Asia fundraising: To the grindstone

As macro uncertainties add red tape to fundraising processes and oblige some managers to operate on a deal-by-deal basis, the improvisational, survivalist nature of Asian private equity is on display

Having launched its debut fund in November 2021 with a target of AUD 300m (USD 202m), Australian private equity firm Glow Capital Partners confirmed a first close this week of AUD 55m. All the capital came from personal high net worth investor contacts. The plan is to entice institutional investors by drip-feeding them co-investment opportunities.

Glow, whose main expertise is in tech-enabled consumer themes, hopes that by demonstrating its due diligence and deal sourcing rigour – while offering investors a taste of deals as well as insights into its process – LPs smelling the cusp of a new macro cycle will be persuaded over the line.

"The only way to get consideration now is to present co-investment opportunities, so we're being much more proactive on that with a view to building relationships," said Justin Ryan, co-founder of Glow, who previously spent extended stints at Quadrant Private Equity and Catalyst Investment Managers

"Some LPs won't co-invest unless they are a fund investor, but there is an emerging group of institutions that are more open-minded to just straight-out co-investing. Some just want to keep doing it deal-by-deal. Others are happy to work toward a potential fundraising down the track."

Ryan observes that LPs are generally looking for co-investment ratios of 1:1, such that every dollar of fund commitment is matched in co-investment. Three sources from around the region described ratios of 3:1 and 4:1 as increasingly commonplace expectations – and these are sometimes met.

Clean primary tickets are not unusual, but they are no longer the most common outcome in a fund commitment process, even among brand-name managers. Beyond ramped-up co-investment rights and accompanying fee discounts, terms-based solutions have tended to focus on quasi-secondaries.

"We're talking to a GP about a combination of structured secondary transactions across two previous vintages, plus a co-investment deal on the fund they're raising right now. There are four components, and all combined, it's worth around USD 90m-100m, including the primary ticket," said Ricardo Felix, head of Asia at placement agent Asante Capital.

"We're seeing more transactions like this, and it's a win-win-win outcome when they work. However, given both their tailored and binary nature, the opportunity cost can also be punitive."

Compromise is king

The most creative workarounds are rapidly proliferating in the US and European markets and considered likely to come to Asia. They include net asset value (NAV) financing arrangements, whereby a lien of credit is introduced into a fund, acting like a dividend recap at the fund level. LPs receive a distribution and the portfolio is collateralised against the debt.

The idea is to create liquidity at minimal cost, but much depends on the loan-to-value ratio (LTV). Large buyout portfolios can generate meaningful distributions; growth and venture less so. Indeed, for the minority investors that dominate the Asian landscape, flexibility around fund terms is a secondary response to simply reducing the target corpus and extending the offer period.

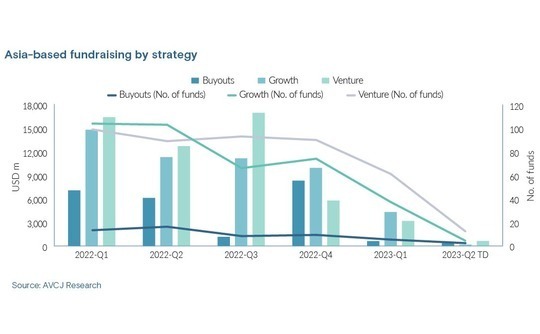

This feeds into the still anecdotal observation that the global fundraising slowdown is forcing would-be fund managers to go into deal-by-deal mode in a more pronounced way in Asia, where 732 growth and venture funds have achieved incremental or final closes since the start of 2022 versus 53 for buyouts.

Nevertheless, the fundraising drop-off in the past two quarters reveals a trend that does not discriminate by strategy. The average quantum raised per quarter fell by around 90% in each of buyout, growth, and venture, when comparing 2022 to 2023 to date, according to AVCJ Research.

Denis Tse, CEO of Singapore-based Asia-IO Partners, an affiliate of Korea's ACE Equity Partners, is a proponent of warehousing as a means of transitioning from deal-by-deal to a comingled fund in the current environment. Both Asia-IO and ACE invest on a deal-by-deal basis, but Tse declined to comment on any potential fundraising aspirations.

"The common denominator is that at the end of the day, it's all about what you invest in," he said regarding best practice for making a warehouse-to-comingled transition work.

"The good thing about the current market is that there's so much price dislocation, you can actually find good deals. If you have a collection of good opportunities and you can amass a decent size portfolio that can be warehoused, then it can be quite attractive."

There's reason to believe, however, that this strategy will be less doable in Korea than Southeast Asia, or indeed any other market in the region.

Korea is unique in that it has a deep pool of institutional LPs well-attuned to single-asset project funds. But these investors are becoming wary of the industry-wide uptick in direct secondary buyouts, not wanting to revisit companies they backed with another local manager. They are also losing their appetite for outbound investments amidst a weakening Korean won.

"In Korea, it's getting extremely hard for managers to find Korea-based equity and debt providers to finance their deal-by-deal project funds. In fact, a lot of project fund deals have gone bust since last year. Many of the new managers in Korea are not going to survive if they rely solely on a project fund strategy," said Jay Kim, founder of Orchestra Private Equity.

Ground rules

Orchestra is attempting to transition to comingled funds by leaving the country and taking a quasi-warehouse approach. The firm's last two acquisitions – KFC Korea and Japanese construction industry supplier Stack – were organised with a Singapore license at new headquarters in the city-state.

Orchestra is targeting USD 300m for its debut blind pool fund, and most of the capital is expected to be raised from global LPs, including investors in the Stack and KFC project funds. Kim acknowledges this is a tough road and said there would be "a lot" of co-investment. The global shift away from China exposure is expected to help.

There are a few rules of thumb for first-time managers in this position. First among them is that GP ownership should be the last thing brought to the negotiating table. It could take three vintages to get it back, and it will be expensive to do so.

Second, some angle around specialisation is helpful. Australia's Heal Partners closed its debut healthcare, education, and lifestyle fund last November on AUD 200m. In September, Tower Capital closed its debut blind pool fund on USD 379m, making much of its deep Singaporean roots and tight focus on the country. Only USD 55m of the corpus was earmarked for co-investment.

Furthermore, strategic repositioning may be necessary but must be done in moderation and without contradicting the idea that LPs tend to prefer that managers stick to their strengths in a downturn.

Credit funds have proven popular among private equity investors in recent months as have expansions into earlier or later stages. The latter is a trend that predates the fundraising slump, but India's Chiratae Ventures reaffirmed the idea in the doldrums of late 2022, collecting INR 7.6bn (USD 93m) for its first growth-stage fund.

The overarching challenge is that new strategies can require time to build out, perhaps longer than the market cycles to which they are responding. This is most often highlighted as a risk for China-focused managers looking to recast themselves as regional actors. There are also risks around perceptions of insincerity, especially in areas of heightened investor wariness such as greenwashing.

"We're seeing a lot of interest in impact and sustainability from regional investors. What's more, although international LPs are interested in Asian impact and sustainability, for now at least, there are very few managers with a proven track record to get those investors comfortable enough to invest," said Charles Wan, Hong Kong-based head of Asia at placement agent Rede Partners.

"While this will take time, if a manager has a viable impact and sustainability-focused asset or strategy at present, it will have a higher chance of being funded by LPs."

SMAs and beyond

Australia's Liverpool Partners – which has made a feature of its environmental, social, and governance (ESG) framework – claims to be one of those exceptions. The firm invests via a mix of separately managed accounts (SMAs) and blind pool funds, which include some of the same LPs.

Funds under management amount to about AUD 1.2bn, including an impact fund that reached a AUD 350m first close in 2021 and a generalist private equity fund set up in 2019. The latter has not yet firmed up its target but will probably seek AUD 300m-AUD 500m. The fundraising process for both blind pools is on hold, probably for the rest of the year.

The SMAs, meanwhile, benefit from the programmatic approach to investment pursued by large-format LPs. Jonathan Lim, a managing partner at Liverpool, declined to specify the number of SMAs under management but described it as "meaningful."

"We're seeing that the larger institutional investors want to allocate more into sustainability, responsible investing, and impact, but you have to be able to structure and address their needs rather than just have a cooking-cutter, conventional PE strategy," Lim said.

"In this market, you must listen more and give LPs a blend. If you have only one single approach to raising capital, it will be trickier, and you could get stuck."

SMAs and sidecar funds are one point of flexibility that is more amenable to the growth and venture end of the spectrum. In most instances, the investors will be government actors seeking more comfortable regulatory and tax terms. In others, they will be addressing tech-oriented strategic agendas. As GPs take on more of these vehicles, they will need to balance fundraising needs with investment orientation.

"GPs considering funds-of-one should prioritise opportunities where those LP relationships are either supplemental or strategic to the flagship mandate, as opposed to dilutive," said Sean Murphy, a fund formation partner in the Singapore office at law firm Cooley.

"Even in a difficult fundraising environment, you don't want to be in a position where you have conflicting SMA mandates, and you're trying to figure out where your attention is going to be."

Later-stage and more experienced managers are pulling different levers, including turning toward local currency vehicles as a way of buttressing their US dollar fundraising. HarbourVest Partners, which closed its latest Asia-Europe fund-of-funds last year on USD 1.6bn, has noted an increase in locally minded LPs becoming more familiar with private equity and supporting such endeavours.

Most of the action on this front is happening in China, with global managers such as L Catterton and Affirma Capital hitting first closes on their debut renminbi-denominated funds within the last six months. Meanwhile, Coller Capital recently confirmed a first close on its inaugural renminbi secondaries vehicle.

Secondaries have also proven a critical fundraising tool at the larger and more established end of the market, particularly where packages are diversified away from single-asset risk and include co-investment staples.

Dominic Goh, a managing director focused on secondaries at HarbourVest, expects to see more GP-led deals in the years to come, noting that while the transactions may take some time to organise, they're still a faster solution than a strategy pivot.

"There has been an increase in inbound enquiries and GPs asking questions about what can be done, as these transactions can be highly structured, highly bespoke," Goh said, describing LP desires to see more distributions in a period of uncertainty as a key theme in the current environment.

"And frankly, you need something like that to arrive at outcomes that all parties will accept in today's environment, where investors are asking more questions around risk, exits, and pricing. Setting up in advance to do such transactions is a big undertaking."

The hard yards

The most potent revelations of the bear market are not in the complexity of specialised vehicles, commitment terms, and fund restructurings, however. They're in the daily grind of the managers such as Glow's Ryan, who are accustomed to blind pool investing but now find themselves in a deal-by-deal world, navigating the malaise with a considerably different job description.

Martin Mok, formerly of EQT, Goldman Sachs, and CVC Capital Partners, left the latter of these firms in February 2022 to set up his own firm the following April. China-focused Azuremount Partners had significant initial commitments from two EQT LPs, but by August, the Shanghai lockdowns and general China jitters were all too much, and the investors pulled out.

Azuremount was compelled to switch from writing USD 50m cheques in China's lower middle market – which accounts for the bulk of Mok's track record – to a VC-oriented mandate of sub-USD 10m deals.

The first investment came in January, with Azuremount leading a USD 5.7m round for brain surgery technology provider PrimaNova, which was targeting USD 4m in the raise at a USD 30m valuation. The start-up is pre-revenue and China-based – "everything people hate nowadays," Mok joked – but he was able to mobilise various ex-China and US-dollar investors from his network.

"It's not an easy life. I used to write a USD 50m cheque here and a USD 100m cheque there without relying on external parties outside the investment committee. Now you have to ask every family office and all your friends and family," Mok said.

"The advantages are you get freedom, satisfaction, a group of people who think alike, and you can really spend time on meaningful things. If I can deploy USD 20m in the first 12 months and USD 30m in the second 12 months, that's enough to cover the costs, and I think I could do it for life. I don't think I'd go back to the old days, but never say never because let's face it, the failure rate of these shops is high."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.