Technology

Gaorong backs China energy storage company

China-based energy storage company WeView has raised CNY 400 million (USD 57m) from a group including Gaorong Capital, Green Pine Capital Partners, and ZhenFund.

China semiconductor player Shangda raises $99m

Chinese semiconductor packaging and testing company Shangda has raised a Series A extension of CNY700m (USD 99m) co-led by three government-backed funds.

India insurance start-up Zopper raises $75m

Indian private equity firm Creaegis has led a USD 75m Series C round for local insurance technology provider Zopper.

China semiconductor: Casualties of war

Private equity investment in China’s semiconductor industry continues unabated despite intensifying US regulatory action. While start-ups are not explicitly targeted, many are feeling the heat

Gobi raises $10m for Asia seed fund

Gobi Partners has closed a USD 10m Malaysia-focused seed fund with contributions from Allianz Malaysia, Malaysia Venture Capital Management (Mavcap) and Sunway Group.

C Ventures rebrands, hits first close on new fund

C Ventures, a VC firm set up by Adrian Cheng, scion of Hong Kong’s New World Development, has rebranded as C Capital – reflecting steps to diversify into a multi-strategy asset manager – and reached a first close on its latest fund.

Deal focus: Morse Micro takes Wi-Fi to the next level

Australia’s Main Sequence Ventures plans to make Morse Micro one of the few Wi-Fi chipmakers in an easy-to-imagine future where more reliable, long-range device connectivity surges in demand

Fund focus: Glenwood gains traction with carve-out thesis

Korea-focused Glenwood Private Equity has closed its second fund on KRW 900m (USD 648m) from local LPs, having established itself as a mid-market corporate divestment specialist

China satellite player Galaxy Space achieves unicorn status

Galaxy Space, a China-based satellite developer, has raised a new funding round led by CCB International at a post-investment valuation of CNY 11bn (USD 1.6bn).

Australia's Telstra Ventures raises $336m for latest global fund

Australia’s Telstra Ventures has closed its third global fund on AUD 500m (USD 336m), beating a target of AUD 400m. Fund II closed on AUD 675m in 2018 and added a USD 50m sidecar the following year.

Indonesia's Fazz raises $100m Series C

Indonesia’s Fazz, a financial services provider for Southeast Asia micro businesses, has raised a USD 100m Series C round featuring Tiger Global, DST Global, and B Capital Group.

Billionaire Venture, DBS to invest $200m in India start-ups

India’s Billionaire Venture Capital and DBS Bank have agreed to invest USD 200m in 150m Indian start-ups via a special purpose vehicle and joint venture (JV).

Profile: Crescendo's Kevin Lee

Kevin Lee founded Crescendo Equity Partners to spot overlooked Korean technology suppliers and reposition them as global leaders of their niches. This required a rare combination of skills

China AI player Fourth Paradigm files for Hong Kong IPO

Fourth Paradigm, a China-based software provider that helps enterprise customers develop in-house artificial intelligence (AI) decision-making applications, has filed for a Hong Kong IPO.

Temasek, Boyu, GGV back Hong Kong's Animoca Brands

Hong Kong metaverse start-up Animoca Brands has raised USD 110m featuring Temasek Holdings, Boyu Capital, and GGV Capital. Funding since the start of 2021 now tops USD 630m.

East leads $26m Series A for Indonesia agtech start-up

East Ventures has led a USD 26m Series A round for Indonesia’s Gokomodo, an agriculture technology provider focused on simplifying fragmented and inefficient supply chains.

China fitness app Keep pursues Hong Kong listing

Keep, a China-focused fitness app operator backed by the likes of GGV Capital, SoftBank Vision Fund 2, and 5Y Capital, has filed for a Hong Kong IPO.

Australia's Morse Micro gets $95m Series B

Morse Micro, an Australian fabless semiconductor developer specialising in long-range, low-power Wi-Fi for internet of things (IoT) devices, has raised AUD 140m (USD 95m) in Series B funding.

Global Brain leads $30m Series A for Japan's Josys

Global Brain has led a JPY 4.4bn (USD 30.5m) Series A round for Japanese business automation and IT services platform Josys with plans for an international expansion.

Deal focus: Remote working delivers for Glints

An outsourced talent management service that enables companies to recruit in far-flung markets has become the bulwark of Glints’ business on the back of COVID-19, underpinning a USD 50m Series D

Q&A: Unitus Ventures' Surya Mantha

Indian returns-focused impact investor Unitus Ventures is sharpening its thesis around jobs as it celebrates its 10-year anniversary. Surya Mantha, a managing partner at the firm, traces the evolution

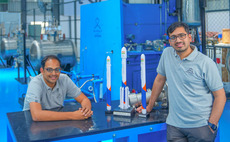

GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

Deal focus: Jai Kisan taps India rural resurgence

The founders of technology-enabled credit platform Jai Kisan went against the grain by forgoing urban customers and targeting India’s rural poor. A USD 50m Series B is an indicator of its progress

Deal focus: Turning data into operational efficiencies

Chinese data mining start-up Prothentic has managed to turn first-time business into repeat subscription business, which led to valuation increase between funding rounds even as the wider market stagnates