2Q analysis: Substituting China?

India and Southeast Asia come to the fore as China demonstrates weakness in both growth-stage investment and fundraising; exits continue to struggle amid reluctance from strategic buyers

1) Investment: Redistributed growth

China growth-stage transactions are usually well-represented in rankings of Asia's largest private equity deals, typically expansion rounds for technology companies. However, the domestic regulatory upheaval of the last 18 months, and more recently, corrections in listed equities globally across technology and healthcare have led to investor wariness.

In the first three months of 2021, 10 of the top 25 deals region-wide were China technology growth plays. The totals for the subsequent four quarters were four, three, four, and two. Biotech made an appearance, but there were no more than a handful of transactions.

Technology once again accounted for two entries on the list in the second quarter of 2022. Both speak volumes for the current investment environment: a CNY 4.5bn (USD 672m) round for Guangzhou CanSemi Technology, which operates in the policy-favoured semiconductor industry; and a USD 1bn commitment to Shein, a fashion e-commerce platform popular outside of China.

In addition, there was one growth-stage healthcare transaction – in MegaRobo Technologies, a technology-enabled service provider to the life science industry rather than a drug developer. Of the three other China representatives in the top 25 (down from seven and nine, respectively, in the previous two quarters), two were buyouts, according to provisional data from AVCJ Research.

That's not to say the second quarter was bereft of large minority technology deals. There were nine in other markets, including four from India and three from Southeast Asia. Consumer internet (Dailyhunt and VerSe Innovation), financial technology (Coda Payments, Xendit, and Stashfin), and healthcare technology (Biofourmis and CitiusTech) all featured.

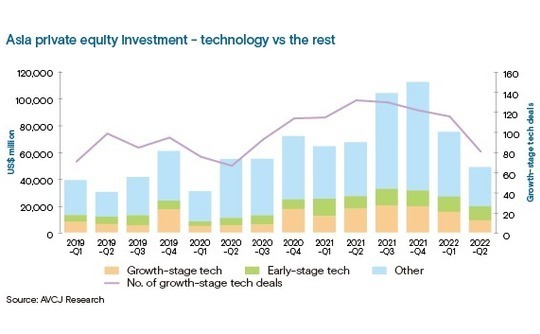

These investment highlights correspond to the broader picture. Early and growth-stage tech sector activity have both been in decline since the third quarter of 2021, but the drop-off has accelerated in the past three months. Investment fell from USD 26.6bn in the first quarter to USD 19.5bn in the second. This was most keenly felt in the growth space, which slipped 41% to USD 9.1bn.

However, the damage differs markedly by geography. In China, the number of growth rounds fell by half to 25, while capital deployed slumped from USD 7.6bn to USD 2.1bn. India also peaked in the third quarter of 2021, but it now appears to be bottoming out, with USD 4.3bn deployed in April-June. Southeast Asia rebounded from USD 2.8bn to USD 3.5bn.

Much is made of global growth investors switching focus from China to India and Southeast Asia, where they see familiar patterns in technology and less regulatory uncertainty. Judging by dollar deployment in the second quarter of 2022, this is happening – although both India and Southeast Asia saw a decline in the number of growth rounds announced.

It is instructive to look at how early and growth-stage technology investment contributes to the regional private equity total. There was a notable uptick in the fourth quarter of 2020 as it became clear that COVID-19 was propelling adoption of technology-enabled remote consumption. The early and growth-stage tech share of overall investment rose to 35% and six months later passed 40%.

It began to fall thereafter, partly because of a surge in overall private equity activity. In the fourth quarter of 2021, when investment hit a record high of USD 112bn, the tech share dropped to 28%. However, it returned to 40% in the second quarter of 2022 as overall activity tailed off.

The USD 48.7bn private equity investors deployed in Asia between April and June represents the lowest quarterly total since the height of COVID-19 uncertainty in the first three months of 2020. The 35% quarter-on-quarter decline was primarily caused by growth equity investment falling from USD 43.7bn to USD 22.4bn, while buyouts regressed from USD 23.1bn to USD 17.9bn.

The role technology played in this has already been established. Healthcare is the other key contributor. Overall investment dropped by half to USD 4.6bn. Much of this can be pinned on early and growth-stage activity in China – and commitments to drug developers specifically – which went from USD 3.8bn to USD 1.8bn, the lowest quarterly total in nearly three years.

2) Fundraising: Sequoia story, part one

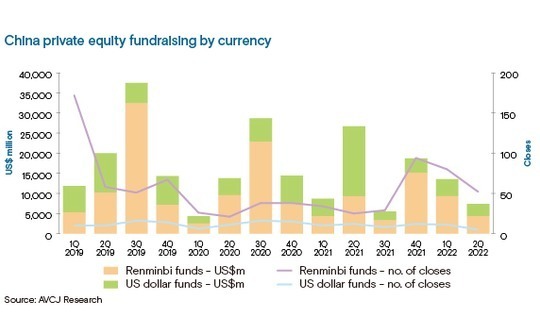

Sequoia Capital is almost uniquely positioned among venture capital firms in Asia to move the fundraising market. This will become apparent when the China team's USD 8.8bn haul is included in calculations for the third quarter of 2020. And it is already apparent in the second-quarter datasets, which saw Sequoia's India and Southeast Asia operations come to the fore.

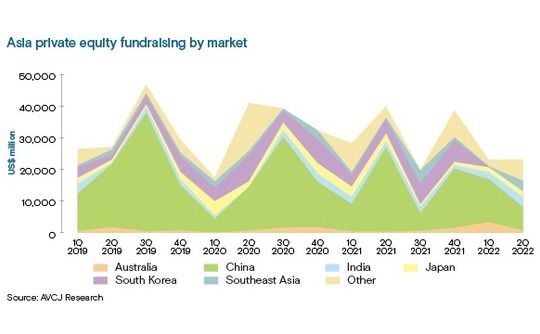

Fundraising across all geographies and strategies was flat – approximately USD 23.1bn was committed to Asia-focused managers, representing a very small increase on the previous quarter. This apparent stability masks some significant shifts within individual markets.

When there is volatility in China fundraising, there is volatility in the headline Asia number. In the third quarter of 2019, third quarter of 2020, and second quarter of 2021 about USD 40bn was raised – China was behind these spikes, accounting for 80%, 73%, and 67% of the total. In troughs such as the first quarter of 2020 and third quarter of 2021, China contributed less than 25% to sub-USD 20bn totals.

The average for the preceding eight quarters is USD 5.8bn, underlining how difficult it has become for local GPs to win support from international investors since the middle of last year.

Despite this continued decline in commitments to US dollar and renminbi funds, Asia fundraising was flat. This is because India and Southeast Asia stepped up: the former from USD 2.2bn to USD 3bn, the latter from USD 230m to USD 3.3bn. The China share of fundraising in the second quarter was 32%, down from 59%.

Sequoia India announced a final close of USD 2bn on its latest venture and growth funds in June. The firm also raised USD 850m for its first-ever Southeast Asia vehicle, having previously addressed the market as an extension of the India business. When Sequoia last came to market in 2020, addressing both geographies together, it raised USD 525m for venture and USD 825m for growth.

This activity helped propel India and Southeast Asia to a 28% share of Asia fundraising – they often struggle to reach double figures – but it was not the sole driving force.

Jungle Ventures has also successfully tapped the India-Southeast Asia axis, closing its fourth fund on USD 600m, nearly twice the target amount. Additional contributions to the second-quarter total came from East Ventures-controlled EV Growth and newly launched Growtheum Capital Partners in Southeast Asia as well as Elevation Capital and Eight Roads in India.

Looking at the largest fundraises from April-June, it is telling that the highest-ranking traditional buyout fund is 12th – Japan's J-Star secured USD 583m for its fifth vehicle. Four of the top six slots are occupied by mezzanine capital funds launched by PAG and Intermediate Capital Group, Bain Capital's latest Asia special situations offering, and LGT Capital Partners' fifth regional fund-of-funds.

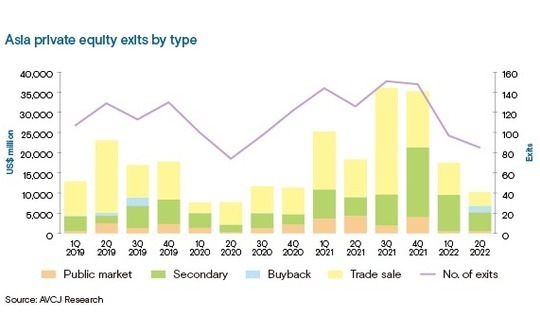

3) Exits: No respite

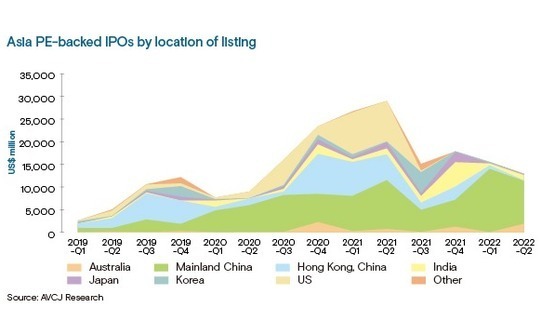

Asia private equity exits fell off the proverbial cliff in the first quarter of 2022, plummeting from USD 35.4bn to USD 17.6bn. The driving factors are largely unchanged – add lockdowns in China to a list that includes conflict in Ukraine, macroeconomic uncertainty, volatile equities markets – and so is the outcome. Investors realised just USD 10.3bn between April and June.

Trade sale proceeds amounted to USD 3.5bn, down from USD 7.9bn. After Shell Petroleum's USD 1.55bn acquisition of Sprng Energy, an India-based renewables platform created by Actis, no deal involving a strategic investor surpassed USD 500m. Several of the larger transactions – Shopmatic. Pickrr Technologies, and Pine Labs – were sales to other technology players, hinting at a wave of consolidation that could become more prevalent in Asia.

Half of the dozen largest exits featured private equity buyers. Baring Private Equity Asia, once again, appeared as both buyer and seller: it completed two approximately USD 1bn exits, offloading 100% of China packaging business HCP Holding to The Carlyle Group and 40% of CitiusTech to Bain Capital. PI Advanced Materials was acquired from Glenwood Private equity for around the same amount.

Nevertheless, the recent rich vein of sponsor-to-sponsor transactions could not be sustained. Having reached a record USD 17.3bn in the final three months of 2021, they fell back to USD 9bn in the first quarter of 2022 and then USD 4.7bn in the second.

With the US markets inaccessible and numerous Hong Kong offerings getting pulled, Chinese companies listed on mainland bourses were responsible for 75% of all proceeds region-wide. In the first quarter, it was 90%. Approximately USD 14.5bn has been raised on Shanghai's Star Market alone since the beginning of the year, more than the 12-month total for 2021.

Eight of the 10 largest IPOs by companies with financial sponsors happened on the Star Market, and 15 of the top 25. Chinext and the Shanghai A-share market were responsible for six more.

Outside of China, there were notable offerings by minerals explorer Od6 Metals in Australia (USD 1.7bn) and Indian e-commerce logistics provider Delhivery (USD 674m). Delhivery is the latest in a stream of pre-profit tech companies joining the domestic bourse. Now trading at a 26% premium to the offering price, it appears to have bucked the trend of disappointing post-IPO stock performance.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.