Sectors

India's Moglix raises $120m Series E at $1b valuation

Indian B2B services player Moglix has raised a $120 million Series E round led by Falcon Edge Capital and Harvard Management Company at a valuation of $1 billion.

Vietnam SOEs: Diverted divestments

Murky accounting and politics have rapidly decelerated the privatization of Vietnam’s government-owned companies in recent years. Private equity is biding its time and testing creative inroads

Indonesia's Gojek, Tokopedia merge as GoTo

Gojek and Tokopedia, two of Indonesia’s best-funded technology start-ups, have completed a merger, forming what they claim is the largest mobile on-demand services and payments platform in Southeast Asia.

Japan microsatellite developer gets $24m Series C

Japanese microsatellite developer Axelspace has raised JPY2.6 billion ($24 million) in Series C funding from a group of domestic VCs, including Sparx Group.

KKR invests $95m in India's Lenskart

KKR has invested $95 million in Indian eyewear retail leader Lenskart via a secondary transaction that facilitated partial exits of undisclosed size for TPG Growth and TR Capital.

Baring Asia exits SAI Global's assurance business

Baring Private Equity Asia is set to exit a significant part of Australia-based SAI Global, having agreed to sell the standards and assurance services business to UK-listed Intertek Group for A$855 million ($664 million).

China snack maker Weilong raises $549m, pursues HK IPO

China’s leading spicy snack food company Weilong has raised a $549 million pre-IPO round at a valuation of $9.4 billion and filed for a Hong Kong IPO.

Hong Kong NFT player raises $89m at $1b valuation

Hong Kong’s Animoca Brands, a blockchain-based games developer diversifying into non-fungible tokens (NFTs), has raised $88.9 million from a group of VCs at a valuation of $1 billion.

NSSK buys Japan power components manufacturer

NSSK has agreed to acquire the power transmission components division of Fujikura, a listed Japanese electrical equipment manufacturer.

China HR SaaS player Beisen raises $260m

Beisen, China’s largest integrated human resources software-as-a-service (SaaS) platform, has raised $260 million in Series F funding. It is said to be the largest-ever round in this segment of enterprise services.

China's WeRide closes Series C, hits $3.3b valuation

Chinese autonomous driving company WeRide has achieved a valuation of $3 billion on closing a Series C round of undisclosed size. It comes four months after the company raised $310 million in Series B funding.

SoftBank increases commitment to second Vision Fund

SoftBank Group has increased its commitment to Vision Fund 2 from $10 billion to $30 billion after a revival in the fortunes of Vision Fund 1 meant the company returned to profit over the past 12 months.

James Murdoch launches Asia-focused SPAC

James Murdoch, son of media tycoon Rupert Murdoch, has launched a special purpose acquisition company (SPAC) that will pursue deals in Southeast and South Asia, with a particular focus on India.

Korea's VIG buys The Skin Factory

Korean mid-market private equity firm VIG Partners has acquired 100% of The Skin Factory, operator of domestic home and personal care products brand Kundal.

FountainVest leads Series B for China's MyMRO

Shanghai-based B2B e-commerce company MyMRO, a spinoff of US industrial products supplier Grainger, has raised several hundreds of million renminbi in Series B funding led by FountainVest Partners.

LG Chem to anchor IMM's Korea battery fund

IMM Private Equity’s recently established credit unit has launched a KRW400 billion ($353 million) Korea-focused fund that will invest in components for electric vehicle (EV) batteries and other environmentally friendly industrial materials.

Vision Fund leads $330m investment in China grocery platform

Dingdong Macai, a China-based online fresh produce delivery business, has raised $330 million in an extended Series D round led by SoftBank Vision Fund.

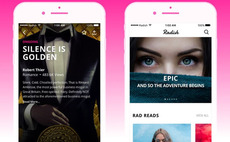

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

EQT backs Indonesia flavors, fragrances player

Product innovation and geographic expansion are on the agenda for Indonesia-based flavors and fragrances (F&F) provider Indesso Group following EQT’s acquisition of a minority stake in the business.

Philippines digital bank Tonik raises $17m

Tonik, which claims to be the first digital bank in the Philippines, has raised $17 million in pre-Series B funding led by Singapore’s iGlobe Partners.

China GPs commit $160m to local ADC player

DAC Biotech, a Chinese biotech company specializing in antibody-drug conjugates (ADCs) commonly used as targeted therapies for treating cancer, has raised RMB1 billion ($160 million) in Series C funding led by GL Ventures, CDG Capital, and CPE.

China self-driving truck start-up agrees $3.3b SPAC merger

Plus, a China-based autonomous driving technology developer that specializes in trucks, has agreed to merge with a special purpose acquisition company (SPAC) at a valuation of $3.3 billion.

Hong Kong crypto start-up gets $40m Series A

Sequoia Capital China, Tiger Global Management, and Boyu Capital have joined a $40 million Series A round for Hong Kong cryptocurrency services provider Babel Finance.

China medical tech supplier AMS raises $100m

China and US-based Access Medical Systems (AMS) has raised a $100 million round co-led by Sequoia Capital China and GL Ventures.