Sectors

Affirma joins $40m round for India air conditioning supplier

Affirma Capital has joined a USD 40m investment in India’s Epack Durable, a leading domestic designer and manufacturer of air conditioning units among other home appliances.

L'Oréal China investment unit backs local fragrance brand

L'Oréal has completed the debut deal from its newly formed China investment arm by participating in an extended Series A round for local fragrance brand Documents.

Quadrant completes exit from Australia's Peter Warren Auto

Quadrant Private Equity has completed its exit from Australian car dealership Peter Warren Automotive Holdings - which it took public last year - through a AUD 50m (USD 34m) block trade.

Deal focus: L'Oréal shows staying power

Europe-based personal care giant L’Oréal looked past short-term impediments like lockdowns and asset price corrections to join Cathay Capital in supporting Chinese perfume brand Documents

Deal focus: Anchorage exits rail player, launches Fund IV

Australia-based Anchorage Capital Partners has extended a string of exits with the sale of a local rail industry player, while going to market seeking AUD 500m (USD 339m) for its fourth fund

Profile: Crescendo's Kevin Lee

Kevin Lee founded Crescendo Equity Partners to spot overlooked Korean technology suppliers and reposition them as global leaders of their niches. This required a rare combination of skills

Korea: A good time to be different?

Macroeconomic uncertainty and liquidity risk are pushing Korean private equity firms to think beyond buyouts, double down on operational capabilities, and consider all their exit options

TPG-backed Dingdang Health raises $51m in Hong Kong IPO

Chinese online pharmacy platform Dingdang Health has raised HKD 402.4m (USD 51m) through a Hong Kong IPO, defying challenging conditions for financial sponsors targeting the bourse.

China AI player Fourth Paradigm files for Hong Kong IPO

Fourth Paradigm, a China-based software provider that helps enterprise customers develop in-house artificial intelligence (AI) decision-making applications, has filed for a Hong Kong IPO.

Temasek, Boyu, GGV back Hong Kong's Animoca Brands

Hong Kong metaverse start-up Animoca Brands has raised USD 110m featuring Temasek Holdings, Boyu Capital, and GGV Capital. Funding since the start of 2021 now tops USD 630m.

East leads $26m Series A for Indonesia agtech start-up

East Ventures has led a USD 26m Series A round for Indonesia’s Gokomodo, an agriculture technology provider focused on simplifying fragmented and inefficient supply chains.

Affirma leads $217m investment in Korean digital insurer

Affirma Capital has led a KRW 300bn (USD 217m) funding round – at a valuation of KRW 1trn – for Carrot General Insurance, a South Korea-based digital insurer.

China fitness app Keep pursues Hong Kong listing

Keep, a China-focused fitness app operator backed by the likes of GGV Capital, SoftBank Vision Fund 2, and 5Y Capital, has filed for a Hong Kong IPO.

Australia's Morse Micro gets $95m Series B

Morse Micro, an Australian fabless semiconductor developer specialising in long-range, low-power Wi-Fi for internet of things (IoT) devices, has raised AUD 140m (USD 95m) in Series B funding.

Global Brain leads $30m Series A for Japan's Josys

Global Brain has led a JPY 4.4bn (USD 30.5m) Series A round for Japanese business automation and IT services platform Josys with plans for an international expansion.

Deal focus: Remote working delivers for Glints

An outsourced talent management service that enables companies to recruit in far-flung markets has become the bulwark of Glints’ business on the back of COVID-19, underpinning a USD 50m Series D

Q&A: Unitus Ventures' Surya Mantha

Indian returns-focused impact investor Unitus Ventures is sharpening its thesis around jobs as it celebrates its 10-year anniversary. Surya Mantha, a managing partner at the firm, traces the evolution

Deal focus: PAG goes back to the theme park

PAG returns to a historically fruitful niche with the acquisition of Japanese theme park operator Huis Ten Bosch. COVID-19 made the deal possible but remains a wildcard

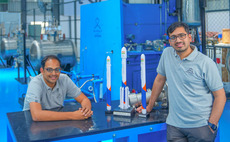

GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

Singapore's Docquity raises $44m Series C

Singapore-based Docquity, a networking service for more than 300,000 doctors across Southeast Asia, has raised USD 44m in Series C funding led by Japan’s Itochu Corporation.

Deal focus: Jai Kisan taps India rural resurgence

The founders of technology-enabled credit platform Jai Kisan went against the grain by forgoing urban customers and targeting India’s rural poor. A USD 50m Series B is an indicator of its progress

China circuit board maker JLC raises $129m

Chinese circuit board manufacturing company Jialichuang (JLC) has raised CNY 900m (USD 129m) from State Development & Investment Corporation (SDIC), Eastern Bell Capital and Jianfa Xinxing Investment.

Deal focus: Turning data into operational efficiencies

Chinese data mining start-up Prothentic has managed to turn first-time business into repeat subscription business, which led to valuation increase between funding rounds even as the wider market stagnates