China biotech start-up LianBio files for US IPO

LianBio, a two-year-old Chinese biotech start-up incubated by life sciences investor Perceptive Advisors, has filed for a US IPO.

The three largest institutional investors are Perceptive with 62.4%, RA Capital with 7.2%, and BridgeBio Pharma with 5.8%, according to the prospectus. US-based BridgeBio is also a strategic partner, giving LianBio preferential access to its drug pipeline.

The company raised a $310 million round last year led by CMG-SDIC Capital - a joint venture between SDIC Fund Management and China Merchants Capital - RA Capital, and Venrock. Additional contributions came from BlackRock, Perceptive, T. Rowe Price, Casdin Capital, Farallon Capital, Pfizer, Tybourne Capital Management, Vida Ventures, Viking Global Investors, and Wellington Management.

Lianbio in-licenses biopharmaceutical assets for Greater China and other Asian markets, focusing on patients with unmet medical needs. One area in which the company seeks to differentiate itself is through collaborations with established partners. It currently collaborates with Pfizer as well as with BridgeBio.

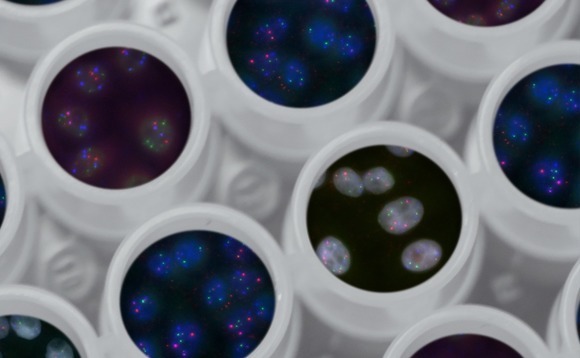

Lianbio has assembled a pipeline of nine assets across five therapeutic areas: cardiovascular, oncology, ophthalmology, inflammatory disease, and respiratory indications.

One of the most advanced treatments is Mavacamten, licensed from Bristol-Myers Squibb, which targets obstructive and non-obstructive hypertrophic cardiomyopathy, one of the most common inherited heart diseases. It is being prepared for phase-three clinical trials in China.

LianBio is also initiating phase-three trials for a treatment for eye infections caused by mites and a radiosensitizer that enhances the localized effect of radiotherapy on tumors.

The company has yet to generate any revenue. It recorded net losses of $24 million in 2019 and $139 million in 2020. Rising R&D expenses are primarily responsible for the widening losses.

China is currently the world's second-largest pharmaceutical market with prescription revenue reaching $89 billion in 2020. It is expected to hit $187 billion by 2025, the prospectus notes, spurred by an aging population and moves to improve the accessibility and affordability of innovative drugs. These include wider medical insurance coverage and expansion of the reimbursement drug list, which ensure inclusion in government-backed insurance plans.

At the same time, the country is encouraging domestic innovative drug development and has made it easier to accelerate clinical trials in China based on clinical data from other markets.

Founded in 1999, Perceptive has approximately $9.5 billion under management across equity and credit investment strategies in the healthcare space. LianBio represents its first foray into China.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.