TA buys Singapore corporate services provider, EQT exits

TA Associates has acquired a majority stake in In.Corp Group, a Singapore-headquartered corporate services provider, facilitating an exit for EQT.

CBC Group founder backs healthcare-focused SPAC

Wei Fu, the founder and CEO of Asia-focused healthcare investor CBC Group, has launched a special purpose acquisition company (SPAC) to pursue deals in the sector.

China audio platform Ximalaya files for US IPO

Ximalaya, China’s largest online audio platform, which counts the likes of Tencent Holdings, General Atlantic, and Goldman Sachs among its backers, has filed for a US IPO.

Asia technology: Anatomy of a rebound

Tech investment has been on a tear in Asia, with private equity joining venture capital at the party. While COVID-19 has contributed to these dynamics, the revival is rooted in deeper structural change

KKR buys New Zealand's Natural Pet Food from Pioneer

KKR has agreed to acquire New Zealand premium pet food maker Natural Pet Food Group (NPFG) from local private equity firm Pioneer Capital.

India food delivery player Zomato files for domestic IPO

Zomato, an India-based food services platform that raised more than $1.25 billion in private funding from the likes of Ant Group, Tiger Global Management, and Sequoia Capital India, is looking to raise up to INR82.5 billion ($1.11 billion) through a domestic...

Quadrant makes partial exit via Australia car dealership IPO

Quadrant Private Equity has made a partial exit from Australian car dealership Peter Warren Automotive Holdings following the company’s A$260.1 million ($203 million) IPO.

China's Mobvista acquires marketing business

Chinese digital marketing player Mobvista has acquired VC-backed local counterpart Reyun in a cash-and-stock transaction worth RMB1.5 billion ($232 million).

Warburg Pincus buys control of India's Parksons Packaging

Warburg Pincus has acquired a majority stake in India-based consumer goods packaging manufacturer Parksons Packaging, taking out positions held by Kedaara Capital, Olza Holdings, and IIFL Holdings.

China bike-sharing player Hellobike pursues US IPO

Hello Inc, best known as the operator of China bike-sharing service Hellobike and backed by the likes of Alibaba's Ant Group and GGV Capital, has filed for an IPO in the US.

Chinese COVID-19 vaccine developer Clover files for IPO

Clover Biopharmaceuticals, a Chinese pre-revenue drug developer that has raised $315 million across several funding rounds since 2011, has filed for a Hong Kong IPO.

Blackstone to cement control of India's Mphasis

The Blackstone Group is set to lift its controlling position in India-listed IT services provider Mphasis to 75% as part of a deal worth up to $2.8 billion.

Rising Japan exits staffing services business

Rising Japan Equity, a domestic private equity firm, has agreed to sell Progress, a staffing and contracting services provider, to listed staffing solutions business UT Group for JPY3.09 billion ($28.6 million).

China-backed Oatly pursues US IPO

Oatly, a Swedish oat-based, dairy-free beverage brand backed by a joint venture between China Resources Group and Verlinvest, has filed for a US IPO and put in place a mechanism for an additional Hong Kong listing.