Vietnam healthcare: Early days

Hospitals attract most of the capital and interest aimed at Vietnam healthcare. Macro tailwinds are benefiting other parts of the services ecosystem as well, but GPs don’t want to jump too early

In almost any country, two sectors can be relied upon to see price growth exceed inflation: healthcare and education. Both have become popular targets for private equity in Vietnam, where rising affluence is expected to drive increased spending on essential services. Corporatization is another key theme: provide a business with capital and expertise to achieve scale, and then watch it turn cost advantages into a cycle of consolidation.

Moreover, private sector involvement is viewed positively for its contribution to longer-term reform in terms of preventive healthcare – which means more testing – and delivery format. "Care must move outside the hospital walls for it to be efficient," says Alex Boulton, a Singapore-based partner at Bain & Company. "There is a need for more integrated care and digital tools. You can run much more efficient lab services if you aggregate labs across hospitals that are sub-scale."

Within Southeast Asia, only Singapore can claim a mature outpatient ecosystem comprising diagnostic labs and specialty clinics, as well as a developed consumer health supply chain from pharmaceuticals to pharmacies. Industry participants say they see the beginnings of this evolution in other markets – notably Indonesia – but it remains to be seen how quickly Vietnam follows.

"Healthcare is hard to do right, so this puts a premium on the management team. When you find teams that execute well and have the right combination of medical expertise and operational competence, that creates a moat around the business," one Vietnam-focused investor observes. "But a clinic run by investment bankers and finance people might not be a success. Similarly, if they are all medical researchers, it might not be able to scale."

Hospitals first

For most of the last decade, private equity investment in Vietnam's healthcare sector has come in fits and starts. A semblance of consistency emerged as recently as 2016 with a handful of deals completed each year since then. The largest transactions have involved hospitals.

Clermont Group, a private investment firm controlled by New Zealand billionaire Richard Chandler, put down an early marker in 2013 with the acquisition of a majority stake in Hoan My from Fortis Healthcare for $80 million. A handful of other deals were completed from 2016 with – in likely order of size – Navis Capital Partners buying Hanoi French Hospital, Quadria Capital purchasing a stake in FV Hospital, and VinaCapital committing $25 million to Tam Tri Medical.

Then, at the end of last year, GIC led a $203 million investment in Vinmec, which is controlled by Vingroup, the country's largest private enterprise. Given GIC's experience with similar assets in other emerging markets – and Vinmec's early challenges, which led to it being converted into a non-profit in 2016 – this was seen as a statement of confidence in the hospital opportunity.

"You see most healthcare deals in the services space because it makes up 40% of the market," says Ewan Davis, a managing director at Quadria. "It is the only place where you will find more mature, scaled-up businesses. When you think about household names looking to deploy $100 million and up in healthcare, that's where they go."

There are two key attributes investors want from hospitals: scale and specialization. They don't necessarily come together, especially in Vietnam where 90% of beds are still in the public sector and the private sector is relatively fragmented. Hoan My has achieved scale, with more than 2,800 beds across 15 hospitals and seven clinics. Vinmec was an early mover in premium healthcare, yet it has a sizeable network of seven hospitals and five clinics with more than 1,500 beds.

Quadria and Navis took the specialization route. FV stood out for Quadria as one of few hospitals in Vietnam accredited by Joint Commission International (JCI), a US-based patient safety organization. The private equity firm's proposition to the founding team of doctors was that it could help establish advanced programs for cancer, heart disease, and gastric sciences. FV comprises a 220-bed hospital and several feeder clinics, but more importantly, it receives plenty of referrals.

"If you can provide specialized, differentiated care and you continue to develop sub-specialization in those areas, then that institution can really make headway. In addition, you become a reference center as the only group capable of providing that level of care in that disease area," says Davis. "You are not seen as a threat to other hospitals, but as a partner that provides something they cannot."

Expansion issues

As a foreign-owned facility located in Hanoi's medical district, Hanoi French was always a premium offering. Navis retained this designation while boosting capacity from 70 to 170 beds. There has been no geographical expansion; the GP is finishing renovations on the existing building, having already built a new seven-floor hospital alongside it. In addition, doctors were recruited, and new equipment installed to strengthen Hanoi French's specialization in pediatrics, obstetrics, and gynecology.

Given expansion was essentially a bet on the spending decisions of an emerging middle class, marketing became an important strategic initiative, especially connecting with the younger generation. David Ireland, a senior partner at Navis, notes that location, reputation, and longevity are what attract people to hospitals, with word of mouth wielding significant influence.

"It's not easy or cheap to build a hospital," he says. "You can create a beautiful facility, put in the best equipment, and then be really unsuccessful. We've been offered greenfield sites in new townships and cities because there's always a hospital zone. But it's 25 kilometers from the city center and it will take a long time to establish a reputation and get a critical mass of patients. That's a challenge."

Several industry participants express a healthy skepticism of buy-and-build in Vietnam's hospital segment. The reasons are like those that have stymied similar efforts in China: limited private insurance penetration or inability to access state insurance programs; difficulty recruiting experienced local doctors from the public sector (in Vietnam, many are said to run their own private clinics on the side); and the availability of quality assets at reasonable valuations.

Quadria's Davis estimates that, among all the hospital groups in Vietnam that are not already corporatized and well-funded, no more than 10 would qualify as candidates for clinical specialization and the same number for scaling.

"Buy-and-build reads well on paper, but the reality is it's about asset availability, asset quality, and valuation. It's rare that you tick off all three and build up a platform in a short timeframe," he says. "A strategic can take a long-term view and pick up complementary assets as and when the stars align. It is difficult for private equity, with a 3-10-year horizon, to do this unless a string of assets is lined up."

However, consolidation may come about through mergers of existing groups with three or four hospitals, creating medium-sized platforms that provide greater competition to the likes of Hoan My and Vinmec. Indeed, it's possible that the next owners of FV and Hanoi French – whether they are financial or strategic players – will take the same approach.

Ecosystem effect

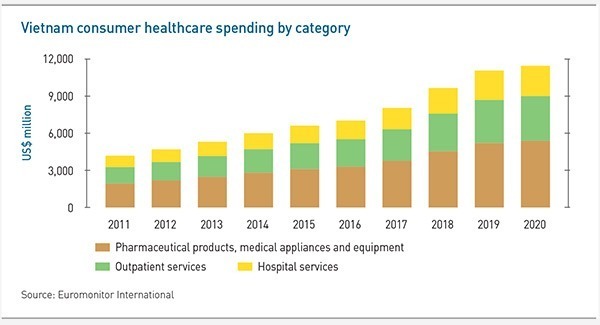

According to the World Bank, domestic private healthcare expenditure per capita increased by 50% between 2011 and 2018, reaching $80. Over the same period, Euromonitor International found that consumer healthcare spending rose 130% to $9.6 billion. As of 2020, it was $11.4 billion, with a near equal split between pharmaceuticals and medical equipment and hospital and outpatient services.

Yet there is some wariness as to when services spending will spill over from hospitals into other areas and the scope for private equity investment. Within diagnostics, imaging is regarded as a challenge because it is a sizeable revenue source for hospitals, and they would be loath to see that money go to third-party outpatient centers. As for pathology, beyond the hospitals, there are two dominant privately owned players, Medlatec and Medic Labs. Both are said to have been courted by PE.

Of the assets that are available, there is no guarantee they will scale or in what timeframe. "The diagnostic labs and clinics are not of the size to support investments from regional private equity funds," observes Paul DiGiacomo, a managing partner at M&A advisory firm BDA Partners. "However, they will get there in a few years."

Investments that have been made tend to focus on relatively niche offerings. Ha Van Education & Healthcare is perhaps the most extreme example. A corporate health check-up business that serves blue-collar workers, the company won backing from Japan-based ACA Investments, participating via its Southeast Asia fund. Most of Ha Van's customers are Japanese corporates with local manufacturing operations and ACA knew it had the networks to help expand the customer base.

Meanwhile, BDA Capital Partners – an investment affiliate of BDA – recently made its debut investment in 315, a leading domestic primary care pediatrics chain, and the impact investment arm of Temasek Holdings led a $24 million Series B for Kim Dental, a dental clinic operator. Both deals were predicated on a belief that the businesses can corporatize in ways that industry peers cannot.

"They have grown to 21 clinics since we first invested, and the goal is to reach 50 within five years," says Andrew Nai, a director at Aura Private Equity, which first backed Kim in 2018. "They have a proven ability to scale, and they have all the necessary licenses and approvals, which is not common in Vietnam. There are a lot of mom-and-pop clinics or single dentist-owned clinics that aren't always professionally run. Not many dentist-founders have built chains of more than 10 clinics."

Chain game

In this sense, comparisons can be drawn with the pharmacy space, where Pharmacity has stolen a march on the industry by establishing a 553-store footprint, roughly four times the size of the next largest player. The company – which is backed by Mekong Capital and TR Capital – achieved this by modernizing the outdated Vietnam pharmacy business model with Walgreens-style wide aisles, shelves stocked with personal hygiene products as well as medicine, and even drive-through services.

There is still plenty of scope for further consolidation and extracting the same kind of economies of scale, supply chain control, and margin improvement pursued by the mass-market hospital operators. Bain's Boulton notes that chain stores account for just 5% of Vietnam's pharmacy market versus 90% in Singapore, 88% in the Philippines, and 20% in Malaysia.

Pharmacity will face increased competitive threats. The second and third-largest operators are consumer electronics retailers FPT Retail and Mobile World. Though trailing by some distance, they know how to scale consumer-facing brick-and-mortar businesses. But the real opportunity might be online or omnichannel, which would allow pharmacies to play a more comprehensive role in healthcare by linking up with disease management and diagnostic components.

The big question is how you get it to pay – yet another reminder of the risks of moving too early in Vietnam and being left with an investment that makes theoretical sense but lacks critical mass. Indonesia's Halodoc might be the most appropriate reference point as a consultation and appointment booking platform established by a local pharmaceutical manufacturer and distributor. Regardless of its origins, the VC-backed company has found B2C customer acquisition expensive.

"They started out by providing teleconsulting for free and making the take rate on the pharmaceutical products sold on the back end," says Boulton. "Making telehealth work hinges on getting providers to pay for it as a SaaS [software-as-a-service] solution or getting insurers to cover it. That's challenging in a market with few private providers incentivized to back it or indeed high private health insurance penetration."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.