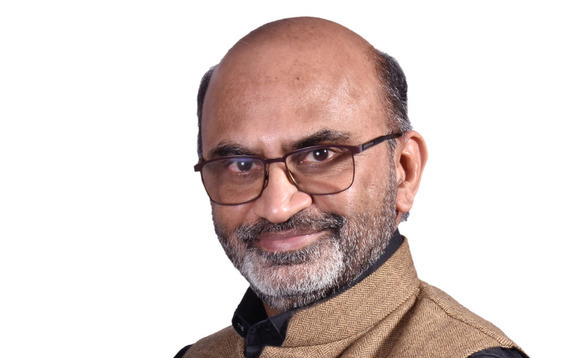

Q&A: Unitus Ventures' Surya Mantha

Indian returns-focused impact investor Unitus Ventures is sharpening its thesis around jobs as it celebrates its 10-year anniversary. Surya Mantha, a managing partner at the firm, traces the evolution

Q: How was Unitus Ventures established?

A: The three co-founders are Dave Richards, Will Poole, and Srikrishna Ramamoorthy. Dave and I go back more than two decades; he and I were colleagues at RealNetworks in Seattle. Will was a senior executive at Microsoft where he led the Windows business globally. Srikrishna was on the investment team at the Michael & Susan Dell Foundation and also on the founding team of Ujjivan, a microfinance pioneer. In the early 2000s, Dave joined Unitus Group and helped pioneer microfinance in India. I moved back to India in 2005 and had a similar impact journey on the founding team of Omidyar Network India. I came on board Unitus Ventures in 2019.

Q: What was the plan?

A: The thesis was that microfinance that was already happening would be replicated in other products and services for the masses. This would be driven by entrepreneurship and risk capital and enabled by technology. Unitus has seen microfinance start with non-profit grant capital, then move to early-stage venture, then impact capital, then growth-stage and hedge funds, and finally quite a few companies have gone public. Unitus was among the first to recognise this innovation template would be replicated more broadly for a whole range of essential products and services targeted at the next half billion. Most of the money at the time was going to the top of the pyramid. Unitus was the first firm to raise domestic venture capital targeted at innovation for the masses.

Q: How big is the firm now?

A: We are a fairly intimate team. We have four partners – two in Bangalore, two in Seattle – and strong investment and marketing teams based in Bangalore. Our investments in marketing are unique, particularly for a firm our size. Will understood from Microsoft the power of marketing and invested heavily in it. We manage a relatively modest corpus of USD 50m across our two funds, but we punch well above our weight when it comes to brand and PR. A few years into the journey, Will and Dave created a fund-of-funds called Capria Network that backs managers across the global south. Every month, we share deals and feedback on our markets. That cross pollination has been very useful.

Q: What's the fundraising history?

A: Fund I raised about USD 21m in 2013. We had to show that we could get market returns in an uncharted sector. Cheques were as small as USD 100,000. Fund II was about USD 30m in 2018 with cheque sizes up to USD 500K to 1m. We're not in the AUM game. Our focus and skills are in identifying opportunities early and helping them grow and become valuable. However, we expect our third fund will be much larger, hopefully USD 100m-plus. We realised that our companies are doing well, but we ran out of reserves to stay invested in the winners, even though we have pro-rata rights.

Q: What's your approach to investment?

A: One point that's very important to us is that it's not discretionary sectors like fashion, gaming, and entertainment. Our focus is on companies that are building essential products and services for the masses, companies that will generate impact at scale along with delivering benchmark returns to investors. One of the proof points for that is when your portfolio companies attract follow-on capital from commercial investors that are not motivated by anything else but profit. We've established a lot of that in Fund I and II. Everybody is coming into this space now because there's only so much the top 100m in India can buy. The real opportunity is in the next 500m. The difference is that we're specialists. Others do it in addition to everything else.

Q: What are the advantages of being a specialist?

A: There is significant brand recognition that is built over a period of years, so sourcing is easier for us. Also, there are synergies among our portfolio companies. Fund I has given some exits, and we hope to return the fund and turn a healthy profit in the next 2-3 years. Fund II is reasonably early in its lifecycle. We are pleased with how the portfolio is performing, both from a business growth standpoint as well as their ability to attract follow-on capital at healthy mark-ups. The mark-ups are good and sustainable because we don't invest in cash-guzzlers. They're not the companies the media talk about every day but they all have sound unit economics. If you compare us to similar funds in our timeframe, we're tracking above the market in terms of mark-ups and DPI [distributions to paid-in].

Q: How have you refined your investment approach?

A: Microfinance was the early template. But now it's job matching, worker benefits, enterprise SaaS [software-as-a-service], gig platforms, skilling and upskilling, e-commerce, marketplaces, SME [small to medium-size enterprise] financing, SME-tech, and anything having to do with the future of work, jobs, or job-tech. We consider fintech a horizontal enabling sector. Also, we want to support the jobs of tomorrow in technologies like artificial intelligence and robotics that are disrupting the nature of work. We've built one of the broadest and deepest portfolios around jobs. For us, it's a theme, not a sector. Thinking about it in a holistic way differentiates us.

Q: What's the scope of Indian employment as an investment theme?

A: India probably has the youngest population of any major country, with about 60% under 30. Every month, 1m people enter the job market. They've been doing so for the last eight years, and they'll do so for the next 20. The challenge for any country is to grow rich before they grow old. The biggest challenge – and opportunity – in India is creating meaningful high-paying jobs for the demographic bulge. We're talking about 500m young people. Just think about that number.

Q: How is the pandemic changing things?

A: Because of the difference in economic growth rates in different parts of the country, the jobs are in the south and west, while most people are in the north and east. So, there's been a lot of in-country migration in the technology industries. In white-collar, there will be more jobs in lower-tier cities, which will create more entrepreneurial activity there. There will also be more cross-border employment with the distribution of global teams in those cities. And there will be a whole new set of tech companies figuring out how to manage all this. It has to go beyond Zoom.

Q: What about the blue-collar space?

A: Blue-collar is interesting and different because a lot of it is physical work, so you have to be where the work is being done. There is also migration, with gig workers coming from the north and east to where those services are popular in the south and west. There are a lot of policy proposals to prevent exploitation of this trend, but they cannot be implemented without technology. Tech-enabled work platforms of the kind supported by Unitus and other investors are critical to ensuring that the government's progressive policies on blue-collar and gig work are implemented at scale.

Q: What kinds of businesses are you targeting?

A: The vast majority of Indians are employed in agriculture and construction. We have a company in the construction industry called Bandhoo that basically brings all the people in the ecosystem together, brands, contractors, and workers. It helps large contractors mobilise resources faster and at competitive prices. Smaller contractors get access to more business. And It makes sure workers get paid competitive wages. This could be transformative for the construction sector as a whole, the second largest employer in the economy. We've been talking to a lot of agtech start-ups as well. However, the bulk of our investments so far have been in professional upskilling edtech, future-of-work, and enterprise SaaS and full-stack platforms. India has 60m SMEs and those companies have 120m jobs. But historically, their adoption of technology, which would generate more and better employment, has been abysmal. So, SME-tech, whether it is to enhance productivity or provide access to capital and markets, is another important area of focus.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.