Vietnam SOEs: Diverted divestments

Murky accounting and politics have rapidly decelerated the privatization of Vietnam’s government-owned companies in recent years. Private equity is biding its time and testing creative inroads

When Vietnam revived its efforts to privatize the state-owned enterprise (SOE) sector last year as part of a plan to fend off the economic impacts of COVID-19, the timing seemed right. The public markets were performing well, valuations were robust, and investor sentiment for Vietnam was rising. Global trade tensions were promising increased industrial activity, and successful pandemic control measures appeared to have preserved the domestic consumption story.

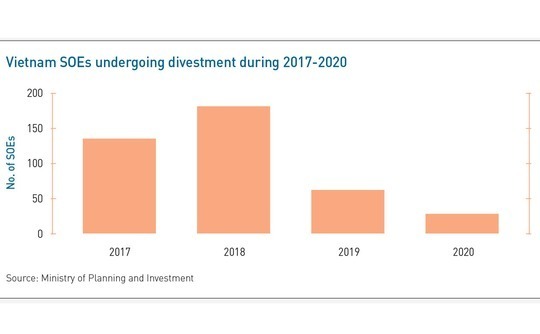

Yet at the same time, border closures had dramatically limited investor participation, and a transition period for the government suggested little would happen to SOEs in the near term. In mid-2020, Prime Minister Nguyen Xuan Phuc, who became president last month, said he wanted to see 120 SOEs equitized within the year. Only 28 underwent this process, down from 62 in 2019 and 181 in 2018.

Timing was not the only problem. Vietnam's SOE divestment story has changed from a big bang of plentiful deals of varying sizes to a less accessible phenomenon of large but sporadic transactions. The pot is still enticing, with the 178 SOEs approved for divestment last year valued at a combined VND443.5 trillion ($19.1 billion). But attempts to recreate the kinetic deal-making days of the early 2000s – when about 3,500 SOEs were privatized in the space of seven years – have fizzled.

"Out of 100 opportunities we see, maybe a handful relate to SOEs, but the rest are really private. SOE equitizations are in pause mode, but they have to continue," says Andy Ho, CIO at VinaCapital. "I suspect that later this year or early next year, we'll see a few more come through, and the government will begin to make decisions. If the stock market remains strong and valuations are strong, they will be motivated to get more bang for their buck."

Got milk?

VinaCapital's key exposure here is Vinamilk, which it backed across two investments in 2003 and 2004 following a domestic IPO. At the time of listing, the company had a market equitization of around $500 million and is now worth about $9.5 billion. It is commonly held up as the flagship example of the SOE divestment opportunity set, but there is much about the company that illustrates why the opening is no longer what it used to be.

The low-hanging fruit of straightforward consumer-facing SOEs such as a milk company with a 60% domestic market share have largely played out. The remains are a mixed bag of mostly complex infrastructure and potentially security-sensitive assets either still on the block or in bureaucratic limbo. Seemingly safe companies in agriculture and non-technical domains can still become unapproachable if their landholdings are considered geographically strategic.

Vinamilk also hints at the persistence of state heritage headaches in terms of post-privatization governance. The company has effectively three boards – a board of directors, a board of management, and an audit committee, which is viewed as a mechanism for state oversight. By comparison, the telecom and energy SOEs now stirring the biggest hopes for divestment might be expected to be held on an even shorter leash.

A study commissioned by the prime minister's office conducted by RMIT University found that one key reason for the stalling of SOE divestments was that the remaining businesses are in sectors that require a strong independent regulatory framework yet do not have it.

In some ways, this scenario has proven attractive to investors, such as in the case of Airports Corporation of Vietnam, which is in the advantageous position of regulating ticket prices as well as being a travel operator. In other areas, like energy, a lack of stable oversight on tariffs is less appetizing and has fed the thinking that a quasi-monopoly can only be made competitive when best-practice protocols are introduced by a fellow industry player.

"There will be great opportunities for investors, but it won't be systematic. The opportunities will be one-off-shots, and they will be much more present for industrial investors than for financial investors," says Burkhard Schrage, a managing partner at Explora Capital and professor at RMIT, flagging ThaiBev's $4.7 billion purchase of brewer Sabecco in 2018.

"Pension funds, family offices, and private equity firms should think about going in with an industrial investor in the remaining SOEs because the key value driver post-privatization will be operational restructuring and synergies."

Technical barriers

Another potential obstacle is that, while SOEs have a technical mandate to dispose of assets, they sometimes lack the political capacity to do so. This factor is believed to be increasingly relevant as the population of SOEs boils down to the businesses most likely to be subject to vested government or party interests. In such cases, there will be significant resistance to disrupting current structures.

The Asian Development Bank (ADB) sees parallel headwinds in a lack of opportunity to take controlling stakes due to foreign investment restrictions in various sectors. It notes that ThaiBev's 54% stake in Sabecco represents the largest interest held by a private company post-equitization and a rare exception. ADB is therefore predominantly active in Vietnam's SOE space as a debt investor.

"The transparency issues come in more on what it takes to get a decision," says Don Lambert, a Vietnam-based principal at ADB. "There are layers of government behind our direct counterparts at an SOE, and the relationships between the SOEs and the line ministries and other ministries can be complex. With loans sometimes taking more than a year to close, imagine how much longer it could take for equity."

Warrick Cleine, a managing director for KPMG in Vietnam, sees roadblocks on both the buyer and seller sides of the equation. For investors, there may be interest in turnaround opportunities, but he notes these ambitions can be spoiled when a target loses advantages associated with being in the SOE ecosystem. On the sell side, a lack of political capacity to realize a deal can be exacerbated by a local penchant for consensus decision-making.

"While many of the technical barriers preventing or slowing asset sales have been remedied over the years, the drivers that would motivate individual decisionmakers and management teams to make disposals only rarely align," Cleine says. "When they do, it is generally a compelling external driver – such the need for capital in the company or the government's fiscal imperatives – that have enabled asset sales to proceed."

Most of the issues around transparency, bureaucracy, governance, and regulatory frameworks are essentially about enterprise valuation. In addition to a general reluctance around allowing foreign advisors into the evaluation process, there is the notion that if a divestment is agreed below an asset's presumed book value, it could be a significant risk for any individuals held responsible for the unqualified audits.

SOE bosses eager to avoid accusations of corruption will therefore be wary of pricing a potential turnaround deal at a reduced valuation. Several investors AVCJ contacted observed that this hesitancy effect is exaggerated in Vietnam versus many of its ASEAN neighbors. One fix has been mooted in the form of the government providing SOE managers with high-level cover that preemptively okays selling a company at a loss, although this could involve legal hurdles.

Dominic Scriven, founder and chairman of Dragon Capital believes, however, that enterprise valuation troubles are not the real issue. He notes that although roughly half of the listed companies in Vietnam are former SOEs, only one of Dragon's top-10 investments falls into that category. The takeaway is that, with the exception of the complex giants still yet to be divested, it's the purely private companies that dominate the investment opportunity in Vietnam.

"The SOEs are either not interesting or too serious," Scriven says. "There's a list of about 15 industries that are viewed for various reasons as significant to the government's ability to influence activity where needed. I don't think those are going to quickly go on the block. So, then you're left with the dross, and who's interested in that? There has to be an element of a fire sale to catalyze it, but as soon as you've got that going, it dries up again."

The partnership approach

Alternative approaches to tapping Vietnam's SOE opportunity are slowly emerging. The best example here might be Warburg Pincus' establishment of a joint venture with state-owned industrial conglomerate Becamex in 2018. The platform, known as BW Industries, is essentially being co-managed as a start-up, with Warburg Pincus and Becamex having jointly invested $500 million to date.

Becamex is one of the largest landowners in Vietnam, but its approach to industrial logistics was self-liquidating. The model was to build up essential transport and power infrastructure on Becamex properties and then sell them on. To better exploit the converging trends of increasing domestic consumption and manufacturing, the company needed a more sustainable infrastructure play, where factories and warehouses are built and retained as an ecosystem that generates recurring revenue.

This is where Warburg Pincus came in. The private equity firm approached Becamex about two years before an initial $200 million investment to kickstart the project, touting its experience incubating a similar ecosystem with ESR in China. Last week, ESR and BW formed a joint venture of their own to develop a modern industrial park near Ho Chi Minh City.

"There was all this talk about the equitization and sell-down of the SOEs, but we hadn't seen that many that were really that available in quantum and size to be able to play into that – so we took a different path," says Jeffrey Perlman, a managing director and head of Southeast Asia at Warburg Pincus.

"As growth investors, we want to see who we could align with to build platforms that can scale over time. In a way, you have to go to them instead of the other way around. BW is a great example of what private and public capital can do with one another in accelerating the growth of the economy."

BW now claims to be Vietnam's largest and fastest growing logistics and industrial real estate developer with 5 million square meters of prime industrial land under control across more than 25 projects in 20 prime economic locations. As a private equity-SOE play, Perlman attributes much of the success to an entrepreneurial and open-minded style within management at Becamex, which already had extensive experience working with foreign corporates.

"The benefit of starting from scratch is there are no issues around how something should be valued," he adds. "It is all on a go-forward basis – how much capital can we bring and how much capital and assets can they bring. We don't have to get caught up in that whole separate process of what's the public valuation of something they're trying to divest and how that should be treated."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.