China GPU chip developer Iluvatar raises $149m

Iluvatar CoreX, a Shanghai-based designer of chips used in cloud computing, has raised CNY 1bn (USD 149m) across two additional tranches of Series C funding. The first tranche closed on CNY 1.2bn in March 2021.

The first extension was led by Beijing Financial Street Capital and the second by Hopu Investment and Hopu-Arm Innovation Fund. The fund is a joint venture between Hopu and Arm, a leading global designer of central processing units (CPUs).

Other commitments came from Zhongguancun Science City Science & Technology Growth Fund, state-owned investment platform Shanghai Guosheng Group, Financial Street Capital-backed Vista Investment, Xinxing Asset Management, Ding Xiang Capital, Ding Li Capital, Guandong-Hong Kong-Macau Industry & Finance, and Shanghai FTZ Fund.

The first tranche of the Series C was led by Cedarlake Capital and Centurium Capital, with support from Gortune Investment and China Unicom Capital. Centurium also featured in the Series B alongside Princeville Capital in 2019, according to AVCJ Research.

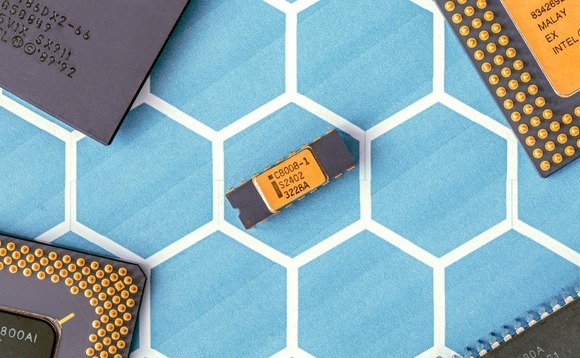

Iluvatar focuses on graphics processing units for general-purpose computing (GPGPU). GPU is the mainstream solution for powering artificial intelligence (AI) computation in areas like autonomous driving, finance, education, and healthcare. GPU chips – often referred to as AI chips – are said to have the largest market ceiling, given the exponential growth of AI-related applications.

Nvidia is the dominant player in China, but various local rivals are emerging. Chip design is popular among PE and VC investors because of its high technology content and lower capital intensity than other areas of semiconductors. Companies that may challenge global market leaders – by virtue of targeting emerging industry segments or having very strong teams – are hot properties.

Last November, Moore Threads, a GPU specialist established less than two years ago by a team from Nvidia, closed CNY 2bn in Series A funding. This was its third funding round. The likes of Biren Technology – established by a former SenseTime executive who recruited a team from Huawei Technologies – Metax Integrated Circuits and Enflame Technology have also raised a lot of capital.

Founded in 2015, Iluvatar describes itself as China's first provider of high-end general-purpose GPU chips. The new funding will be used to move Zhikai 100, an AI inference chip, into mass production and to develop second and third-generation iterations of AI training chips. There are also plans to expand Iluvatar's accompanying software platform and accelerate the integration of AI and graphics.

The company's debut AI training chip, Tiangai 100, was officially released in March 2021. It was China's first 7-nanometre cloud computing GPGPU chip. As of March 2022, orders had reached nearly CNY 200m. The next-generation product, a cloud-edge reasoning chip, was initiated in May.

"GPGPU is the foundation of China's next-generation IT computing power base and a fundamental channel for building digitally enabled smart cities," said Ruiqi Cheng, chairman of Financial Street Capital, in a statement.

"We continue to be optimistic about the prospects for China's semiconductor industry and the prospects for Iluvatar, based on its technical strength in addressing GPU core technology and the forward-looking capabilities of its management team. We hope this round of funding can help the company accelerate mass production."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.