Sectors

Korea's VIG buys The Skin Factory

Korean mid-market private equity firm VIG Partners has acquired 100% of The Skin Factory, operator of domestic home and personal care products brand Kundal.

FountainVest leads Series B for China's MyMRO

Shanghai-based B2B e-commerce company MyMRO, a spinoff of US industrial products supplier Grainger, has raised several hundreds of million renminbi in Series B funding led by FountainVest Partners.

LG Chem to anchor IMM's Korea battery fund

IMM Private Equity’s recently established credit unit has launched a KRW400 billion ($353 million) Korea-focused fund that will invest in components for electric vehicle (EV) batteries and other environmentally friendly industrial materials.

Vision Fund leads $330m investment in China grocery platform

Dingdong Macai, a China-based online fresh produce delivery business, has raised $330 million in an extended Series D round led by SoftBank Vision Fund.

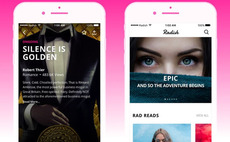

Korea's Kakao acquires VC-backed storytelling platform

Radish, a Korea and US-based mobile fiction platform, will be acquired by a unit of Kakao Corporation for $440 million. Its backers include SoftBank Ventures Asia and Kakao.

EQT backs Indonesia flavors, fragrances player

Product innovation and geographic expansion are on the agenda for Indonesia-based flavors and fragrances (F&F) provider Indesso Group following EQT’s acquisition of a minority stake in the business.

Philippines digital bank Tonik raises $17m

Tonik, which claims to be the first digital bank in the Philippines, has raised $17 million in pre-Series B funding led by Singapore’s iGlobe Partners.

China GPs commit $160m to local ADC player

DAC Biotech, a Chinese biotech company specializing in antibody-drug conjugates (ADCs) commonly used as targeted therapies for treating cancer, has raised RMB1 billion ($160 million) in Series C funding led by GL Ventures, CDG Capital, and CPE.

China self-driving truck start-up agrees $3.3b SPAC merger

Plus, a China-based autonomous driving technology developer that specializes in trucks, has agreed to merge with a special purpose acquisition company (SPAC) at a valuation of $3.3 billion.

Hong Kong crypto start-up gets $40m Series A

Sequoia Capital China, Tiger Global Management, and Boyu Capital have joined a $40 million Series A round for Hong Kong cryptocurrency services provider Babel Finance.

China medical tech supplier AMS raises $100m

China and US-based Access Medical Systems (AMS) has raised a $100 million round co-led by Sequoia Capital China and GL Ventures.

Portfolio: CDH Investments & China Grand Pharma

The contribution CDH Investments has made to China Grand Pharma belies the size of its equity interest in the company. M&A, at home and overseas, has been central to the growth strategy

Deal focus: L Catterton backs Social Bella to emulate Perfect Diary

Social Bella has risen to prominence in Indonesia as an omnichannel distributor for other beauty brands, but the start-ups is now developing some of its own. L Catterton is backing this diversification drive

Deal focus: The e-commerce agglomeration effect

Inspired by Thrasio buying up e-commerce brands in the US and using its resources to drive growth, Una Brands wants to do the same in Asia. The start-up has secured $40 million to kick-start this effort

Deal focus: Bibit lays claim to be Indonesia's Robinhood

A couple of quickfire funding rounds for Bibit reflects global investor appetite for robo-advisory businesses and the Indonesian company’s rare double-headed product offering

India retail: Bazaar bedrock

Traditional micro-retailers continue to dominate India’s consumer economy, thriving amid COVID-19, encroaching supermarkets, and the rise of e-commerce. So, why is investing in them so hard?

Source Code leads Series C for China online insurance broker

Yuanbao, a Chinese online insurance broker, has raised nearly RMB1 billion ($156 million) in Series C funding led by Source Code Capital. Other investors include Cathay Capital, Hike Capital, Northern Light Venture Capital, Qiming Venture Partners, and...

Nordstar, Insignia back Asia Amazon marketplace consolidator

Southeast Asia has seen its second e-commerce aggregator investment in a matter of days, with Rainforest securing $36 million in seed funding from Nordstar and Insignia Venture Partners.

Blackstone sweetens offer for Australia's Crown Resorts

The Blackstone Group has improved its take-private offer for Crown Resorts, valuing the Australian casino operator at about A$8.3 billion ($6.5 billion).

KKR relaunches IPO bid for Australia's Pepper

KKR has returned to the market with Australia-based mortgage and asset finance lending business Pepper Money – a year after a previous IPO failed to get traction – seeking to raise up to A$500.1 million ($394 million).

Carlyle makes $536m realization from India's SBI Life

The Carlyle Group has sold more than two-thirds of its remaining stake in India-listed life insurance company SBI Life for approximately INR39.4 billion ($536 million) via a bulk transaction.

China's Hope Medicine raises $56m Series B

Chinese innovative drug company Hope Medicine has raised a $56 million Series B round jointly led by Qiming Venture Partners and Grand Flight Investment.

China's ANE Logistics files for Hong Kong IPO

ANE Logistics, a Chinese road freight transportation business backed by Centurium Capital, CDH Investments, and CPE among others, has filed for a Hong Kong IPO.

PE-backed Waterdrop falls on debut after $360m US IPO

Waterdrop, a China-based insurance, medical crowdfunding and mutual aid platform, fell 19% on its New York Stock Exchange debut following a $360 million IPO.