GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

It follows a USD 4.5m investment in January featuring US-based Sherpalo Ventures and Wami Capital of the United Arab Emirates. A USD 11m Series A came last year from renewable energy players Greenko Group and Solar Industries India, as well as Vedanshu Investments, Sutton Capital, WorldQuant Ventures, and Graph Ventures.

Mukesh Bansal and Ankit Nagori, co-founders of local health and fitness app CureFit, provided about USD 1.3m in seed funding in 2018.

The Series B proceeds are said to be sufficient to fund all Skyroot's initial launch plans. It will see Mayank Rawat, a managing director at GIC, will join the company's board.

Skyroot hopes to establish a reputation as a best-in-class and affordable launch services provider for small satellite companies. It was the first Indian private company to test fire a full-scale liquid propulsion engine, test fire at the solid-rocket stage, and develop a 3D-printed cryogenic engine.

The company's first rocket, Vikram-I, is designed to carry as much as 480 kilograms of cargo into orbit. Vikram-II and Vikram-III are hoped to lift as much as 595 kg and 815 kg, respectively. Vikram is powered by a 3D-printed engine that is said to benefit from 95% faster production time than conventional manufacturing methods.

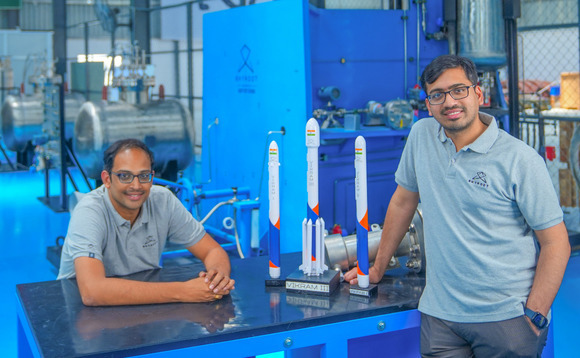

"We have validated all three propulsion technologies in our Vikram space launch vehicles, and completed a full duration test of one of our rocket stages in May," Naga Bharath Daka, co-founder and COO (pictured left with co-founder and CEO Pawan Kumar Chandana), said in a statement.

"We are also planning a demonstrator launch this year. This round will help us get to full-fledged commercial satellite launch scale within a year. We have started booking payload slots for our upcoming launches."

The global space launch services market is projected to grow from USD 14.2bn in 2022 to USD 31.9bn by 2029 as more orbital data collection-related satellite businesses emerge. Indian investment in this theme came as recently as last month, when Accenture backed satellite imaging provider Pixxel via a VC unit.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.