South Korea

GP profile: 500 Global

500 Global’s emergence as a preeminent seed investor in Southeast Asia has played out against the backdrop of a broader transformation from US accelerator into international multi-stage venture capital firm

Hahn launches tender offer for Korean medical devices player

Hahn & Company has launched a KRW 957bn (USD 735.9m) tender offer for listed Korean medical devices manufacturer Lutronic, working in conjunction with the company’s founder and CEO.

Affinity's Korea head resigns

Sam Lee has resigned from his position as a partner and head of Korea at Affinity Equity Partners, ending a 15-year tenure with the pan-regional private equity firm.

Praxis invests $170m in Korea's Beyond Music

Korean private equity firm Praxis Capital has led a USD 170m investment in local music rights investment and management company Beyond Music.

Anchor, Aspex re-up in Korea's Kurly

Kurly, a Korean grocery delivery platform that abandoned its planned domestic IPO earlier this year, has raised KRW 120bn (USD 91m) from existing investors Anchor Equity Partners and Aspex Management.

Korea plans $751m venture capital fund-of-funds

The Korean government has sought to counter a steep drop-off in venture capital investment by pledging significant policy support for the industry, including a KRW 1trn (USD 751m) fund-of-funds.

1Q analysis: Barely disguised weakness

Government guidance funds in China and Toshiba Corporation in Japan papered over obvious cracks in Asia private equity fundraising and investment. Nothing could hide the pain around exits

Asia fundraising: To the grindstone

As macro uncertainties add red tape to fundraising processes and oblige some managers to operate on a deal-by-deal basis, the improvisational, survivalist nature of Asian private equity is on display

Samsung backs Korea autonomous delivery start-up

Samsung Venture Investment has invested in Korea’s Neubility, a robot maker aiming to “automate urban sidewalks” via autonomous rolling boxes capable of on-demand deliveries.

Altos, Mirae Asset re-up Korea's Kream in $39m round

Altos Ventures and Mirae Asset Capital have each made their third investment in the past 18 months in Korean e-commerce player Kream, with the latest round amounting to KRW 50.6bn (USD 38.8m).

Deal focus: K-wave media savvy explores new markets

Korean audience interaction technology provider Bemyfriends hopes a sizeable Series A round led by Cleveland Avenue, a lifestyle-focused VC firm in the US, will jumpstart a global expansion

Korea audience engagement platform Bemyfriends gets $29m

Korea’s Bemyfriends, an audience engagement platform for brands and creators, has raised USD 29m in Series A funding, with the latest tranche provided by US-based VC firm Cleveland Avenue.

EQT buys Korean security services provider

EQT has agreed to acquire a majority stake in Korea-based security monitoring business SK Shieldus from an affiliate of SK Group and Macquarie Asset Management, through an investment under its core-plus infrastructure strategy.

Orchestra to launch debut Korea, Japan blind pool fund

Orchestra Private Equity, a Korea and Japan-focused manager that has to date operated on a deal-by-deal basis, plans to launch its first blind pool fund later this year.

IMM commits $121m to Korea cloud business

IMM Investment is providing KRW 150bn (USD 121m) in Series A funding for Korean cloud computing business NHN Cloud at a valuation of KRW 1trn.

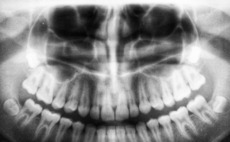

MBK, Unison Korea pursue dental implant buyout

MBK Partners and Unison Capital Korea have launched a tender offer for Osstem Implant, a Korea-based manufacturer of dental implants, that values the company at approximately KRW 2.85trn (USD 2.3bn).

Deal focus: Orchestra seeks the right recipe for KFC Korea

Having secured permission to do sub-franchising and to make alterations to menus and store formats, Orchestra Private Equity believes it can succeed with KFC Korea where others failed

Profile: Elevation Equity Partners' Gordon Cho

Negotiating a spinout while troubled by health issues tested Gordon Cho’s faith and resilience. He feels stronger for the experience and is now looking to make his mark on Korea’s middle market

Deal focus: VIG secures rare airline turnaround opportunity

VIG Partners stepped into the breach when Eastar Jet’s previous white knight bailed. It agreed to recapitalise the airline on obtaining assurances that key licenses and routes remain in place

GIC, PIF invest $924m in Korea's Kakao Entertainment

Singapore’s GIC and Saudi Arabia’s Public Investment Fund (PIF) have agreed to invest a combined KRW 1.15trn (USD 924m) in Korean internet giant Kakao’s entertainment division.

ICG invests in Korea's Big Mama Seafood

Intermediate Capital Group (ICG) has announced a second deal in three weeks from its fourth Asia fund – which closed last year on USD 1.1bn – with a commitment of undisclosed size to Korea-based Big Mama Seafood.

VIG acquires Korea's Eastar Jet

Korea’s VIG Partners has acquired 100% of local low-cost airline Eastar Jet for USD 117m, citing plans to introduce new aircraft to the fleet as part of a “quick turnaround.”

MBK buys Korea dental scanning player Medit, Unison exits

MBK Partners has agreed to buy Medit, a South Korea-based manufacturer of 3D dental scanners, for a valuation of approximately KRW 2.4trn (USD 1.88bn). The transaction facilitates an exit for Unison Capital’s Korea business.

Korea's Google-backed Mathpresso raises $70m

Seoul-based education technology start-up Mathpresso has closed its Series C round on USD 70m following an investment of undisclosed size last year from Google.