Articles by Tim Burroughs

KKR seeks up to $1.5b for Asia tech fund

KKR has launched its debut Asia-focused technology growth fund, two-and-a-half years after first indicating it would add this strategy in the region.

Bertelsmann spinout BAI Capital closes $700m China fund

BAI Capital, formerly Bertelsmann Asia Investments, a captive unit of the eponymous German media company, has closed its debut China fund on approximately USD 700m.

Matrix leads Series B for China's SpeedBot Robotics

Matrix Partners has led a CNY 300m (USD 44m) Series B round for SpeedBot Robotics, a China-based start-up specialising in vision-guided intelligent robotics.

Korea's Viva Republica raises USD 225m

Viva Republica, operator of the Korean money transfer app Toss, has raised KRW 296bn (USD 225.5m) in series G funding from an investor group that includes Altos Ventures, Goodwater Capital, Greyhound Capital, and Kleiner Perkins.

Australia's mx51 secures $22.5m Series B

Mx51, an Australia-based payments technology platform that emerged as a partnership with Westpac, has raised AUD 32.5m (USD 22.4m) in Series B funding.

China's Jaka Robotics raises $150m Series D

Prosperity7 Ventures, a USD 1bn venture capital fund established by Saudi Arabia state oil giant Saudi Aramco, has continued its run of robotics investments in Asia by joining a USD 150m Series D for China’s Jaka Robotics.

Navis enters Asia credit space

Navis Capital Partners has launched a credit unit that will provide financing to companies in Asia that require growth capital but are reluctant to bring in equity investors.

Mutiples commits $30m to India neo-banking platform

Multiples Alternate Asset Management has invested USD 30m in India-based neobank Niyo, entering on the heels of a USD 100m Series C round that closed in February.

RRJ to invest $251m in Singapore's Fullerton Health

RRJ Capital is poised to invest SGD 350m (USD 251m) in Singapore-based integrated healthcare platform Fullerton Healthcare Corporation after the target company settled a dispute with two of its co-founders.

Deal focus: SJL fills Korea's cross-regional gap

Steve Lim launched SJL Partners to help Korean corporates pursue M&A in the US and Europe, having seen global GPs pass on such opportunities. Meridian Bioscience is the latest addition to the portfolio

Asia logistics: Cost and complexity

Investment opportunities are expected to emerge as companies look to technology as a means of easing inflationary pressure on supply chains. Will Asia’s shallow pool of specialist logistics GPs deepen?

Australia's Fortitude exits Shopper Media to Woolworths

Australian grocery giant Woolworths has agreed to buy Shopper Media Group, an out-of-home digital advertising business with 2,000 screens across more than 400 shopping centres, for approximately AUD 150m (USD 102m).

ANZ withdraws from MYOB acquisition talks

Australia and New Zealand Banking Group (ANZ) has ended its pursuit of KKR-owned Australian accounting software provider MYOB just days after confirming talks over a potential acquisition.

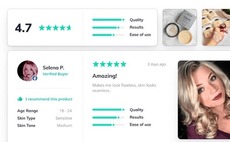

Australia customer reviews specialist gets $26m Series A

Okendo, an Australia-founded customer review platform for e-commerce brands, has received USD 26m in Series A funding led by US venture capital firm Base10 Partners.

China's Miss Fresh brings in state backer at knock-down valuation

Chinese online grocery delivery platform Miss Fresh, which went public on NASDAQ 12 months ago with a market capitalisation of around USD 3bn, has sold a minority stake to a state-owned enterprise at a valuation of USD 90m.

India SaaS player Detect Technologies closes $28m Series B

Detect Technologies, an India-based software-as-a-service (SaaS) start-up with a suite of artificial intelligence-enabled products that help enterprise customers assess risk exposure, has raised USD 28m in Series B funding.

China GPU chip developer Iluvatar raises $149m

Iluvatar CoreX, a Shanghai-based designer of chips used in cloud computing, has raised CNY 1bn (USD 149m) across two additional tranches of Series C funding. The first tranche closed on CNY 1.2bn in March 2021.

Canada's AIMCo to establish Asia base in Singapore

Alberta Investment Management Corporation (AIMCo), a Canadian pension plan with CAD 168.3bn (USD 127.9bn) in assets under management, has chosen Singapore over Hong Kong for its first Asia office.

KKR explores sale of Australia's MYOB to ANZ

Australia and New Zealand Banking Group (ANZ) has confirmed it is in negotiations with KKR over the potential acquisition of Australia-based accounting software provider MYOB.

IDG leads $100m Series A for China's Xpeng Robotics

IDG Capital has led a USD 100m Series A round for Xpeng Robotics, a smart robot developer affiliated to US and Hong Kong-listed Chinese electric vehicle (EV) manufacturer Xpeng.

Philippines venture builder, Ayala engineer health-tech merger

917Ventures, a corporate venture builder controlled by Philippines-based telecom operator Globe Group, has merged its KonsultaMD telehealth platform with assets held by Ayala Corporation to create a one-stop health super app.

Tiger Global leads Series A extension for Singapore's Intellect

Tiger Global Management has led a USD 10m Series A extension for Singapore-based mental health start-up Intellect, demonstrating its willingness to reach more deeply into early-stage deals in Asia.

Temasek sees portfolio hit new high, warns of global weakness

Temasek Holdings continued its rapid pace of investment over the past year as the portfolio reached a new record high valuation, but the Singapore investor warned of potential difficulties ahead, noting that the global economy is in a “fragile state.”...

2Q analysis: Substituting China?

India and Southeast Asia come to the fore as China demonstrates weakness in both growth-stage investment and fundraising; exits continue to struggle amid reluctance from strategic buyers