Articles by Tim Burroughs

Deal focus: Navis targets hospitals in the hinterlands

The Southeast Asian manager will commit up to $100 million to hospital roll-up strategy intended to address rising demand for private healthcare in Malaysia’s underserved territories

Deal focus: Novo spreads its wings in Southeast Asia

In Hummingbird Bioscience and Halodoc, Novo Holdings believes it has backed a potential global leader in hard-to-drug cancer and a likely domestic champion in telemedicine and disease management

China online education player Zhangmen targets US listing

Zhangmen, a private equity-backed Chinese online K-12 education platform specializing in one-to-one and small-class tuition, has filed for a US IPO.

Ocean Link, Sequoia seal China hotel operator take-private

Ocean Link and Sequoia Capital China have completed the $190 million privatization and subsequent delisting of Zhejiang New Century Hotel Management.

Anchor invests $550m in Japan unit of Korea's Kakao

Anchor Equity Partners, a mid-market private equity firm focused on opportunities in North Asia, with a particular focus on Korea, has invested JPY60 billion ($550 million) in the Japan unit of Korean internet giant Kakao.

China-backed Oatly raises $1.4b in US IPO

Oatly, a Swedish oat-based, dairy-free beverage brand backed by a joint venture between China Resources Group and Verlinvest, raised $1.43 billion in its US IPO, facilitating partial exits for several investors.

Korea's Centroid rallies local support for TaylorMade buyout

Korean GP Centroid Investment Partners is tapping local investors to participate in a KRW1 trillion ($886 million) equity pool in support of its $1.7 billion acquisition of US golf club manufacturer TaylorMade.

Singapore biotech start-up closes $125m Series C

Novo Holdings, which manages the wealth of Denmark’s Novo Nordisk Foundation, has led a $125 million Series C round for Hummingbird Bioscience, a Singapore and US-based drug developer.

Paddy Sinha joins India government infrastructure fund

Paddy Sinha, formerly managing partner of Tata Opportunities Fund, has become executive director and CIO for private equity at India’s National Investment & Infrastructure Fund (NIIFL).

Alibaba, Baring Asia back Masan's Vietnam grocery push

A consortium led by Alibaba Group and Baring Private Equity Asia has invested $400 million in the combined consumer goods and grocery retail operations of Vietnam conglomerates Masan Group and Vingroup.

Legend closes China healthcare continuation fund

Legend Capital has spun out the healthcare assets from two of its China venture capital funds into a continuation vehicle supported by Hamilton Lane and Coller Capital. The $270 million deal includes capital for follow-on investments.

India's Pine Labs raises $285m

Pine Labs, an India-based payments start-up that recently expanded its Southeast Asia footprint through the acquisition of Malaysia’s Fave, has secured $285 million in new funding.

China's Panacea, Dell family office raise $200m SPAC

Panacea Venture, a China-focused early-stage healthcare investor, has teamed up with Michael Dell’s family office to raise $200 million for a special purpose acquisition company (SPAC).

Vietnam healthcare: Early days

Hospitals attract most of the capital and interest aimed at Vietnam healthcare. Macro tailwinds are benefiting other parts of the services ecosystem as well, but GPs don’t want to jump too early

Q&A: Gaw Capital Partners’ Christina Gaw

Hong Kong-based real estate investor Gaw Capital Partners has leveraged its knowledge and networks to expand into technology and education. Christina Gaw, a managing principal, explains how

Vietnam middle market: Room for maneuver

There is a perceived sweet spot in Vietnam where check sizes are too big for local GPs and too small for pan-regionals. Taking advantage means addressing structural nuances and strategic competition

AVCJ daily bulletin returns May 20

AVCJ’s daily bulletin will not be published on May 19 due to a public holiday in Hong Kong.

Indonesia's Gojek, Tokopedia merge as GoTo

Gojek and Tokopedia, two of Indonesia’s best-funded technology start-ups, have completed a merger, forming what they claim is the largest mobile on-demand services and payments platform in Southeast Asia.

Baring Asia exits SAI Global's assurance business

Baring Private Equity Asia is set to exit a significant part of Australia-based SAI Global, having agreed to sell the standards and assurance services business to UK-listed Intertek Group for A$855 million ($664 million).

NSSK buys Japan power components manufacturer

NSSK has agreed to acquire the power transmission components division of Fujikura, a listed Japanese electrical equipment manufacturer.

SoftBank increases commitment to second Vision Fund

SoftBank Group has increased its commitment to Vision Fund 2 from $10 billion to $30 billion after a revival in the fortunes of Vision Fund 1 meant the company returned to profit over the past 12 months.

James Murdoch launches Asia-focused SPAC

James Murdoch, son of media tycoon Rupert Murdoch, has launched a special purpose acquisition company (SPAC) that will pursue deals in Southeast and South Asia, with a particular focus on India.

LG Chem to anchor IMM's Korea battery fund

IMM Private Equity’s recently established credit unit has launched a KRW400 billion ($353 million) Korea-focused fund that will invest in components for electric vehicle (EV) batteries and other environmentally friendly industrial materials.

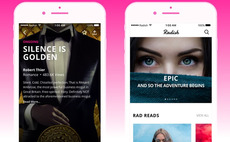

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.