1Q analysis: Barely disguised weakness

Government guidance funds in China and Toshiba Corporation in Japan papered over obvious cracks in Asia private equity fundraising and investment. Nothing could hide the pain around exits

1) Fundraising: A renminbi band-aid

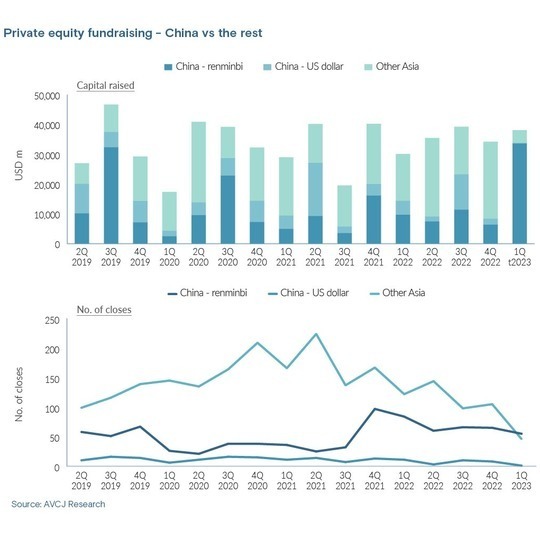

Asia-focused managers raised more capital in 2022 than in 2021 despite a deteriorating global economy, uncertainty over valuations and portfolio performance, and a swath of LPs grappling with overallocation issues. This robust form continued into the first three months of 2023 as USD 38.1bn went to funds in the region, exceeding the average of USD 33.6bn for the preceding eight quarters.

Sound too good to be true? Well, it is. Renminbi-denominated funds – which operate according to their own rules with their own LP bases in their own universe – accounted for USD 33.7bn, or nearly USD 90 out of every USD 100 raised. The US dollar share of USD 4.5bn represents the lowest quarterly total in 14 years, according to provisional data from AVCJ Research.

There were about 100 partial or final closes during the three-month period, versus an average of more than 200 for the prior eight quarters. China managers with US dollar funds fared especially poorly, registering only two closes: B Capital Group secured USD 234.7m for its first country vehicle and Sequoia Capital China spinout Monolith reached a USD 185m first close on its debut fund.

With a target of USD 200m, Monolith might turn out to be the only successful first-time US dollar fundraise in China this year, given how US LPs are holding off on China funds or sticking to re-ups. It's worth noting that a portion of the first close comprised commitments LPs agreed to transfer from a USD 500m hedge fund Monolith raised in 2021.

Outside of China, capital flowed to managers that are either proven and targeting popular geographies or pursuing a niche strategy. India and Japan were both relatively well-represented in the top 25 fundraises from the quarter with four and three apiece.

The top 25 fundraises were filled out by 14 renminbi vehicles. Much has been made of GPs with US dollar track records entering the local currency space. AVCJ explored the trend last year amid claims that US dollar funds wouldn't be able to access certain technology deals because start-up founders are either set on domestic IPOs or fear having to rebuild their cap tables if US-China tensions feed into regulatory action.

Since then, the likes of L Catterton, Affirma Capital, and Coller Capital have launched renminbi funds, though not for regulatory-driven reasons. More pertinently – and after the first quarter ended – Lightspeed China Partners returned to the renminbi ecosystem for the first time in seven years, reaching a first close of CNY 800m (USD 116m) on its latest local currency vehicle.

None of the 14 on the top 25 list fits the profile of US dollar manager turns to renminbi; they are either established operators of renminbi funds or managers with some element of government backing at the GP level. Moreover, with exception of funds raised by smart devices brand Xiaomi and healthcare-focused GL Capital, most are relatively small, typically in the sub-USD 300m range.

It is telling – and illustrative of how renminbi fundraising presents assorted challenges – that about 85% of the renminbi capital raised went to two bumper government guidance funds. The vehicles in question are both the work of the Guangzhou provincial government: Guangzhou Industry FoF and Guangzhou Venture Capital FoF secured CNY 150bn and CNY 50bn, respectively.

The fund-of-funds, which will make commitments to third-party funds and participate in direct investments, have a strategic objective to attract companies to Nansha, a state-level new area of Guangzhou, with a view to building an industry cluster worth CNY 600bn.

2) Exits: Hopes for China liquidity

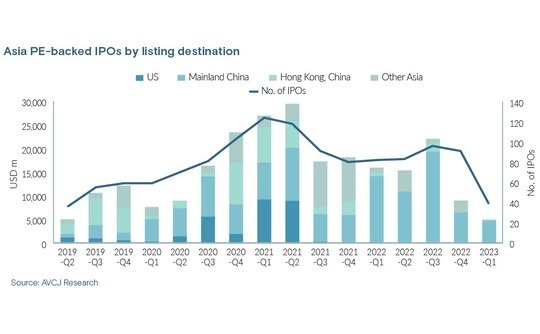

Nestling among the domestic share sales by Chinese companies that have come to dominate the private equity-backed IPO rankings is Hesai Technology. The developer of sensors used in autonomous driving raised USD 190m on NASDAQ, only good enough for sixth place, but this was still the largest offering by a Chinese company in the US since Didi in 2021.

Ever since it became clear last year that an audit access dispute between China and the US – which at one point threatened to result in the compulsory delisting of Chinese companies from US bourses – IPO candidates have crept back to New York. Previously confidential filings are being made public as underwriters reignite processes that might have been delayed for months if not years.

There is a long way to go. PE-backed offerings generated proceeds of just USD 5.7bn in the first three months of 2023 versus an average of USD 19.3bn for the prior eight quarters. The number of offerings hasn't dropped below 70 in any single quarter for three years; between January and March, there were fewer than 50.

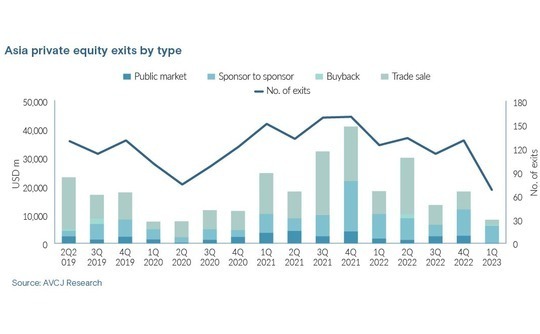

Private equity exits amounted to USD 8.3bn between January and March – a return to the levels seen in early to mid-2020 when COVID-19 was proliferating. Just under 70 transactions were announced compared to an average of 138 for the preceding eight quarters. The total might be revised upwards as previously unreported activity emerges, but there is a lot of ground to make up.

Trade sales slumped to USD 1.8bn from USD 6.2bn in the previous quarter, while sponsor-to-sponsor sales fell to USD 5.9bn from USD 9.2bn. A surge in deal flow in late 2022 propelled the sponsor-to-sponsor share across the 50% threshold for the first time. In the first three months of 2023, it reached 72%, largely because of weak showings in other segments.

3) Investment: Toshiba and not much else

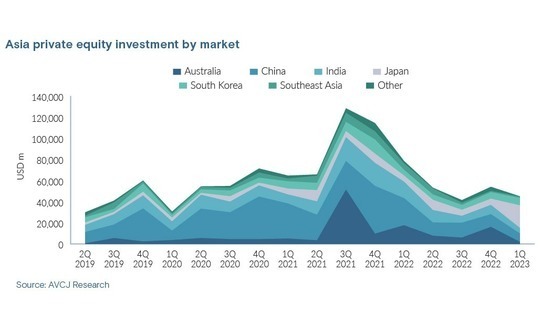

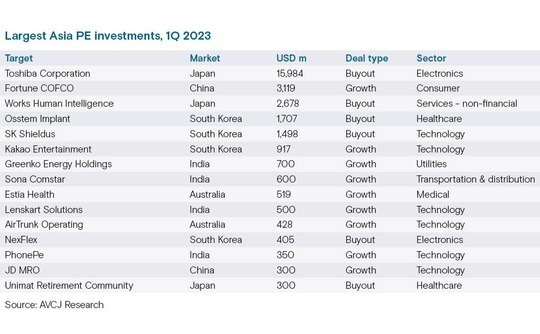

Just as renminbi funds propped up Asia private equity fundraising in the first quarter, Japan – and specifically Toshiba Corporation – did the same for investment. A total of USD 45.2bn was put to work; in keeping with the muted activity that characterised much of 2022, but not an exaggerated version of it. Peel away Toshiba and it's the weakest quarter in about seven years.

Only two major markets saw more investment in the first three months of 2023 than in the last three of 2022: Japan and Korea. They were responsible for four of the five USD 1bn-plus deals. Japan jumped from USD 5.9bn to USD 21.4bn, helped by Toshiba and Works Human Intelligence; Korea's more modest ascent from USD 6.2bn to USD 6.9bn owed much to Osstem Implant and SK Shieldus.

Some familiar trends were at play. Works Human Intelligence and SK Shieldus were both sponsor-to-sponsor deals: Bain Capital sold 50% of the former to GIC for JPY 350bn (USD 2.6bn) while holding on to the rest; SK Group and Macquarie Asset Management offloaded a majority stake in the latter to EQT for KRW 3trn (USD 2.3bn). Both qualify as stable businesses with consistent revenue streams.

There were elements of familiarity in the KRW 2.85trn tender offer for Osstem Implant as well. It came a matter of weeks after the two proponents, MBK Partners and Unison Capital Korea, were on either side of another deal in the same industry. In that instance, MBK acquired 3D dental scanners business Medit, facilitating a full exit for Unison.

The Toshiba deal is exceptional not only because of its size but also because of its inevitability. CVC Capital Partners effectively put the company in play in 2021 by tabling a tentative offer before backing off. As Toshiba became embroiled in a corporate governance scandal on top of its existing financial challenges later the same year, a PE-backed privatisation emerged as the most likely outcome.

Japan Industrial Partners (JIP) assembled a consortium of companies and institutional co-investors for a JPY 2trn (USD 15.3bn) bid that has won board approval. Orix Corporation, semiconductor manufacturer Rohm, and Chubu Electric Power are reportedly among the participants.

Assuming the deal proceeds, it will sit alongside the Bain Capital-led carve-out of Toshiba Memory Corporation – now known as Kioxia – in 2018 as the largest private equity buyout in Japan and in all of Asia. However, the Kioxia deal is larger in US dollar terms, given yen depreciation in recent years.

The Toshiba transaction is not exceptional in that it reflects some of the inherent weaknesses in the current deal-making environment. CVC's proposed acquisition was at a valuation of USD 20bn. JIP's initial proposal, submitted last September, set the price at JPY 5,200-JPY 5,500, which implies an overall valuation of up to JPY 2.38trn. They ended up on JPY 4,620 per share.

Toshiba said the price erosion reflected downward revisions in its earnings projections, a deterioration in the value of Kioxia – in which it retains a significant minority stake – and a JPY 300bn reduction in available debt financing for the deal.

The remaining USD 1bn-plus deal outside of Japan and Korea was a CNY 21bn (USD 3.1bn) growth equity commitment to China-based grain and edible oils processor Fortune COFCO by a consortium of state-owned investors. Ten of the 15 largest transactions in the first quarter were minority growth deals, including five in the technology sector.

Early and growth-stage investment in technology has declined for six consecutive quarters, reaching USD 7.6bn in the first three months of 2023. The regional slowdown reflects a similar phenomenon in China, where investment in the sector slowed markedly over the course of 2022, coming in at USD 1.4bn for January-March 2023.

India, on the other hand, saw an increase in activity. The USD 2.2bn that went into technology – beating China for only the third time in the last 16 quarters – was underpinned by large rounds for eyewear retailer Lenskart (USD 500m) and payments platform PhonePe (USD 350m). Flipkart spinout PhonePe is now worth USD 12bn, making it India's most valuable financial technology unicorn.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.