Mobility: Batteries and beyond

The electrification of transportation has created a wealth of opportunities in energy saving and storage. Investors across Asia – led by China – are looking at batteries and other technologies

As recently as five years ago, investing in mobility in Asia meant targeting internet-enabled business model innovations like ride-hailing and car-sharing. How quickly the market turns. Now, these innovations are widely viewed as saturated and opportunities in and around China's electric vehicle (EV) industry are top of mind for private equity and venture capital players.

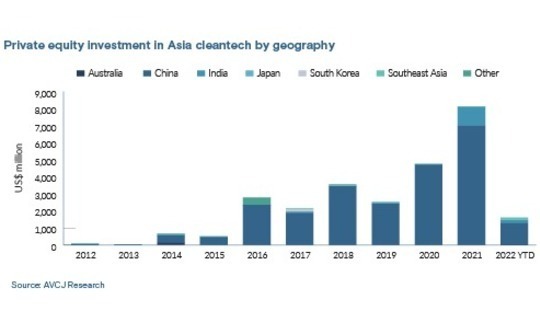

EV investment has risen from negligible in 2015 to USD 3.5bn last year, with more than 90% of that capital targeting China, according to AVCJ Research. The EV value chain – from batteries to smart cockpits – is harder to quantify, but it helped drive investment in Asia cleantech to USD 1.4bn in 2020 and USD 4.6bn in 2021. Prior to that, the USD 700m threshold has been crossed only three times.

"Significant EV players can only emerge in the US and China thanks to their sizeable domestic markets, abundant capital, and deep talent pools," said Julien Mialaret, an operating partner at Eurazeo, a Europe-headquartered GP that focuses on energy, mobility, and deep technology in Asia.

China has ranked first globally in production and sales of new energy vehicles (NEVs) for six consecutive years. Sales in the first half of 2022 reached 2.6m units, 121% up year-on-year. NEV penetration among new cars reached 21.6%, up from 5.8% in 2020.

Evolution has not been smooth. Significant cuts in EV subsidies in 2019 left leaders like Nio floundering and market watchers deliberated over the future of the industry. Falling battery costs proved to be the saviour. They helped make the lifecycle expenditure of EVs superior to conventional fuel vehicles, turning what was once a fashion choice into an economically viable mainstream option.

"Once this trend becomes established, the growth rate will accelerate," Ian Zhu, a managing partner at Nio Capital, an independently operated private equity firm led by the founder of Nio, told AVCJ last year. "There is no doubt that the electric passenger vehicle penetration rate in the new car market will exceed 90% in a few years."

Nio, Xpeng, and Li Auto have established themselves as China's preeminent "new force" EV manufacturers. All three are now publicly listed, suggesting the private equity opportunity in EV has dissipated. However, they still trail the mass-market brands in terms of sales, with BYD Auto, SAIC-GM-Wuling Automobile, and state-owned Cherry Automobile leading the way.

Moreover, Hozon Auto, which recently received CNY 3bn (USD 443m) in funding from local investors, started outselling Nio and Li Auto last year. The competitive threat to the new force powers is there, even though some investors claim Hozon is inferior in terms of brand, quality, and technology and its impressive sales figures are the result of orders from government-related shareholders.

Sharing and swapping

In Asia ex-China, PE activity in the EV space remains limited. A TPG Rise Climate-led investment of INR 75bn (USD 994m) in the EV unit of India's Tata Motors is by some distance the largest transaction; few others have registered double figures in US dollar terms.

The real opportunity might be platform-based – shared mobility or mobility-as-a-service – rather than in conventional EVs. For example, India's Lithium Urban Technologies claims the largest EV fleet outside of China, with 2,000 vehicles available for lease and a network of over 600 charging stations.

"You hit a breakeven point on unit economics much faster in mass mobility than in personal mobility applications. We think India – as a fairly price-sensitive market with a high focus on value proposition – has already reached that inflection point in EV," said Dhanpal Jhaveri, CEO of EverSource Capital

Jhaveri was speaking to AVCJ in April after EverSource, an energy transition joint venture established by Everstone Group and BP, acquired a majority stake in Lithium Urban for about USD 50m.

Princeville has exposure to two-wheelers through Gogoro, having launched a US-listed special purpose acquisition company (SPAC) that merged with the Taiwan-based company at a valuation of USD 2.3bn earlier this year. Before that, Gogoro received several rounds of VC funding.

Most of the company's revenue comes from sales of its signature Smartscooter, but the key design feature is a battery that can be swapped out at special stations, eliminating the need for recharging. More than 200m battery swaps have been completed at over 2,000 swapping stations across Taiwan, and framework agreements are in place to take the technology into mainland China and India.

As the major cost component in EVs – they account for 35-40% of the total – batteries are a logical target for VC and PE investors keen to address industry pain points.

To date, most of the capital has focused on a handful of leading companies. In China, Svolt Energy Technology, formerly the battery manufacturing unit of Chinese automaker Great Wall Motor, and Envision, which has interests spanning batteries and wind turbines, have been the key recipients. Korea, which has carved out a global leading position in battery development, is much the same.

"Our basic investment strategy is to focus on the growth stage, providing capex investment. We look to help leading companies that are looking for capital to really increase their capacity," said Jungwon Kim, a managing director at IMM Private Equity who heads the firm's battery fund, which launched last year with a target corpus of USD 353m and won an anchor LP commitment from LG Chem and LG Energy Solution.

Politics to pricing

Some market leaders have already expanded well beyond the growth stage. China-based CATL has been the world's largest power battery company for five straight years. Its installed capacity was 96.7 gigawatt-hours in 2021, which equated to a global market share of 32.6%, up from 24.6% in 2020.

Much of that 8-basis point increase came from Korea's LG Energy and Japan's Panasonic, respectively the second and third largest players globally. In 2020, shipments by LG to Tesla's Shanghai factory were four times higher than those by CATL. Twelve months later, the roles had nearly reversed.

One perspective is that these competitive dynamics are guided by geopolitics rather than quality. One Korea-based private equity investor attests that CATL's technology is inferior to that of its global peers and the company's dominance results from preferential treatment in the huge China market.

A second Korean investor, who has exposure to EV components, concurred with this narrative: "The market is splitting in two between China and the rest of the world. China will use Chinese-made EV batteries. Everywhere else in the world will be dominated by Korea. Say that to anyone in the automotive industry globally and they'll nod their head and tell you to stop stating the obvious."

However, this view is contested by those on the other side of the Yellow Sea. According to one China-based investor, Tesla chose CATL because of its stable and reliable supply. Moreover, the company's international credentials are underpinned by Germany's three leading luxury car brands, Mercedes-Benz, BMW, and Audi, choosing to partner with CATL in Europe.

"South Korea's battery R&D used to be better than China, but CATL and BYD have been catching up quickly since 2015. OEMs [original equipment manufacturers] can no longer spot an obvious technology gap between leading battery companies in the two countries," the investor added.

"On the contrary, OEMs are still dealing with supply shortages of high-quality batteries. The core competitiveness of a battery maker is its scale, its stability, and reliability of its supply. Based on these criteria, CATL is definitely the world's number one."

Regardless, capital-raising activity by leading battery makers has slowed this year because investors are unwilling to meet valuations expected by the companies. According to IMM's Kim, valuations for leading players with proven technologies and strong customer bases have fallen 10-15% since the end of last year. Newer, unproven players, however, face the prospect of significant corrections.

Solid-state batteries are a case in point. Last year, automotive manufacturers like Honda, BMW, and Mercedes-Benz flocked into the space. Now they are conspicuous by their absence. When Enpower Greentech, which claims to be a pioneer in next-generation all-solid-state batteries (ASSBs), closed a Series A extension of USD 20m, Dayone Capital and Sequoia Capital China took the lead.

Nevertheless, Ning Yang, a partner at Dayone, remains bullish about the opportunity, citing the greater efficiency and safety features of ASSBs, which rely on solid electrolyte materials to trigger the chemical reaction that generates energy whereas lithium-ion batteries use liquid.

"ASSBs are the ultimate goal for the industry – it is one of few technological innovations in new energy in recent years. From a consumer perspective, this is very exciting. If ASSBs can be mass-produced, there would be an industrial revolution that would dramatically reshape our daily lives," he told AVCJ in July.

IMM is also interested in solid-state batteries, but with a different perspective. Kim observes that the technology is not yet commercialised, and OEMs accept the inherent risk of these deals because they want to show suppliers that they can retain control of supply chains. Financial investors like IMM, meanwhile, recognise the potential to improve the performance of mainstream lithium-ion batteries.

"The key technology of solid-state batteries can significantly enhance safety features and improve charging speed for lithium-ion batteries. Rather than being the substitute for mainstream batteries, companies in this space can be technology suppliers like ARM in semiconductors," said Kim.

Into the future

Another emerging battery theme is manganese, which stabilises the nickel in lithium-ion batteries at lower cost than other materials, leading to immediate efficiency gains. The technology can function within existing frameworks and therefore appeals to investors looking for mature solutions. Others believe the rise of manganese is a temporary phenomenon driven by rising lithium prices.

When asked to name likely next breakthrough investments in batteries, Gly Capital Management – a Hong Kong-based manager majority-owned by Chinese carmaker Zhejiang Geely Group – and Princeville both point to recycling.

"There's a big demand-supply gap for materials. Prices of these commodities will continue to increase and governments will have to push through regulations requiring people to recycle batteries," said Torres of Princeville. He also sees potential in using artificial intelligence-enabled software to make batteries more efficient, for example through better-controlled recharges.

Batteries are just one stopping point in the EV value chain, albeit a significant one. There are plenty of options that fit different risk-return appetites. Trustar Capital, for example, prefers mature businesses. Earlier this year, it backed Intramco, a Europe-based manufacturer of components used in EV charging systems such as cables and plugs.

Meanwhile, venture capital players are tracking more nascent trends like "smartisation" – a catch-all term for autonomous driving, smart cockpits, and the chips and sensors that enable them.

"From a VC perspective, investment in vehicles and batteries was laid out 5-7 years ago. The EV opportunity in the first period was driven by electrification. In the second period, it will be driven by in-vehicle internet, computing power, and so-called informatisation," said Mingming Huang, founding partner of China-focused Future Capital, told AVCJ last year.

Advanced driver assistance systems (ADAS) and LiDAR technology are also popular themes. However, much like solid-state batteries, deal flow has slowed because of valuation mismatches.

Nio Capital's Zhu also divides investment into distinct periods. His EV value chain journey started with batteries in 2017 and then moved into autonomous driving. Car-relevant semiconductor products are now of interest, given each vehicle contains multiple chipsets. Zhu believes the "intelligentisation" of automobiles will ultimately lead to semiconductor technology upgrades.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.