South Asia

India mass market: Bharat dreams

A labyrinth of logistical, cultural, competition, and business modelling challenges is curbing private equity appetite for India’s quickly modernising proletariat

LP interview: Partners Capital

Nearly a decade after establishing a foothold in Asia, Partners Capital has acquired a string of local clients and devised a distinct, middle market-oriented approach to deploying capital in the region

India gifting platform secures $23m Series B

Join Ventures, an India-based company that owns a portfolio of direct-to-consumer gifting brands, has raised USD 23.5m in Series B funding led by Motilal Oswal Alternate Investment Advisors.

India insurance start-up Zopper raises $75m

Indian private equity firm Creaegis has led a USD 75m Series C round for local insurance technology provider Zopper.

Fundamentum leads round for India's Kuku FM

Indian growth-stage investor The Fundamentum Partnership has led a USD 21.8m Series B extension for audio platform Kuku FM.

KKR leads $450m investment in India's Hero Future Energies

KKR has led a USD 450m investment in Indian renewable energy company Hero Future Energies (HFE), with parent company Hero Group also participating.

PE-backed Mankind Pharma files for India IPO

Indian drug maker Mankind Pharma has filed for a domestic IPO, setting up an exit for Capital International, a private equity arm of Capital Group.

Indonesia's Fazz raises $100m Series C

Indonesia’s Fazz, a financial services provider for Southeast Asia micro businesses, has raised a USD 100m Series C round featuring Tiger Global, DST Global, and B Capital Group.

Everstone buys India's Softgel Healthcare

Everstone Capital has acquired a controlling stake in Indian pharmaceuticals manufacturer Softgel Healthcare (SHPL) for an undisclosed sum.

Billionaire Venture, DBS to invest $200m in India start-ups

India’s Billionaire Venture Capital and DBS Bank have agreed to invest USD 200m in 150m Indian start-ups via a special purpose vehicle and joint venture (JV).

Affirma joins $40m round for India air conditioning supplier

Affirma Capital has joined a USD 40m investment in India’s Epack Durable, a leading domestic designer and manufacturer of air conditioning units among other home appliances.

Bessemer closes latest global VC fund on $3.85b

US-based Bessemer Venture Partners, which is currently expanding a longstanding presence in India, has closed its latest global VC fund with USD 3.85m in commitments.

Q&A: Unitus Ventures' Surya Mantha

Indian returns-focused impact investor Unitus Ventures is sharpening its thesis around jobs as it celebrates its 10-year anniversary. Surya Mantha, a managing partner at the firm, traces the evolution

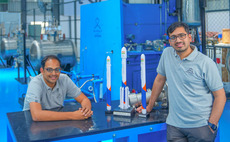

GIC leads $51m round for India space start-up

GIC Private has led a USD 51m Series B round for Indian rocket developer Skyroot Aerospace. It is being touted as the largest round yet in the local space-tech market.

Deal focus: Jai Kisan taps India rural resurgence

The founders of technology-enabled credit platform Jai Kisan went against the grain by forgoing urban customers and targeting India’s rural poor. A USD 50m Series B is an indicator of its progress

Deal financing: Homegrown solutions

Private equity firms are relying more heavily on Asia-based debt investors to support leveraged buyouts amid a loan logjam in the US, highlighting the region’s innovation and durability

Novo Holdings leads $50m round for India's MedGenome

Novo Holdings, which manages the wealth of Denmark’s Novo Nordisk Foundation, has led a USD 50m investment in MedGenome, an India-based genetic testing business.

Accenture backs India space tech start-up Pixxel

Accenture has made an investment of undisclosed size in Indian satellite imaging provider Pixxel via a VC unit. It follows a USD 25m Series A round in March.

Rise Fund, Norwest lead $110m Series D for India's EarlySalary

TPG’s Rise Fund and Norwest Venture Partners have led a USD 110m Series D round for EarlySalary, which claims to be India’s largest consumer lending financial technology start-up.

Fund focus: Fundamentum finds its niche

As one of few Series B and C specialists operating in India, The Fundamentum Partnership expects to have plenty to choose from over the next two years as the glut of early-stage start-ups thins out

GrowX team seeks $100m for spinout India VC fund

The team behind Indian angel investor GrowX Ventures has launched a separate fund targeting USD 100m under the name Merak Ventures.

Kedaara buys minority stake in India's Oasis Fertility

Kedaara Capital has invested USD 50m for a significant minority stake in Oasis Fertility, a fertility treatment business with more than 26 centres across India.

Singularity Growth leads Series D for India's Servify

India’s Singularity Growth Opportunity Fund, a vehicle associated with former Reliance Capital executive Madhusudan Kela, has led a USD 65m investment in after-sales software provider Servify.

Fundamentum raises $227m for India growth-stage tech fund

The Fundamentum Partnership, an India-based growth-stage technology investment firm established by Infosys co-founder Nandan Nilekani and Helion Venture Partners co-founder Sanjeev Aggarwal, has closed its second fund on USD 227m.