GP profile: 500 Global

500 Global’s emergence as a preeminent seed investor in Southeast Asia has played out against the backdrop of a broader transformation from US accelerator into international multi-stage venture capital firm

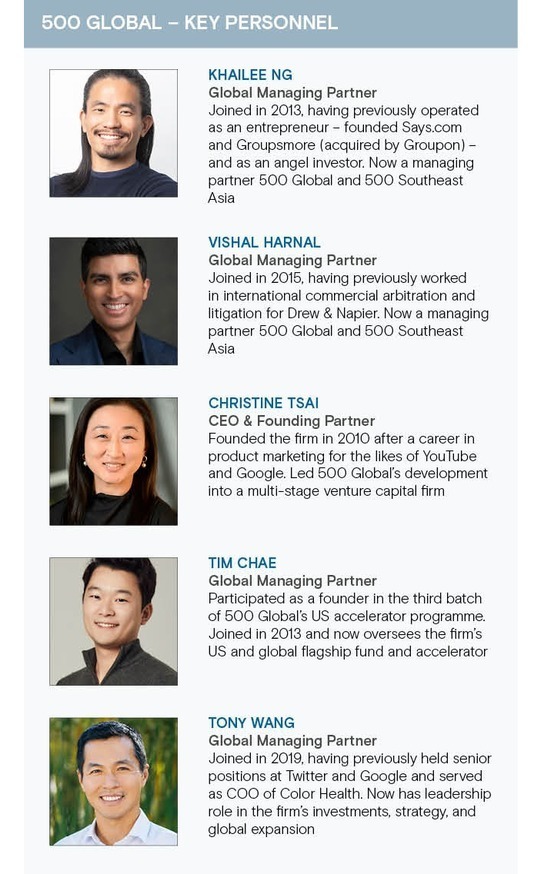

500 Global recently hired three new partners to lead growth investment in Southeast Asia, tapping talent that previously worked for the likes of Rakuten Ventures and Khazanah Nasional. Vishal Harnal, a managing partner at the firm, contrasts this with his own recruitment a decade earlier.

A fast-rising yet unfulfilled lawyer in Singapore, Harnal went in search of a career path that might click, methodically meeting with everyone from interior designers to bankers. A friend recommended he touch base with a couple of people from 500 Global who were in town from Silicon Valley. It was the last meeting of a frenetic two-week period. And at the time, he knew nothing about VC.

"We just talked about entrepreneurship," said Harnal, who had launched a start-up before university. "There's no way I could have done late-stage investment. But early-stage is more like art: it's about intuition, pattern recognition, building systems over time, persuading your way into deals, and establishing relationships across a variety of stakeholders."

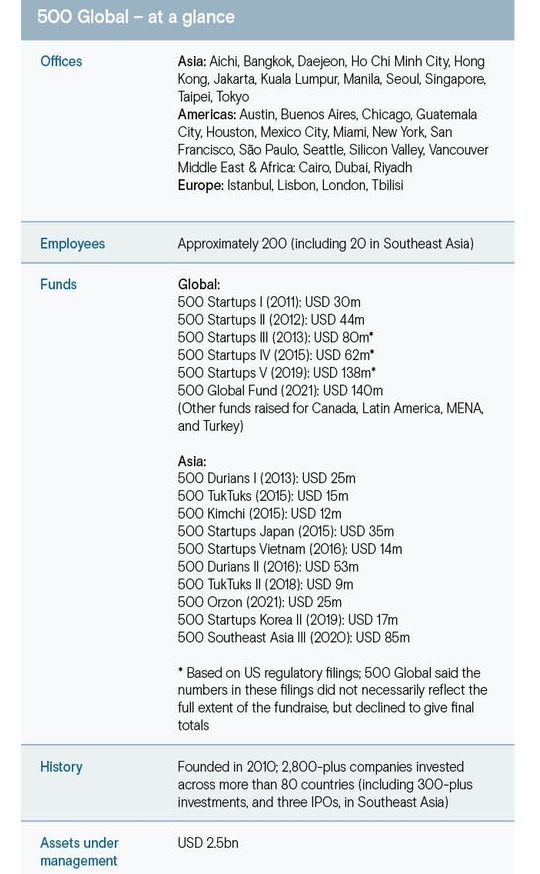

One of the people Harnal met was Khailee Ng, a Malaysian-born entrepreneur who joined 500 Global in 2013 as a venture partner. Ng took the lead in raising a Southeast Asia fund of USD 25m and Harnal was hired to help deploy it – a learning experience for both, yet ultimately a fruitful endeavour. 500 Global has gone on to back more than 300 start-ups in the region with three IPOs to date.

This ascent tracks that of Southeast Asia's technology ecosystem, which has attracted USD 42.9bn across early and growth-stage rounds in the past five years, a 3.5x increase on the five years before that. But 500 Global itself has also evolved. Once a US-based, internationally-minded accelerator, it now boasts a network of seed-stage investment practices spanning the Americas, Africa, Eastern Europe, and Asia.

Ng attests that the firm never aspired to be purely a seed platform; early-stage investment was seen as an advantageous anchor to a broader asset management player. This is apparent not only in a wider remit but also in a diversifying LP base and what Harnal describes as a more joined-up and better-resourced network.

"When I joined, they were running an accelerator with fewer than 30 people. It was like a start-up, and it helped us understand what we were investing in because we were building ourselves in the same way – very scrappy with everyone doing a bit of everything," Harnal said. "Once we reached a certain size, that changed. It's a function of maturity, of rising AUM [assets under management], of institutionalisation."

International agenda

500 Global – originally known as 500 Startups – was established in 2010 by Christine Tsai and Dave McClure. The accelerator welcomed more than 60 start-up founders across three batches in 2011. The third included Tim Chae and Courtney Powell, now a managing partner and COO at the firm, respectively.

A debut global fund of USD 30m closed in 2011, primarily relying on LP commitments from larger VC firms, high net worth individuals, corporates, and family offices. The original ethos, according to Tsai, was to make early-stage venture capital more predictable by building larger portfolios.

"With the rise of cloud services and social platforms making customer acquisition more efficient, companies didn't need as much money to get started. We weren't the first seed investors, but we were the first to have a significantly diversified portfolio," said Tsai, now founding partner and CEO. "We also thought that great companies could come from all over the world – 20% of Fund I was non-US."

In 2012, 500 Global established its first international beachhead with the acquisition of Mexican.vc, an accelerator in Mexico City. Santiago Zavala, a general partner at the accelerator, is now one of 500 Global's managing partners. Ng arrived the following year and pitched the firm on a Southeast Asia fund.

"I went to Silicon Valley for three months, met a lot of people, and many of them said, ‘The US is the epicentre, you should move here.' I was deflated," he said. "Then on the last day, I met 500 and they had made money backing what I believed in."

Ng's first fundraising meeting was with Mavcap, a wing of Malaysia's Ministry of Science, which agreed to participate as an anchor LP. High net worth families and individuals contributed the remainder of the USD 10m corpus. The first investment was in a dating app; it proved short-lived because the founders fell out. The second was in Carousell, a C2C marketplace that achieved unicorn status two years ago.

500 Global joined Carousell's USD 800,000 seed round in 2013. Siu Rui Quek, the group CEO, recalls that he and his two co-founders were already aware of the firm's reputation, having interned with companies in Silicon Valley. This pedigree, plus Ng's first-hand experience with start-ups, made 500 Global "a truly compelling partner in our mission and long-term goals."

Two more eventual unicorns – ride-hailing platform Grab and e-commerce player Bukalapak – featured in the first six investments. Used car trading business Carsome and genetic testing specialist Prenetics made it five out of 120 deals in the first Southeast Asia fund. The vehicle was upsized to USD 25m mid-way through the investment period on the back of robust early performance.

Ng mined 500 Global's US and Mexican accelerators for ideas, often studying which business models prevailed at certain points in the consumer evolution of different markets and applying that to Southeast Asia. There were plenty of benchmarks for Carousell, but Grab was tougher. A call to Mexico, where the accelerator had backed a similar business called Yaxi, was the clincher.

"They said Yaxi was doing great, and we looked more favourably at Grab on the back of that," said Ng. "Carsome was selling new cars when we first invested, so I showed them Auto1 Group in Germany – I had been studying the model – and they recognised the opportunity."

Getting traction

Ng and Harnal travelled avidly and widely in Southeast Asia, running workshops, participating in events, and generally trying to make themselves accessible and useful to portfolio companies. Quek credits 500 Global with helping Carousell expand from Singapore into Malaysia, advising on recruitment and on the company's first M&A deal, as well as making valuable introductions along the way.

"I still remember those conversations with Anthony [Tan] from Grab, which was another early portfolio company that 500 backed. We eventually held recruitment events in Silicon Valley where 500, Carousell and Grab would convince Southeast Asian Silicon Valley talent to return to work for us," Quek added.

Ng and Harnal's objective was reputation-building – to become the first call for a start-up contemplating a significant move. They also leveraged 500 Global's international reputation, recognising the instant credibility conferred on a start-up with a Silicon Valley-founded VC firm in its cap table.

"We asked, ‘What gives a start-up the highest chance of raising its next round of capital?' and we wanted to help with that. The signalling and our reach are powerful. We aren't just a Southeast Asian VC firm; we are connected to all the big US investors," said Harnal, adding that many of Sequoia Capital's initial investments in Southeast Asia were 500 Global portfolio companies.

Grab was the first portfolio company to hit a USD 1bn valuation in 2015 and this represented a broader inflection point for Southeast Asia's technology ecosystem: entrepreneurs no longer had to look outside the region for role models; launching a start-up became a more widely accepted career path; and capital flooded into Southeast Asia with a view to propelling other businesses to unicorn status.

The biggest headache for start-ups remains fundraising, so 500 Global focuses on this area. The firm not only leverages its international brand, but also provides a supporting infrastructure that maps out timelines, assembles presentation decks, and matches funds to potential LPs. To this, it adds the might of an internal PR and marketing team.

"People determine credibility by understanding who you are," said Harnal. "The more often a start-up is talked about, the higher the chance of attracting new customers and employees and securing additional capital. We send out a newsletter every day that gives portfolio company news. The founders love it."

500 Global has also introduced technology-enabled operational efficiencies that cut across geographies. For example, Zavala in Mexico oversaw the construction of Founders Hub, a platform on which portfolio companies post requests for assistance and resources, and Ng led the creation of a centralised repository for investor reports ranging from audit materials to funding reports.

"All this information was trapped in inboxes, and I wanted to put it into a database so we could cross-examine it," said Ng. "We want to build unified platforms for products, systems, software, and governance. It's like we are a technology business that happens to operate a venture capital firm."

Other support initiatives rolled out in Southeast Asia specifically include sales training programmes for start-ups targeting business customers, as well as mental health and wellness boot camps intended to address the psychological burdens – and risk of burnout – that come with being an entrepreneur.

Big picture

Ng and Harnal are now two of six managing partners who serve alongside Tsai and other C-suite members on a global committee responsible for the strategic direction of the firm. 500 Global has USD 2.5bn in AUM and half of its approximately 2,800 portfolio companies are based in the US with Latin America, Southeast Asia, and the Middle East accounting for most of the rest.

While the firm's latest global fund – its largest yet at USD 140m – is gravitating towards writing larger cheques for a smaller set of core companies, the network of seed funds still underpins all activity. A selection of different facilities sits on top, ready to participate in growth-stage rounds. 500 Global contributed USD 21m to Carousell's USD 85m Series C in 2018 through a special purpose vehicle (SPV).

"Some of these later-stage cheques are from SPVs we spin out, others are from standalone growth funds. We've done a lot of SPVs, they can get quite large, and they work well for us because LPs don't want to invest in every company," Ng explained. "We look to build a pyramid of different funds or facilities at different stages, depending on which geographies are ready for them."

Decisions on geographic expansion are driven by priorities and resources – most pertinently, whether local market conditions are conducive to 500 Global's strategy and whether people who share the firm's ethos are available to execute it. 500 Global may invest repeatedly in a geography, but it doesn't necessarily follow that a local fund will be launched. India is perhaps the best example of this in Asia.

"Maybe we aren't as active as before, but we haven't stopped. We were early in India, and we still have a portfolio there through the global fund and the Southeast Asia fund, but when you look at somewhere like Eastern Europe, where we also invest, it's so much more mature," said Tsai. "India is still on our radar. So is Western Europe, which is covered by our Istanbul team that focuses on Eastern Europe."

Meanwhile, the firm's direct presence in Japan ceased in 2019 when the local team spun out, rebranding as Coral Capital. It was described as an amicable split, with Coral continuing to manage 500 Global's Japan fund and raising fresh capital of its own. In 2021, Eddie Thai, who led the firm's Vietnam operation, spun out to launch Ascend Ventures Vietnam. This also happened with 500 Global's blessing.

Last year, AVCJ interviewed multiple Asia-based investors who had worked for global seed platforms and then decided to go solo. Two themes emerged: a desire to pursue a strategy that wasn't consistent with that of the mother ship; and a reluctance to continue giving up a portion of the economics, especially when they have established a local track record and took the lead in raising a local fund.

Tsai observed that spinouts are part of the fabric of venture capital – not least because many of the best early-stage investors are entrepreneurial by nature. Such moves can also be beneficial to emerging technology ecosystems. At the same time, she highlighted the long tenure of 500 Global's senior team.

Both Ng and Harnal added that investment professionals are highly incentivised to stay, based on the value of the 500 Global platform, the autonomy granted to local teams, and the money. There is global and local representation on the investment committees of individual funds; the ability to hold managers accountable is centralised; and most of the economics accrue to those making the investments.

"The firm must care about the region, the region must make a lot of money for LPs that trust the brand, and there must be a level of collaboration within the GP that makes sense. If those elements do not align, fiefdoms might spawn," said Ng. "I often get asked about a spinning out, including by LPs that want to test me. My goal has never been to build a fiefdom for Southeast Asia. I wanted to build a platform."

Valuation to realisation

His commitment to the 500 Global model is unchanged, and his outlook on Southeast Asia is undimmed. There is growing evidence of indigenous innovation, exemplified by the likes of eFishery, a provider of smart feeding systems – plus support on procurement and marketing – to Indonesian fish and shrimp farmers. 500 Global took part in the Series A; the company reportedly recently became a unicorn.

Seed-stage valuations spiked briefly – rising from USD 3m to as much as USD 10m – and have since normalised. 500 Global is still uncomfortable with Series A rounds, where investors are being asked to pay a premium for companies that haven't been de-risked much compared to the seed stage, although the risk-reward tends to even out by Series B following a drop-off in competition.

The late-stage reset has impaired fund performance – a unicorn once on course to return 2x of a fund on its own is now tracking at 1.5x – but Ng noted that LPs are hardly complaining. He is generally ambivalent regarding down rounds, arguing that they lead to stronger companies and better returns in the long term, provided founders and investors are willing to address some immediate discomfort.

If the more challenging conditions have altered anything at all, it is perspective on exits. Backing a company all the way to IPO isn't necessarily the preferred outcome; early trade sales are also appealing.

"I think there is a lot of value in exiting quickly. Do you want to wait 10 years for 200x or would you settle for 50x in two years? These days, I am cognizant of finding ways to sell earlier and generate a better IRR. Small M&A deals don't get much attention, but they aren't bad: you might have come in at a USD 2m post-money valuation and then get out at USD 30m within a year."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.