India

Affirma joins $40m round for India air conditioning supplier

Affirma Capital has joined a USD 40m investment in India’s Epack Durable, a leading domestic designer and manufacturer of air conditioning units among other home appliances.

Bessemer closes latest global VC fund on $3.85b

US-based Bessemer Venture Partners, which is currently expanding a longstanding presence in India, has closed its latest global VC fund with USD 3.85m in commitments.

Q&A: Unitus Ventures' Surya Mantha

Indian returns-focused impact investor Unitus Ventures is sharpening its thesis around jobs as it celebrates its 10-year anniversary. Surya Mantha, a managing partner at the firm, traces the evolution

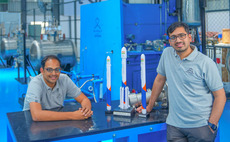

GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

Deal focus: Jai Kisan taps India rural resurgence

The founders of technology-enabled credit platform Jai Kisan went against the grain by forgoing urban customers and targeting India’s rural poor. A USD 50m Series B is an indicator of its progress

Novo Holdings leads $50m round for India's MedGenome

Novo Holdings, which manages the wealth of Denmark’s Novo Nordisk Foundation, has led a USD 50m investment in MedGenome, an India-based genetic testing business.

Accenture backs India space tech start-up Pixxel

Accenture has made an investment of undisclosed size in Indian satellite imaging provider Pixxel via a VC unit. It follows a USD 25m Series A round in March.

Rise Fund, Norwest lead $110m Series D for India's EarlySalary

TPG’s Rise Fund and Norwest Venture Partners have led a USD 110m Series D round for EarlySalary, which claims to be India’s largest consumer lending financial technology start-up.

Fund focus: Fundamentum finds its niche

As one of few Series B and C specialists operating in India, The Fundamentum Partnership expects to have plenty to choose from over the next two years as the glut of early-stage start-ups thins out

GrowX team seeks $100m for spinout India VC fund

The team behind Indian angel investor GrowX Ventures has launched a separate fund targeting USD 100m under the name Merak Ventures.

Kedaara buys minority stake in India's Oasis Fertility

Kedaara Capital has invested USD 50m for a significant minority stake in Oasis Fertility, a fertility treatment business with more than 26 centres across India.

Singularity Growth leads Series D for India's Servify

India’s Singularity Growth Opportunity Fund, a vehicle associated with former Reliance Capital executive Madhusudan Kela, has led a USD 65m investment in after-sales software provider Servify.

Fundamentum raises $227m for India growth-stage tech fund

The Fundamentum Partnership, an India-based growth-stage technology investment firm established by Infosys co-founder Nandan Nilekani and Helion Venture Partners co-founder Sanjeev Aggarwal, has closed its second fund on USD 227m.

Blackstone part-exits Indian auto components maker

The Blackstone Group has realised proceeds of INR 40.4bn (USD 506m) through a partial exit from Sona Comstar, an India-listed manufacturer of automotive systems and components that trades as Sona BLW Precision Forgings.

India rural fintech player Jai Kisan raises $50m

India’s Jai Kisan, a financial technology start-up focused on digital banking in rural areas, has raised USD 50m in Series B funding from a group including DG Daiwa Ventures and Blume Ventures.

Tiger Global leads Series B for India savings platform Jar

Tiger Global Management has led a USD 22.6m Series B round for ChangeJar Technologies, operator of India-based savings and investment app Jar, at a valuation of more than USD 300m.

India seaweed biotech start-up raises $18.5m

India’s Sea6 Energy, a company that cultivates and processes seaweed to make a range of bio-engineered products, has completed a USD 18.5m Series B round featuring BASF Venture Capital.

Stride closes India venture debt fund on $200m

India’s Stride Ventures has closed its second venture debt fund with USD 200m in commitments. The target was INR 10bn (USD 125m).

OTPP to acquire majority stake in India's Sahyadri Hospitals

Ontario Teachers' Pension Plan (OTPP) has agreed its first control private equity buyout in India, taking a majority stake in Sahyadri Hospitals and setting up a partial exit for Everstone Group.

KKR makes $1.2b exit from Indian hospital chain

KKR has exited its entire interest in Indian hospital operator Max Healthcare Institute – nearly four years after assuming control of the business by merging it with an existing portfolio company – with proceeds of approximately INR 91.9bn (USD 1.15bn)....

Mobility: Batteries and beyond

The electrification of transportation has created a wealth of opportunities in energy saving and storage. Investors across Asia – led by China – are looking at batteries and other technologies

Energy transition case study: Hermina and AIG

Healthcare is not a particularly energy-intensive industry, but specialists such as Quadria Capital are tightening up operations where possible at hospitals

Quadria plans full exit through Concord Biotech's India IPO

Singapore-based healthcare specialist Quadria Capital is set for a full exit from pharmaceuticals industry supplier Concord Biotech via an India IPO.

CPPIB puts $236m into Asia co-investments in second quarter

Canada Pension Plan Investment Board (CPPIB) defied the recent slowdown in Asia private equity investment to deploy more than CAD 300m (USD 236m) across five deals alongside portfolio GPs between April and June.