IPO

China's SenseTime plans pared back Hong Kong IPO

Chinese artificial intelligence (AI) technology developer SenseTime is looking to raise up to HK$5.99 billion in a Hong Kong IPO that is considerably smaller than originally envisaged.

China's Didi to delist in New York

China ride-hailing platform Didi, which has traded poorly ever since being targeted by regulators in the wake of its IPO in June, plans to delist from the New York Stock Exchange and relist in Hong Kong.

Grab completes SPAC merger, sees volatile trading debut

Southeast Asia ride-hailing platform turned super app Grab experienced a tumultuous first day of trading on NASDAQ following the completion of its merger with a US-listed special purpose acquisition company (SPAC) at an enterprise valuation of $30.4 billion....

PE investors wary of inflation in 2022 - AVCJ Forum

Inflation is top of mind for Asia-focused private equity investors as they assess the various uncertainties facing the industry in 2022, the AVCJ Private Equity & Venture Forum heard.

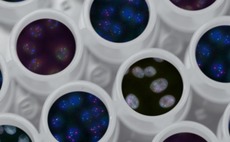

China biotech IPOs in Hong Kong to stay strong - AVCJ Forum

The frenzy for Chinese biotech developers listing in Hong Kong is expected to continue well into 2022, industry participants told the AVCJ Private Equity & Venture Forum.

SPAC regime reflects HK's cautious approach to expansion - AVCJ Forum

The Hong Kong Stock Exchange (HKEx) is positioning its soon-to-launch special purpose acquisition company (SPAC) regime as part of efforts to broaden its appeal in terms of capital markets tools and geographies. At the same time, executives are wary of...

NetEase music spinout completes $449m Hong Kong IPO

Cloud Village, a music streaming business controlled by Chinese internet giant NetEase and backed by several private equity investors, has raised HK$3.5 billion ($449 million) through a Hong Kong IPO.

China IPOs: The star still wanes

Proceeds from private equity-backed offerings on China’s Star Market are down 75% from their peak one year ago, reflecting ongoing regulatory interference and diminished investor confidence

PE-backed Paytm raises $2.5b in India's largest-ever IPO

Indian digital payments platform Paytm completed the country’s largest-ever IPO – raising INR183 billion ($2.47 billion) – but then saw its stock fall 27% on debut.

Baring, Quadrant claim firm of the year prizes at AVCJ Awards

Baring Private Equity Asia (BPEA) and Quadrant Private Equity won the firm of the year prizes at the 2021 AVCJ Private Equity & Venture Capital Awards, as KKR and NewQuest Capital Partners secured two victories apiece, and Weijian Shan received the AVCJ...

India's Nykaa trades up after $719m IPO

India-based beauty e-commerce platform Nykaa is trading at more than 100% premium to its IPO price after completing a INR53.5 billion ($719 million) offering that facilitated partial exits for TPG Capital and Lighthouse Funds.

Southeast Asia IPOs: Opportunity knocks

A breakthrough offering in Indonesia and regulatory progress in Singapore highlight Southeast Asia’s growing viability as a tech IPO market. It’s unclear how well this is being communicated globally

North Asia IPOs: Welcome eruptions

A steady rhythm of small and mid-sized IPOs in North Asia is now being punctuated by globally noticeable events. Valuations are up, but Korean and Japanese investors are game

Hong Kong IPOs: Winner by default

New York’s loss is expected to be Hong Kong’s gain as regulatory and political turbulence drives Chinese start-ups to look for alternative listing destinations – unless valuations become a sticking point

PE-backed Delhivery files for India IPO

India-based e-commerce logistics provider Delhivery is looking to raise up to INR74.6 billion ($1 billion) through a domestic IPO that would facilitate partial exits for The Carlyle Group, Fosun Group, SoftBank Vision Fund 1, and Times Internet.

PE-owned APM Human Services set for $743m Australia IPO

APM Human Services, an Australia-based employment services provider with operations in 10 countries, is looking to raise A$986.2 million ($743 million) through a domestic IPO that will facilitate a partial exit for Madison Dearborn Partners (MDP).

SPACs: Longer menu

As the US recovers from a glut in SPAC fundraising, Asian jurisdictions are launching their own regimes. Not every start-up is a good fit for New York. Is Singapore or Hong Kong a good fit for them?

Hahn & Co's K Car raises $285m in Korean IPO

K Car, a Korean automotive marketplace created by Hahn & Company through the merger of SK Encar and Joy Rent a Car, has raised KRW336.6 billion ($285 million) in a domestic IPO.

PE-backed Abbisko trades up after $225m Hong Kong IPO

China-based oncology drug developer Abbisko Therapeutics gained nearly 10% on its Hong Kong trading debut following a HK$1.75 billion ($225 million) IPO.

3Q analysis: India advances

India technology investment continues to ramp up as China flatlines; international payments M&A drives Asia trade sale revival, but IPOs slump; fundraising remains slow

Stonebridge Ventures targets Korea IPO

Stonebridge Ventures, a Korean venture capital firm with more than KRW700 billion ($595 million) in assets under management, has filed to list on KOSDAQ.

China in six trends

Key themes in China private equity fundraising, investment, and exits

PE-backed MicroTech Medical targets $254m Hong Kong IPO

MicroTech Medical, a China-based manufacturer of insulin pumps for diabetes sufferers that counts Lilly Asia Ventures (LAV) and Qiming Venture Partners among its investors, is looking to raise up to HK$1.98 billion ($254 million) in a Hong Kong IPO.

China biotech start-up LianBio files for US IPO

LianBio, a two-year-old Chinese biotech start-up incubated by life sciences investor Perceptive Advisors, has filed for a US IPO.