Coronavirus & China VC: Bifurcation point

China might be emerging from the grip of COVID-19, but many start-ups face a long battle. This is when VCs find out who the winners are

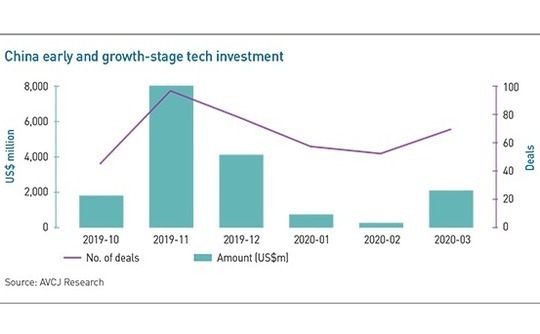

The coronavirus outbreak inevitably crippled early- and growth-stage activity in China's technology sector. A meager $3.1 billion was invested in the first quarter of 2020, a six-year low. By March, however, light had appeared at the end of the tunnel. New infections were under control, lockdowns were ending, and investment was back up. It rebounded to $2 billion, a more than seven-fold increase on the February total.

The caveat is that half the money went into a single deal: Yuanfudao, an online K-12 education provider, raised $1 billion at a bumper valuation of $7.8 billion. The company maintains its position at the top of the large-class segment through heavy spending on customer acquisition. This has not put off investors who argue that its unit economics justify the spending.

But is Yuanfudao the exception to the rule? Students flocked to online education platforms when schools closed in response to COVID-19 – and many believe they will stay. Long Qin, co-founder of Singsound, an education-focused voice recognition start-up, is adamant that classroom digitization is a long-term trend. At the same time, other Chinese start-ups have been suffocated by the pandemic and will struggle to recover. The lucky ones will get down rounds and recapitalizations. For the rest, it is acquisition, bankruptcy, or stripping out costs and crawling on in the hope of redemption.

"We will see a lot of disparity over the next few months. There will be companies that continue to do well and raise big rounds and there will be companies that won't be able to raise money at all," observes J.P. Gan, founding partner of Ince Capital Partners. "A lot of businesses will need to be saved by existing investors. Right now, VCs say they need to save their bullets. It's not that they don't feel optimistic, but they need to concentrate their remaining capital on the existing portfolio."

There is a sense of inevitability about these outcomes among investors who have experienced severe downturns before. However, the disruption caused by COVID-19 is unusual in the speed with which it has taken hold. And then markets respond in different ways, based on factors such as the level of government support, the amount of private capital available, the maturity of the technology ecosystem, and the extent of any preexisting weaknesses.

The longer the virus endures, the deeper the economic impact. But what appears to be playing out in China is not playing out in other territories within Asia at the same time, and it may not play out in the same way. Some saw investment drop off in March – while China was apparently recovering – as COVID-19 spread across the region.

"There will be companies looking to pull together rounds right now and they will be struggling, but I haven't seen much of that yet and I haven't seen any crazy rescue rounds and unpleasant deal terms," says Rick Baker, co-founder of Blackbird Ventures in Australia. "You have to remember we are still early into this situation, it's only a couple of months old."

Regardless of geography, investors have one immediate priority: figure out how much runway portfolio companies have left, establish whether it can be extended, and calculate the cost of doing that in terms of reduced marketing, product investment, and headcount. While many founders start thinking about new funding rounds once their cash reserves hit six months, VCs warn that, based on previous downturns, at least 18 months of runway is required to weather the storm. No one wants to be raising money when markets are dogged by uncertainty and valuations are in flux.

Pre-existing conditions

Any analysis of the COVID-19 impact on China's technology sector should consider the wider context. Investor sentiment began to dwindle as early as 2018 due to a combination of slower economic growth, trade tensions with the US, and muted consumer behavior. Start-ups received $30.7 billion in funding in 2019, down from $57.7 billion in the previous year.

A collapse in late-stage investments was responsible for the drop-off. While early-stage activity rose marginally, the amount of capital going into growth transactions fell by more than half to $23.5 billion. In 2018, there were 11 funding rounds of $1 billion or more; in 2019, there were six. This coincided with a distinct weakening in appetite for companies that burned through cash indiscriminately to gain market share and offered little visibility on medium-term sustainability.

"You shouldn't be afraid to invest in acquiring users, but you must look at how scalable the marginal benefit is versus the marginal cost," says Jixun Foo, a managing partner at GGV Capital. "Businesses with positive marginal utility that will continue to grow and scale because they are more efficient than traditional businesses. Businesses where the marginal utility doesn't make sense will disappear. COVID-19 magnifies problems like these."

Debt is often preferable to equity for companies that expect business to rebound relatively swiftly. However, local banks only lend to the largest and best-established technology players, bridge financing from VC firms is limited, and the institutional venture debt market is nascent. This has created opportunities for non-institutional players, typically high net worth individuals who subscribe to debut instruments that can be called or converted into equity later.

Companies can also apply for government support programs, most of which operate on a provincial or municipal level, while simultaneously cutting costs. "I don't want to make a general prediction like a lot of unicorns will die, rather there will be a lot of maneuvering. Chinese founders are more willing than most to cut their business in half, lay off a bunch of people, and survive with their remaining cash," says Ince's Gan. "And then the government is a wild card. Local governments may bail out local darlings, especially if they are responsible for a lot of employment and tax contributions."

If equity is available to a start-up in difficulty, it would likely be at a discount to the previous round. Last week, James Lu, a partner at Cooley, had "three very aggressive term sheets" for flat or down rounds on his desk. Sometimes, valuations appear to be the same as the previous round, but they include provisions to buy additional shares from existing investors at a lower price.

While all the deals Lu worked on that were signed off before the outbreak are still getting done, he expects new investments to come under even more pressure. "It started 18 months ago in the tech space, but COVID-19 is accelerating it," Lu says. "I've had pay-to-play situations where every existing investor had to extend a lifeline to a company. If they refused, their preferred shares would be converted into common shares and they would lose their board seat. The message is: no one wants to participate at this valuation, but the company is dying.'"

Negotiations can be fraught, especially when companies have raised multiple rounds of funding at very different valuations. However, existing investors might try to sweeten the deal by removing some of the founder-friendly terms that have crept into agreements during the bull market. Ruomu Li, a partner at Morrison & Foerster, notes that investors may consider making approval for a down round – even if they don't participate in it – conditional on enhanced information and governance rights, the removal of share transfer restrictions, and more aggressive liquidation preferences.

As for M&A, it is suggested that a spate of activity will kick off in the second half, once people can travel freely, and established players from Alibaba Group to ByteDance Technology pick up smaller peers. They will drive hard bargains. Hai Zhu, head of M&A at advisory firm Hina Group, points to Alibaba Pictures Group's recent acquisition of Galaxy Cool Media as an example: payment will be made in installments over four years; the valuation could be adjusted based on Galaxy's future performance; and there are different pricing terms for the founding team and external investors.

Looking for positives

Several VC players compare how start-ups handle recessions to the human grieving process. There is an initial period of delusion and denial. This is followed by bursts of renewed activity, first pivots into new business areas to boost topline growth and then austerity measures intended to reduce cash burn. An AlphaX Partners-backed founder went so far as to give creditors an ultimatum: accept a portion of the money and write off the rest or take legal action and potentially get nothing.

Towards the end of last year, AlphaX set targets for portfolio companies with relatively high cash burn rates to take meaningful steps towards break even. Fewer than 10% missed those targets and they are unlikely to get follow-on funding. Others have been hurt by COVID-19, but the firm still believes these start-ups can deliver on their growth potential.

"Investors must clean up their portfolios, decide which ones can survive and which ones must be let go, and revalue the ones that can survive," says Chuan Thor, founder of AlphaX. "We invest in two types of companies: those with an advantage in terms of business model and those that are technology-driven. The second type is doing well. We have start-ups offering robot services to hotels and smart factory services that saw increased revenue in the first quarter. Artificial intelligence-enabled technology companies are closing rounds at reasonable valuations."

This is characteristic of where a lot of VC money has been flowing in recent months. The enforced online migration of various consumer-facing services – education, entertainment, telemedicine – has been flagged up as an investment opportunity plenty of times. The same applies to food and grocery delivery services. These are the segments where, in the space of two months, start-ups have surged from 100,000 to two million daily active users or their revenue has grown tenfold. Investors must now distinguish sustainable business models from COVID-19 whims.

Migration is happening on the enterprise side as well. Wei Zhou, founder of China Creation Ventures, claims the recovery in investment activity is plain to see, with his firm meeting with five or six start-ups every day. Technology-enabled business solutions is an area that interests him. "The pandemic has forced traditional offline businesses to adapt to the new economy," Zhou says. "People will get used to things like online conference calls. We meet start-up founders face-to-face before making final decisions. But the initial meetings happen online, and we've found they are more efficient."

Several investors suggest the next wave of Chinese unicorns will be B2B rather than B2C operators. Business-facing companies in areas such as software, robotics and supply chains are among those that have withstood the COVID-19 impact. Changzheng Zhang, CEO of enterprise cost management platform Huilianyi, notes that first-quarter revenue was robust because large corporate customers did not cancel subscriptions. In fact, some are now paying more attention to cost efficiency.

Once again, there is a caveat. The B2B players that are thriving tend to offer sophisticated tools beyond the reach of mass-market providers – their value proposition is more than just being cheaper than the competition. This is how COVID-19 might be shaping the future. Right now, business models and balance sheets are effectively being stress-tested. Companies that emerge on the other side of the downturn will be stronger for the experience. Moreover, there is no better way to get a sense of the capabilities of a founder and the team beneath them than watching how they deal with a curveball.

"There will be more fear than greed over the next 12-18 months. This is not a bad thing from a longer-term perspective if it consolidates the market, resulting in fewer players and less competition once the market recovers," says GGV's Foo. "COVID-19 also allows you to see better the quality of the companies you have. Now is the time to tell who the real players are. It was after SARS that Baidu, Alibaba and Tencent became dominant players. Three to five years down the road, you will see major winners out of this correction as well."

SIDEBAR: Case Study - XTransfer

In March, Chinese cross-border payments facilitator XTransfer recorded a transaction volume three times that of its peak month in 2019. The company has opened a new office and increased headcount by 50% to handle the steady flow of new customers.

"We saw a negative impact of the coronavirus outbreak for 10 days. After that, our volume rebounded quickly," says Guobiao Deng, founder of XTransfer.

During that initial period of uncertainty, the company decided to run ads on Toutiao, ByteDance Technology's news aggregation platform. "We considered doing this last year but it was too expensive. When the epidemic broke out, the price dropped while traffic grew significantly. Everybody was staying home, spending time on their cell phones," says Deng.

Moreover, XTransfer didn't waste any time in launching a telemarketing campaign when transaction activity appeared to be in stasis. This proved amazingly effective. "Our potential customers were panicking at home. We called and gave them a solution," Deng adds.

XTransfer is an online platform that helps Chinese SMEs to set up offshore accounts and remit and receive money in major export destinations. Transactions are routed through banks such as DBS, Barclays, Citibank and Standard Chartered, at wholesale rates. XTransfer charging a 0.4-0.5% commission on transactions.

Following a $15 million fundraise last October, the company has enough cash on hand to support itself for two years, even if revenue dries up. Another funding round is scheduled for May and Deng accepts it may take longer than usual.

Approximately 20% of XTransfer's growth in transaction volume related to the anti-coronavirus materials, including masks produced by Chinese garment makers that have changed focus. This trend might be short-lived, but at the same time, COVID-19 is a catalyst for customer acquisition because small-scale exporters cannot travel overseas to open bank accounts in person.

Deng is confident these new users will be loyal. "Trust is the ultimate threshold that we have to break. After being forced to use us, they have experienced the convenience and better service quality, so we are confident we will keep them," he says.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.