TMT

Coronavirus & Southeast Asia VC: Unpleasant surprises

Start-ups in Southeast Asia have few capital sources, so it helps that the region’s VCs are well-funded – assuming they are ready to invest

Coronavirus & North Asia VC: Diverging fortunes

Speed of response to COVID-19 has led to differing outcomes for VC investment in Korea and Japan. But structural issues are also a factor

Facebook takes 9.9% stake in Reliance's India app platform

Facebook has acquired a 9.9% stake in Jio Platforms, the holding company behind a number of apps and the parent of India's largest telecom operator.

Coronavirus & India VC: Struggling to work

Investors don’t expect business activity in India to resume until the second half. Many start-ups will be desperate for capital before then

Coronavirus & China VC: Bifurcation point

China might be emerging from the grip of COVID-19, but many start-ups face a long battle. This is when VCs find out who the winners are

Indian corporate travel booking platform raises $13m

Itilite, a platform that helps Indian corporates manage travel-related expenses, has raised $13 million in a Series B round led by Greenoaks Capital and Vy Capital.

Lightspeed completes $4b global fundraising effort

Lightspeed Venture Partners has raised $4 billion across early and growth-stage funds, including $1.5 billion for an opportunity fund that will support breakout companies in global markets such as China, India and Southeast Asia.

Matrix, CICC back Chinese optical chip pioneer

Lightelligence, a US and China-based manufacturer of optical chips, has raised a $26 million Series A round led by Matrix Partners China and China International Capital Corporation (CICC).

India's Capital Float secures $15m funding round

Capital Float, an online lending platform for small and medium-sized enterprises (SMEs) and e-commerce financiers in India, has raised $15 million in funding from existing investors.

Tenaya Capital leads Series A round in Indonesia's Kargo

Indonesian logistics platform Kargo Technologies has finalised a IDR504 billion ($31 million) Series A round led by Tenaya Capital, formerly the venture arm of Lehman Brothers.

Profile: 500 Startups' Khailee Ng

Khailee Ng’s transition from start-up founder to VC investor has made him happier and healthier. He plans to continue pushing 500 Startups into uncharted territory within Southeast Asia

TDM leads $35m round for Australia's SafetyCulture

Australia’s TDM Growth Partners has led a A$60 million ($35 million) Series C round for SafetyCulture, a locally-based software provider for safety compliance inspectors.

Southeast Asia VC: Different strokes

Ahead of an expected increase in LP interest, Southeast Asian VCs vie to stand out from the crowd by fine-tuning strategies to capture the virtues of both generalists and specialists

Indonesia's Agaeti, Convergence merge to form AC Ventures

Indonesian venture capital investors Agaeti Ventures and Convergence Ventures have announced a merger to form a new firm, AC Ventures.

Hostplus backs $19m Series B for Australia's Myriota

Hostplus, an Australian superannuation fund known for its VC activity, has backed a $19.3 million Series B round for local space technology start-up Myriota.

Korean investors contribute $43m to India's Swiggy

Ark Impact, Korea Investment Partners, Samsung Ventures and Mirae Asset Capital Markets joined a $43 million funding round for Indian food and grocery delivery platform Swiggy.

Indian TPG-backed cosmetics player Nykaa gets $13m

Nykaa, an online retailer of cosmetic and fashion products in India, has raised INR1 billion ($13 million) in a funding round led by Steadview Capital.

China AI player 4Paradigm closes $230m Series C

4Paradigm, a Chinese artificial intelligence (AI) start-up, has raised about $80 million in an extended Series C round, bringing its valuation to more than $2 billion.

Ocean Link seeks $7b privatization of China's 58.com

Ocean Link, a Chinese private equity firm that targets travel, tourism and related consumer subsectors, has made a take-private offer for online classifieds marketplace 58.com that values the business at approximately $7 billion.

Blackstone increases stake in India's Mphasis

The Blackstone Group has purchased shares worth INR51.7 billion ($67.9 million) to increase its stake in Indian IT services provider Mphasis by 4.01% to 56.21%.

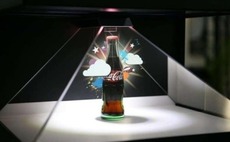

VC-backed Chinese AR start-up raises $26m in US IPO

WiMi Hologram Cloud, a PE-backed Chinese augmented reality (AR) technology developer, traded flat on its opening day on NASDAQ following a $26.1 million IPO.

China's Haier raises $134m for industrial internet platform

COSMOPlat, an industrial internet platform developed by Chinese home appliance giant Haier Group, has raised RMB950 million ($134 million) in Series A funding led by the state-owned China Structural Reform Fund.

Openspace co-leads $17m round for Indonesia's TaniHub

TaniHub, an online marketplace for farm products in Indonesia, has raised more than $17 million in a funding round led by Openspace Ventures and Intudo Ventures.

China's Gaocheng secures $300m for debut US dollar fund

Gaocheng Capital, a China-focused private equity firm established in 2018 following a spin-out from Hillhouse Capital, has closed its first US dollar-denominated fund with $300 million in commitments.