North Asia IPOs: Welcome eruptions

A steady rhythm of small and mid-sized IPOs in North Asia is now being punctuated by globally noticeable events. Valuations are up, but Korean and Japanese investors are game

Few investors have enjoyed more exposure to Korea's booming exit market this year than Altos Ventures.

The VC firm was an early investor in e-commerce business Coupang, which raised $4.5 billion in a New York IPO in March and now has a market capitalization of $52.4 billion. It also had stakes in food delivery player Woowa Brothers, which has been acquired by Germany's Delivery Hero for about $4 billion, and social media platform Hyperconnect, which was sold to US dating giant Match Group for $1.7 billion.

Other portfolio companies like payments platform Viva Republica and online shopping player Danggeun Market are considered some of the biggest fish in the IPO pipeline. Viva, which counts Kleiner Perkins and PayPal among its investors, closed a funding round in June at a valuation of $7.2 billion. Danggeun's valuation has increased 15x since 2019 to $2.7 billion as of a Series D round in August featuring DST Global and Goodwater Capital.

"A lot of tech investors globally really only cared about Naver, Kakao, and maybe a couple of telecom companies that have internet assets. But now, I think we're going to see more tech companies coming out and when we have a critical mass, global investors will pay more attention," says Han Kim, a managing director of Altos.

"There will be fluctuations in expectations versus reality. Late-stage investors that passed on a Korean company before will take a more serious look, but Korea is not China. I just don't see a bunch of funds setting up to take advantage of this because, while it's exciting that more companies are coming up, it's going to take years."

Kim considers the Woowa deal, agreed in December last year, as the start of the flood, while M&A activity more broadly is a major contributor to IPO market confidence. An influx of global capital (both strategic M&A and pre-IPO VC) is driving the valuations, which has triggered chain reactions in growing entrepreneur confidence and local retail investor appetite.

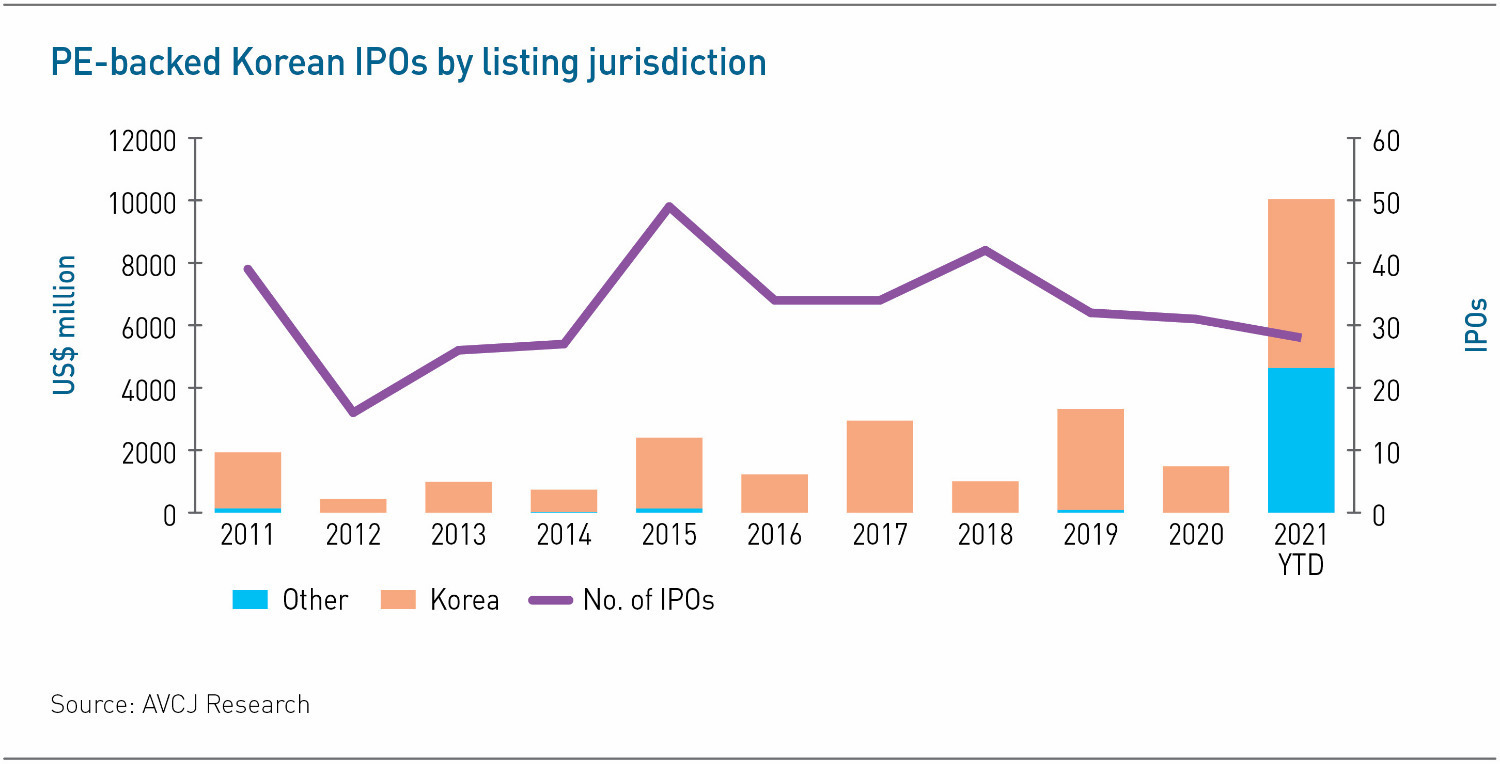

Recent activity for private equity-backed companies also includes game developer Krafton and Kakao Pay raising about $3.8 billion and $1.3 billion, respectively, in domestic IPOs. Hybe, the manager of K-pop band BTS, formerly called Big Hit Entertainment, raised about $840 million in a 2020 IPO and currently has a market capitalization of KRW15.2 trillion ($13 billion).

Bubble territory?

Some industry participants are wary that a bubble could be forming, especially given the fad-driven nature of some of the assets. But there is little sign of those concerns spoiling the party.

John Nahm, co-founder of Strong Ventures, a US-Korea focused firm invested in Coupang and Danggeun, is tracking these signals closely and remains generally upbeat. In a comparison of valuations (pulled on November 5), he notes that Hybe's price-to-earnings multiple is almost 3x that of Netflix, while Krafton's is more than twice that of ActivisionBlizzard.

"The fact that investors are giving these tech companies much higher multiples than their counterparts in the US is quite an outstanding sign of health for the Korean Exchange. We can tell our start-ups, ‘Forget the New York Stock Exchange and NASDAQ. I know it's a bit more paperwork, but if you go public in Korea, it can actually be a better outcome,'" Nahm says.

"I wouldn't have said that one year ago. If Coupang went public today on the Korea Exchange, it might have had an even better result [than it did in the US]. At the time, that was the best route for them to take, but one year later, the markets have changed."

Two key factors are keeping bubble fears in check. First, although much of the domestic IPO activity is attributed to a large retail investor allocation, Korea has a relatively sophisticated and tech-savvy retail investor base. Second, IPO activity for mid-sized tech companies has paced along normally in the background, suggesting the ecosystem has sturdy foundations, regardless of greater dynamism at the top end.

The best demonstration of this viewpoint is in KOSDAQ's often overlooked strengths in the biotech sector. Biotech typically represents 30-40% of the companies on the tech board; semiconductors is the second-place category around 15%.

The large weighting by no means indicates a low hurdle to listing. Indeed, the evaluation criteria were tightened earlier this year, with nine assessment items added to a list of 26 just for the preliminary review process. A string of surprise rejections ensued.

If this is part of an effort to raise the profile and prestige of biotech on the exchange, it appears to be working. Last month, Singaporean neurotherapeutics specialist Cerecin raised $40 million from a clutch of Korean investors, including Hana Financial Investment, which has agreed to act as the lead manager in a potential listing in Seoul in the near term.

"Within biotech, when you're looking at different exchanges, some are more focused on pharmaceuticals, healthcare, services, or Big Pharma, but we're looking for familiarity with innovation, which has a different risk-return," says Charles Stacey, Cerecin's president and CEO, adding that there has been a significant push to add foreign biotech companies to KOSDAQ.

"We want analysts and bankers with capabilities around that, and we want investors and institutions that are used to that dynamic. We're very familiar with the US and London exchanges, and we've seen the level of rigor with which things are done there. We've seen that in Korea as well, which has given us comfort."

Structurally sub-size

Japan offers a clear contrast on this point, with decidedly low listing hurdles on its Mothers technology board resulting in a consistent stream of tiny, premature IPOs. According to the Japan External Trade Organization, less than 10% of start-ups in the US, Southeast Asia, and India are exited via IPO. In Europe, the number is 32%. In Japan, it's 67%.

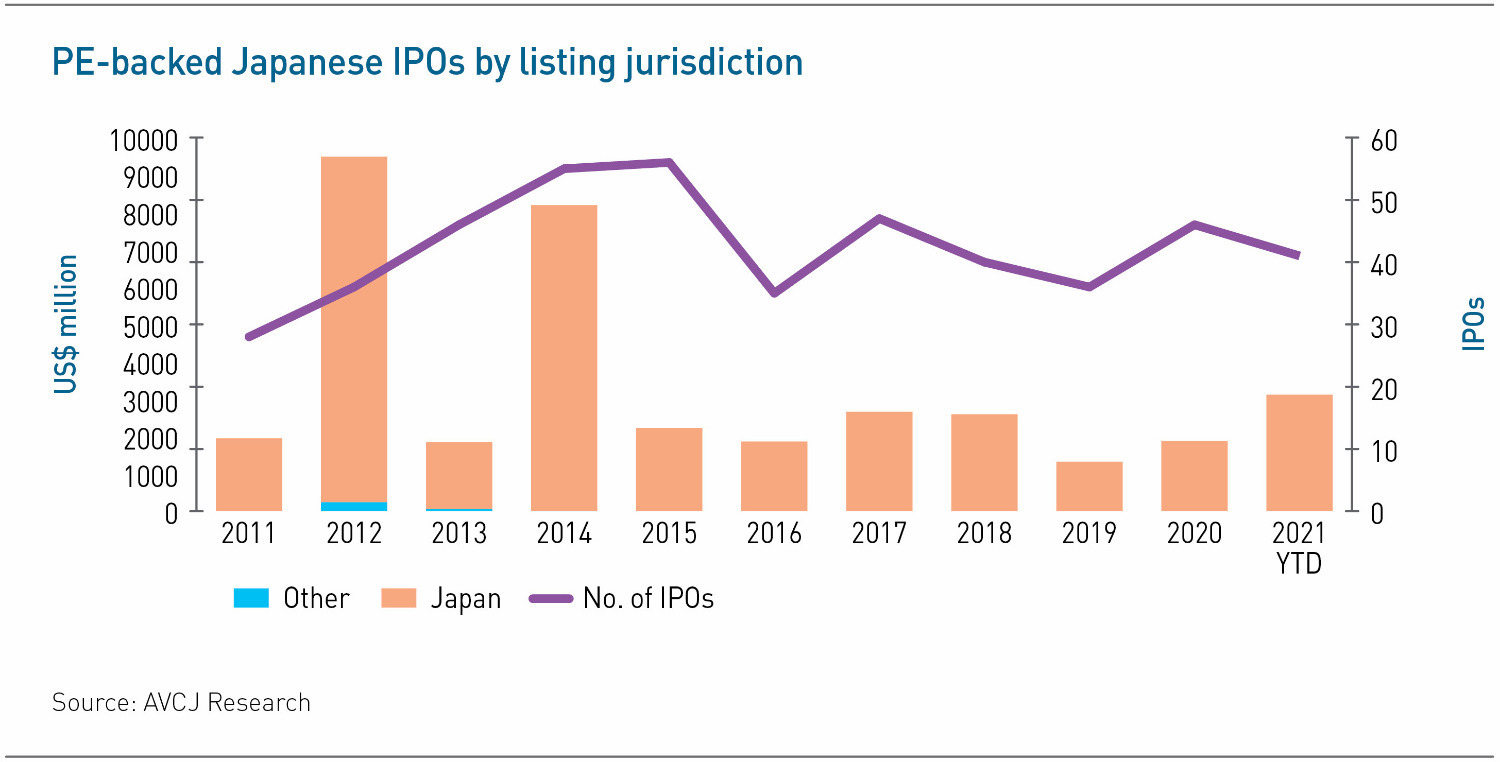

The Tokyo Stock Exchange wanted it this way. With a lack of equity funding available from VCs, IPOs were made easier to achieve, giving start-ups at least some options for growth. As the ecosystem has developed, later-stage funding channels opened, culminating in the landmark $1.2 billion IPO for online shopping company Mercari in 2018. Since then, things have picked up.

Standout VC-backed offerings for digital companies in the meantime include accounting software provider Freee, business card management company Sansan, and perhaps most notably Taiwan's Appier, a leading advertising technology supplier that raised $271 million in April. This marked the first time since 1998 a Taiwan-based company had gone public in Tokyo and signaled the rising regional profile of the Mothers board.

Globis Capital Partners, an early investor in Mercari, associates this activity with increased attention from global investors and a significant rise in valuations. The firm's most recent fund closed in 2019 on JPY36 billion ($320 million), twice the size of its predecessor, yet both vintages have backed the same number of companies. The effect has reached down to the early stages, with Series A rounds, which recently ranged around $20 million, now often scaling as high as $50 million.

IPO momentum has maintained Japan's attractiveness to investors, however. Globis has already notched two noteworthy IPOs this year, including human resources player Visional, which raised about $630 million on Mothers in April and now has a market capitalization around $2.8 billion. Globis is also an investor in media app SmartNews, which is currently valued at around $2 billion and exploring an IPO.

"Mercari basically shifted the ecosystem up a gear," says Emre Yuasa, a director at Globis. "VCs are able to raise bigger funds, they can invest more capital into start-ups, and entrepreneurs are going for bigger outcomes. Nowadays, a $200-300 million IPO is considered small, and rather than going IPO at that size, start-ups are deciding to raise another round and go IPO at $1 billion. The whole ecosystem is now geared toward bigger exits."

Such is the enthusiasm around IPOs, it has percolated into Japan's sizeable corporate venture capital space, a logically M&A-dominated environment. As the corporate VC ecosystem has expanded, so too have the instances of start-ups straying from their original business models and finding a better product-market fit outside the domain of their sponsoring corporation.

Global Brain has corporate VC partnerships with the likes of Sony, Epson, Yamato Transport, Kirin, and JGC Group. As such, the VC has an unusually low IPO rate for Japan (only 25% of its total exits) and this ratio is expected to hold going forward. Nevertheless, public offerings are creeping conspicuously into the mix.

The firm's standout exit this year is smart security camera company Safie, which completed a $100 million IPO last month and now has a market capitalization around $1.7 billion. Safie is notable for being one of the few digital hardware players to go public; Globis-backed smart lock maker Photosynth is another. More significantly, it was the product of a corporate VC program with real estate giant Mitsui Fudosan ostensibly geared toward strategic absorption.

"We expect more IPOs from our funds, and we're adding people to our investment group to handle that," says Yuki Matsuo, a principal at Global Brain. "In our unique business model, which creates value through collaboration between start-ups and corporate VC owners, there will be more situations where corporate VCs will have wider options, including pursuit of economic return via more IPO exits such as Safie, as well as business synergies via M&A."

Growing pains

The emergence of sizable IPOs and the accompanying attention of foreign investors has been so quick, however, that many of the systemic issues facing the ecosystem remain to be ironed out. Perhaps the most important of these is a tendency for inaccurate underwriting to result in shares popping post-IPO by 40% on average, versus 10-20% in most markets.

Indeed, this was the case for Visional, which jumped as much as 50% above its JPY5,000 listing price, which was the top of the indicative range. It was the biggest IPO on Mothers since SoftBank Group's mobile phone unit went public in December 2018.

"That 40% appreciation is taken by investors who held the shares for only one day instead of the entrepreneurs who have been working on the company for 10 years and the VCs who have been working on it for 5-10 years," says Globis' Yuasa.

"They're leaving money on the table because the underwriters are discounting the valuation of the companies too much. If the valuations are more accurate, there will be smaller pops, and if we see more institutional investors come in at or before the IPO, that will be a correction mechanism."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.