Australia's Morse Micro gets $95m Series B

Morse Micro, an Australian fabless semiconductor developer specialising in long-range, low-power Wi-Fi for internet of things (IoT) devices, has raised AUD 140m (USD 95m) in Series B funding.

The round was led by Japan-listed semiconductor company MegaChips Corporation and featured existing investors Blackbird Ventures, Main Sequence Ventures, Clean Energy Finance Corporation, Skip Capital, Uniseed, and SpringCapital. Malcolm Turnbull, the former Australian prime minister, and his wife Lucy also participated.

Morse Micro was founded in 2016 and Main Sequence provided seed funding the following year. This was followed by a AUD 24m Series A in 2019 featuring Blackbird, CEFC, Right Click Capital, Skip, and Uniseed, and a supplementary USD 13m in 2020 from Blackbird, CEFC, Main Sequence, and Skip, according to AVCJ Research's records.

Main Sequence first invested through a fund it manages for CSIRO, an Australian government research unit. Uniseed is a fund launched by CSIRO in conjunction with a group of local universities, while CEFC is a government-backed investor focused on energy transition.

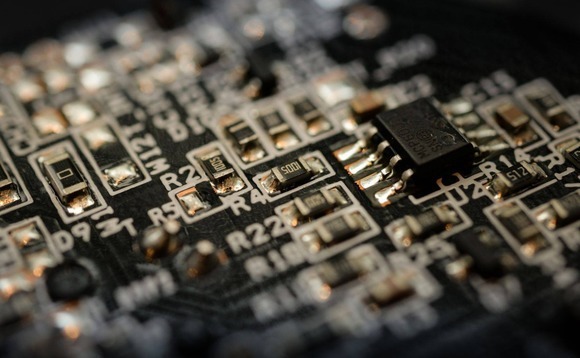

Sydney-based Morse Micro produces system-on-chips (SOCs) and modules for Wi-Fi HaLow, which claims to be the first Wi-Fi standard tailored to meet the needs of the IoT. Wi-Fi HaLow operates at 10x the range of mainstream wireless networks, penetrates walls and other obstacles more easily by using lower frequencies, and consumes limited power, so IoT devices can run on batteries for years.

The company was established by Michael De Nil and Andrew Terry, who subsequently joined forces with Neil Weste, designer of the chipset for IEEE 802.11a wireless LAN, the original Wi-Fi standard.

Morse Micro has offices in Australia, China, India, the UK, and the US. It will use the new funding to deepen its product offering and accelerate its go-to-market strategy. The MegaChips investment also comes with a partnership that will see the Japanese company manufacture and distribute Morse Micro's semiconductors and modules.

"With MegaChips' financial backing and robust manufacturing and sales support, Morse Micro will be poised to achieve our goal of revolutionising IoT connectivity with our growing portfolio of Wi-Fi HaLow SoCs, modules, software and development tools," said De Nil in a statement.

"With growing market traction for Wi-Fi HaLow-compliant solutions in the IoT ecosystem, we're at an exciting inflection point. MegaChips shares our vision to revolutionise connectivity and build enduring Wi-Fi HaLow solutions for the future."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.