China IPOs: The star still wanes

Proceeds from private equity-backed offerings on China’s Star Market are down 75% from their peak one year ago, reflecting ongoing regulatory interference and diminished investor confidence

The ghost of Ant Group lingers over Shanghai's Star Market. While one major sticking point created by a more draconian oversight system has been resolved, the barriers remain high, and regulators continue to impose their own views as to who is worthy of a listing.

In its two years of existence, the Star Market – or the Science & Technology Innovation Board – had seen 340 IPOs as of September by companies with a combined market capitalization of more than RMB5 trillion ($782 billion), according to data provider Wind.

But early traction was lost when listing candidates were subjected to increased scrutiny in the wake of Ant Group's abandoned IPO in November 2020. Fifteen offerings were halted that December, a fourfold increase on the previous month. In the first half of 2021, 51 companies withdrew or were forced to cancel IPOs, exceeding the full-year total for 2020.

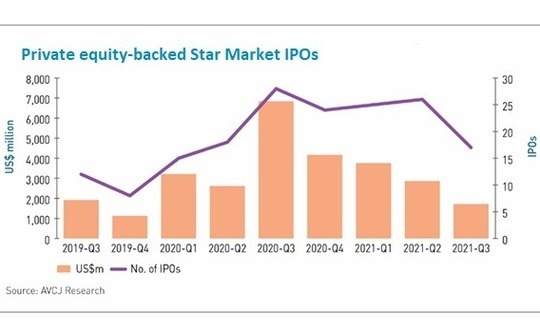

The malaise is a headache for private equity and venture capital investors. They hoped the bourse would become an active liquidity channel, populated by sophisticated investors who could handle the lighter-touch regulation of a registration-based system. Instead, proceeds from PE-backed IPOs peaked at $6.8 billion in the third quarter of 2020 and then withered.

A total of $3.7 billion was raised in the first three months of this year, followed by $2.8 billion and $1.7 billion over the next two quarters, AVCJ Research's records show. The Star Market's share of global Chinese listings has fallen below 25%. It exceeded 50% in the first quarter of 2020.

Expected difficulties for local companies accessing US markets are no panacea. "There has been a tendency to restructure onshore over the last 3-5 years and we are still seeing that, but for now, people are keeping their options open," says one Hong Kong-based private equity lawyer. "They are not taking any drastic action."

Disclosure dilemma

One unhelpful post-Ant Group development is a requirement, imposed at the end of last year, that all domestic IPO candidates disclose the identities of their ultimate shareholders, whether individuals, listed enterprises, or government-related entities.

This was internal housekeeping by the China Securities Regulatory Commission (CSRC). Current and former officials of the agency are banned from investing in listed companies, but some have sought to conceal their activities behind layers of corporate structuring. The CSRC said underwriters would be held accountable for any transgressions.

"In the past, we only needed to sign agreements claiming there were no shareholdings held on behalf of third parties. Now underwriters are responsible for the accuracy of such disclosures. If an investigation uncovers improper behavior, the underwriter must replace everyone involved if they are to work on future deals," says a Beijing IPO lawyer.

One side-effect might be shareholders representing third parties demanding extortionate sums from companies for those interests because they know they are standing in the way of an IPO. A second, verified side-effect is the drop-off in listings by companies with overseas PE backers who are reluctant to name their LPs as beneficial owners.

Fortunately, the latter issue was resolved earlier this year by foreign private equity firms being exempted from the disclosure requirement. Overseas government investment funds, university endowments, charitable foundations, pension funds, and public asset managers have been categorized as qualified beneficial owners

Other investors can also be exempted if the underwriter establishes "through proper verification" that no domestic entities are participating in a fund as LPs and demonstrating there is no pricing abnormality. There is some uncertainty over the definition of "proper verification."

"We disclose our situation to the underwriter, rather than directly to the regulator. Underwriters don't want to take any risk, so the process often becomes a burden for pre-IPO companies and there are still gray areas where we haven't received full clarification," notes the founder of a local technology investment fund.

Regulators have tried to reduce the disclosure burden still further. It was announced in June that an entity holding fewer than 100,000 shares, or 0.01% of the listing company, would no longer need to go through the verification process.

Regardless, many companies have fallen back on private funding because it is easier to execute. For example, Hesai Technology, which develops sensors used in autonomous driving, applied for a Star Market IPO in January and withdrew in March. It soon raised a $300 million Series D led by GL Ventures and then a $70 million extension led by Xiaomi.

"Hesai is expanding quickly and it needed capital to build a new production facility, but the listing procedure for Star Market is lengthy. Once an application is filed, no changes can be made to the shareholder structure, which means the company cannot raise capital in the interim. As a result, it decided to withdraw," an investor in Hesai tells AVCJ.

This investor expects Star Market IPOs to accelerate following the introduction of the exemptions. Moreover, the queue has become shorter because so many applications have been withdrawn.

Withdraw, regroup

While the enhanced disclosure regime is not limited to Star Market IPOs, broader listing activity - including companies without PE backers - remains robust. Nearly RMB409 billion was raised through all A-share IPOs in the first three quarters of the year, beating the 2020 total, according to KPMG. A drop on the Star Market was counterbalanced by the Shanghai mainboard and ChiNext.

Both the Star Market and ChiNext have registration-based systems, but the former is arguably trickier because it is exclusive by design.

"Currently, registration-based IPOs involve a double review - first by the stock exchange and then by the CSRC," the Beijing-based lawyer explains. "This has an especially strong impact on the Star Market because reviews must also establish whether a listing candidate is in a tech-related industry and whether the deep-tech component is sufficient enough."

From the outset, access to the Star Market was limited to companies of a certain scale and with exposure to innovative technologies. In April, regulators raised the bar, emphasizing hard and core technologies.

There are four new criteria: R&D expenditure must account for 5% of income, or exceed RMB60 million over three years; at least 10% of staff must be in R&D; the main business must have five or more invention patents; and operating income must achieve compound annual growth of 20% over three years, or hit RMB300 million in the most recent year.

A negative list has also been introduced, barring IPOs by financial technology, real estate, and investment-related businesses.

In fact, the bar is even higher. Lenovo Group, which already trades in New York and Hong Kong, planned to raise up to $1.8 billion through a Star Market offering but withdrew its application in October, eight days after being accepted for review.

This month, Yuanqing Yang, the company's chairman and CEO, dismissed rumors that it "did not meet the IPO standards of the Star Market." Based on its financial disclosures, Lenovo meets the four criteria. However, a lawyer who worked on the proposed IPO tells AVCJ that Lenovo is considered a manufacturing company, rather than a technology company.

It is claimed that the Shanghai Stock Exchange has persuaded some companies to withdraw applications even though there are no grounds for rejection. Hong Kong-listed automaker Geely could be another example.

Plans for a RMB20 billion Star Market IPO were announced in June 2020 and received by the exchange three months later. In July 2021, the application was withdrawn, with Geely citing strategic adjustments to its business. Electric vehicle unit Zeekr then spun out and raised $500 million in pre-Series A funding. Geely's interest fell from 51% to 48%.

"The withdrawal of the application and the promotion of a separate listing by Zeekr will help accelerate the development of the EV business," China Merchants Securities said in a research report, highlighting the regulatory uncertainty around Star Market listings.

"Waiting for an A-share listing is not worth it because the gain as the EV industry is undergoing exponential development. Zeekr cannot lose out on the opportunity to quickly expand its business."

The message is clear. Chinese technology companies can do little but wait, raise more capital via the private markets to maintain their growth trajectory, and hope to resume their Star Market quest later – either when they are large enough to make the grade or when the regulator's eye has become less severe.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.