Investments

China satellite player Galaxy Space achieves unicorn status

Galaxy Space, a China-based satellite developer, has raised a new funding round led by CCB International at a post-investment valuation of CNY 11bn (USD 1.6bn).

Blackbird leads $23m Series B for Australia's Sonder

Australia’s Blackbird Ventures has led a AUD 35m (USD 23.4m) Series B round for Sonder, a staff and student management app focused on wellbeing and safety.

Japan's J-Star backs campervan manufacturer

Japanese lower-middle market private equity firm J-Star has confirmed an investment of undisclosed size in Toy Factory, a campervan designer and manufacturer.

Indonesia's Fazz raises $100m Series C

Indonesia’s Fazz, a financial services provider for Southeast Asia micro businesses, has raised a USD 100m Series C round featuring Tiger Global, DST Global, and B Capital Group.

Everstone buys India's Softgel Healthcare

Everstone Capital has acquired a controlling stake in Indian pharmaceuticals manufacturer Softgel Healthcare (SHPL) for an undisclosed sum.

Australian GPs sell food businesses to PAG

PAG has acquired Australia-based Patties Foods and Vesco Foods, facilitating exits for Pacific Equity Partners (PEP) and Catalyst Investment Managers, respectively.

Affirma joins $40m round for India air conditioning supplier

Affirma Capital has joined a USD 40m investment in India’s Epack Durable, a leading domestic designer and manufacturer of air conditioning units among other home appliances.

L'Oréal China investment unit backs local fragrance brand

L'Oréal has completed the debut deal from its newly formed China investment arm by participating in an extended Series A round for local fragrance brand Documents.

Deal focus: L'Oréal shows staying power

Europe-based personal care giant L’Oréal looked past short-term impediments like lockdowns and asset price corrections to join Cathay Capital in supporting Chinese perfume brand Documents

Korea: A good time to be different?

Macroeconomic uncertainty and liquidity risk are pushing Korean private equity firms to think beyond buyouts, double down on operational capabilities, and consider all their exit options

Temasek, Boyu, GGV back Hong Kong's Animoca Brands

Hong Kong metaverse start-up Animoca Brands has raised USD 110m featuring Temasek Holdings, Boyu Capital, and GGV Capital. Funding since the start of 2021 now tops USD 630m.

East leads $26m Series A for Indonesia agtech start-up

East Ventures has led a USD 26m Series A round for Indonesia’s Gokomodo, an agriculture technology provider focused on simplifying fragmented and inefficient supply chains.

Affirma leads $217m investment in Korean digital insurer

Affirma Capital has led a KRW 300bn (USD 217m) funding round – at a valuation of KRW 1trn – for Carrot General Insurance, a South Korea-based digital insurer.

Australia's Morse Micro gets $95m Series B

Morse Micro, an Australian fabless semiconductor developer specialising in long-range, low-power Wi-Fi for internet of things (IoT) devices, has raised AUD 140m (USD 95m) in Series B funding.

Global Brain leads $30m Series A for Japan's Josys

Global Brain has led a JPY 4.4bn (USD 30.5m) Series A round for Japanese business automation and IT services platform Josys with plans for an international expansion.

Deal focus: Remote working delivers for Glints

An outsourced talent management service that enables companies to recruit in far-flung markets has become the bulwark of Glints’ business on the back of COVID-19, underpinning a USD 50m Series D

Deal focus: PAG goes back to the theme park

PAG returns to a historically fruitful niche with the acquisition of Japanese theme park operator Huis Ten Bosch. COVID-19 made the deal possible but remains a wildcard

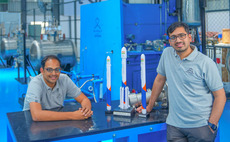

GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

Singapore's Docquity raises $44m Series C

Singapore-based Docquity, a networking service for more than 300,000 doctors across Southeast Asia, has raised USD 44m in Series C funding led by Japan’s Itochu Corporation.

Deal focus: Jai Kisan taps India rural resurgence

The founders of technology-enabled credit platform Jai Kisan went against the grain by forgoing urban customers and targeting India’s rural poor. A USD 50m Series B is an indicator of its progress

Deal financing: Homegrown solutions

Private equity firms are relying more heavily on Asia-based debt investors to support leveraged buyouts amid a loan logjam in the US, highlighting the region’s innovation and durability

China circuit board maker JLC raises $129m

Chinese circuit board manufacturing company Jialichuang (JLC) has raised CNY 900m (USD 129m) from State Development & Investment Corporation (SDIC), Eastern Bell Capital and Jianfa Xinxing Investment.

Deal focus: Turning data into operational efficiencies

Chinese data mining start-up Prothentic has managed to turn first-time business into repeat subscription business, which led to valuation increase between funding rounds even as the wider market stagnates