Articles by Justin Niessner

Deal focus: PAG goes back to the theme park

PAG returns to a historically fruitful niche with the acquisition of Japanese theme park operator Huis Ten Bosch. COVID-19 made the deal possible but remains a wildcard

Q&A: Unitus Ventures’ Surya Mantha

Indian returns-focused impact investor Unitus Ventures is sharpening its thesis around jobs as it celebrates its 10-year anniversary. Surya Mantha, a managing partner at the firm, traces the evolution

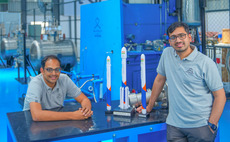

GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

Singapore's Docquity raises $44m Series C

Singapore-based Docquity, a networking service for more than 300,000 doctors across Southeast Asia, has raised USD 44m in Series C funding led by Japan’s Itochu Corporation.

Anchorage exits Australia rail operator

Australia’s Anchorage Capital Partners has sold local rail operator Rail First Asset Management for AUD 425m (USD 290m) to Dutch GP DIF Capital Partners and Amber Infrastructure of the UK.

Australia branding platform Outfit acquired by US strategic

Australia’s Outfit, a VC-backed brand management business, has been acquired by Smartsheet, a New York-listed enterprise workflow management platform for an undisclosed sum.

Japan remote workforce player oVice raises $32m

Japan’s oVice, a start-up that provides virtual co-working spaces for remote and hybrid teams, has raised JPY 4.5bn (USD 32.1m) in Series B funding featuring Jafco and Eight Roads Ventures.

Navis exits Singapore's Adampak after 10-year hold

Navis Capital Partners has sold 100% of Singapore-based Adampak, a diversified manufacturer specialising in labels and barcode stickers, to Oji Imaging Media, a leading Japanese paper company.

Japan’s D Capital nears target for debut PE fund

Japan’s D Capital, a private equity firm specialising in digital transformation that spun out from Unison Capital last year, has raised JPY 26bn (USD 188m) for its debut fund against a target of JPY 30bn.

Japan middle market: Crowded field

The expansion of Japan’s middle-market private equity scene has not kept pace with the rise in global investor interest. Spiking competition is inducing GP formation, but impediments are myriad

Singapore, Thailand blockchain remittance player gets $50m

Singapore and Thailand-based Lightnet, a blockchain-enabled payments and remittance services provider, has raised USD 50m from US-based LDA Capital.

Accenture backs India space tech start-up Pixxel

Accenture has made an investment of undisclosed size in Indian satellite imaging provider Pixxel via a VC unit. It follows a USD 25m Series A round in March.

Rise Fund, Norwest lead $110m Series D for India's EarlySalary

TPG’s Rise Fund and Norwest Venture Partners have led a USD 110m Series D round for EarlySalary, which claims to be India’s largest consumer lending financial technology start-up.

GrowX team seeks $100m for spinout India VC fund

The team behind Indian angel investor GrowX Ventures has launched a separate fund targeting USD 100m under the name Merak Ventures.

Dymon Asia carves out shipping industry supplier

Dymon Asia Private Equity has agreed a carve-out of Singapore-based shipping industry equipment supplier RAM Spreaders from its German parent Salzgitter Maschinenbau for an undisclosed sum.

Japan healthcare AI start-up Ubie closes $26m Series C

Japan’s Ubie, a healthcare technology start-up that uses artificial intelligence (AI) for symptom-checking questionnaires, has raised USD 26.2m in Series C funding from local investors.

Singularity Growth leads Series D for India's Servify

India’s Singularity Growth Opportunity Fund, a vehicle associated with former Reliance Capital executive Madhusudan Kela, has led a USD 65m investment in after-sales software provider Servify.

Singapore's Genesis hits first close on second venture debt fund

Singapore-based Genesis Alternative Ventures has reached a first close on its second venture debut fund, having raised nearly half the overall target of USD 150m.

Korea medical tech start-up raises $20m Series B

Korea’s Airs Medical, a healthcare technology provider active in diagnostics software and robotics, has raised USD 20m in Series B funding from Klim Ventures, Q Capital Partners, and Hanwha Life Insurance.

NZ Super, ACC exit Kiwibank via $1.3b NZ government buyout

New Zealand Superannuation Fund (NZ Super) and Accident Compensation Corporation (ACC) have exited state-owned Kiwibank at an implied valuation of NZD 2.1bn (USD 1.3bn).

India rural fintech player Jai Kisan raises $50m

India’s Jai Kisan, a financial technology start-up focused on digital banking in rural areas, has raised USD 50m in Series B funding from a group including DG Daiwa Ventures and Blume Ventures.

Singapore's TotallyAwesome raises $10m seed round

Singapore’s TotallyAwesome, a digital advertising start-up focused on children’s online safety, has raised a USD 10m seed round featuring US venture debt provider Partner For Growth (PFG).

India seaweed biotech start-up raises $18.5m

India’s Sea6 Energy, a company that cultivates and processes seaweed to make a range of bio-engineered products, has completed a USD 18.5m Series B round featuring BASF Venture Capital.

Stride closes India venture debt fund on $200m

India’s Stride Ventures has closed its second venture debt fund with USD 200m in commitments. The target was INR 10bn (USD 125m).