India mass market: Bharat dreams

A labyrinth of logistical, cultural, competition, and business modelling challenges is curbing private equity appetite for India’s quickly modernising proletariat

When Amazon entered India in the early 2010s, there was much talk about accessing a 1bn-plus population of consumers. About 10 years down the track, the US e-commerce giant remains a dominant force locally, but its user-base remains limited to the country's 100m most affluent shoppers.

This is, in a nutshell, the quandary of India's "next 500m," also referred to as Bharat, a term meaning India in several local languages that has become an investor and start-up buzzword in the past year.

The high level of confidence and hope around investing in a digital-savvy Bharat is equally matched by scepticism, at least in the near term. Despite significant infrastructure achievements in terms of connectivity and technology-enabled finance, access and adoption challenges are myriad.

What's more, a critical truism has finally come into focus: consuming online is not the same as spending online. Bharat consumers gravitate toward free options, including pirated versions of content. They are upwardly mobile but yet to attain the discretionary spending capacity believed to make most mass market models work.

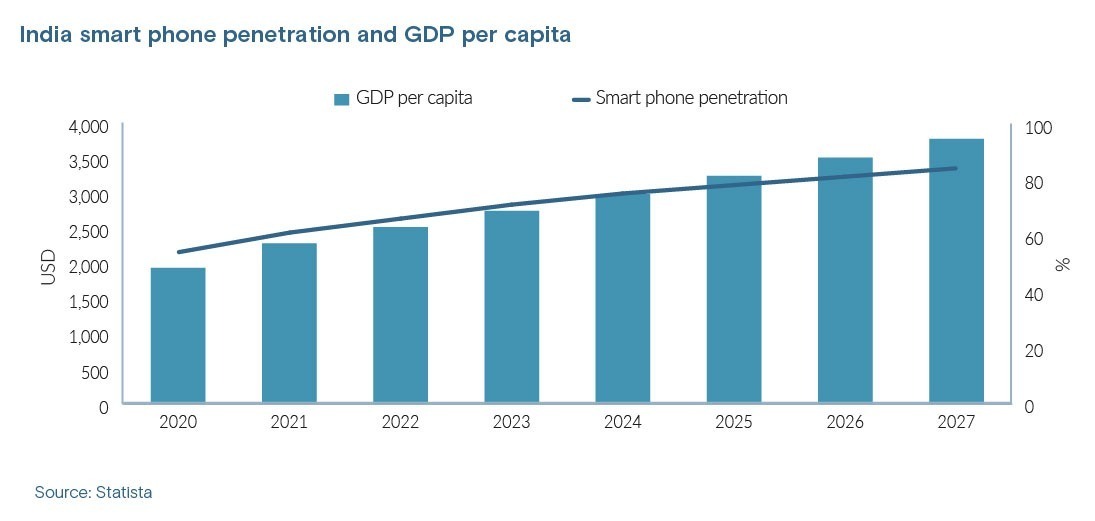

"I'm not saying Bharat will never be profitable, but it's going to take probably seven to 10 years. The digital penetration is primarily there, but what India needs for Bharat to work is GDP per capita growth," said Anand Prasanna, a managing partner at Iron Pillar Capital.

"The sad reality is, the catch-up is really long because the total disposable income is not large. If you just look at how much money it takes that 1.3bn people to get their basics – housing, education, food, sanitation – you realise that's going to be a large part of GDP for a long time."

Nevertheless, investors appear to see light at the end of the tunnel with some statistical encouragement. India's roughly USD 2,500 GDP per capita is set to hit USD 3,500 – widely seen as an inflection point in discretionary spending – by 2026, according to Statista. This will coincide with smart phone penetration topping the 80% mark.

Another sticking point, however, is that these growth figures will skew toward tier-one cities. Bharat is often targeted as a geographic phenomenon characterised by consumption in small cities, semi-urban districts, and rural areas. But it more accurately reflects an economic stratification.

Investing in Bharat with a strong focus on regional areas therefore entails significant additional risk, especially in discretionary spending but also potentially in consumer staples.

"Unlike urban consumers, who are willing to pay for convenience, in rural India and smaller towns, the average consumer has the luxury of time. They look for price advantage and not necessarily convenience," said Srikrishna Ramamoorthy, a partner at Unitus Ventures, which targets Bharat where it intersects with financial services, education, employment services, and healthcare.

"For the higher-value, more aspirational products, the opportunity is there, and food [restaurant] delivery has picked up. But for groceries, will it make sense to replicate that in tier-two and tier-three cities? I don't know. Intuitively, it may not be worth the effort or the money."

Cultural, logistical barriers

With India claiming some of the cheapest data services globally and an irreversible smart phone adoption trajectory, the main obstacles to Bharat across sectors are cultural and logistical. Both are most directly felt in customer acquisition costs.

Cultural challenges include language, literacy, and trust, whereas logistical challenges essentially boil down to the difficulties of last-mile delivery for small-ticket items in remote areas or complex urban areas.

Only about 5% of India is comfortable speaking English, the primary language for targeting the economy's top 50m consumers. In Bharat, the more transactional the business, the less language is an issue. Most e-commerce and B2B models, for example, can typically make do with a blended Hindi and English, or Hinglish, interface.

In consumer media, the need to address vernacular languages can be a significant hurdle in terms of fractionalising the offering and building an audience. In rural areas, the dominance of traditional advertising is a practical economic impediment that will subside with greater online penetration, but the fact that traditional media are more trusted is seen as a sticker customer acquisition obstacle.

The logistical challenges are stickier still, if not intractable. First, traditional e-commerce delivery models are not viable at basket sizes of less than INR 500 (USD 6), but the bulk of purchases in Bharat will be in this range. Second, the attrition rates for last-mile delivery personnel are high; by the time they know the neighbourhood, they've changed jobs.

Various experiments have targeted these issues, including collaborations with the postal system, drone deliveries, and, attracting the most investment, social commerce. The leader in the latter camp is Meesho, which raised USD 570m last year at a valuation of USD 4.9m. It has since shifted to a more traditional e-commerce model while reportedly laying off 150 staff and struggling to get favourable funding terms.

In this model, individual sellers handle last-mile logistics, demanding commissions that are usually so high the economics don't make sense. The most recent activity in the social commerce space is Amazon's acquisition of GlowRoad in March. Within two months, GlowRoad attempted to increase its network of influencer-sellers by eliminating their fees for listing and selling products.

"With low-margin products, there's not enough money to go around to pay a middleman on top of what you're making," said Rajesh Raju, a managing director at Kalaari Capital, which struggled in this niche with its investment in Shop101. Google-backed mobile content company Glance acquired Shop101 last year for an undisclosed sum.

Kirana connection

Instead, Kalaari's coup in accessing Bharat came slightly further upstream with ElasticRun, an e-commerce marketplace. ElasticRun is considered a pioneer of disintermediated delivery in India, essentially enlisting neighbourhood shops, known as kiranas, to do the last-mile legwork. It has a network of about 300,000 kiranas and is targeting 1m. India is said to have 12m kiranas in total.

Kalaari has backed the start-up since 2016. Last February, it raised a USD 330m Series E round at a valuation of USD 1bn featuring SoftBank Vision Fund 2, Prosus Ventures, and Goldman Sachs. All three emphasised an interest in tapping rural supply chains.

The biggest endorsement of the ElasticRun model is Udaan, a B2B marketplace that previously relied solely on more traditional distribution channels before evolving into a kirana-supported last-mile play. It has raised more than USD 1.1bn in private funding.

The key innovation here is that businesses are exploiting local-level resources to resolve local-level operational challenges. This stands in contrast to the likes of direct-to-consumer food delivery leaders Swiggy and Zomato, which have recently veered into non-perishable goods, effectively competing against the kiranas rather than leveraging them.

Still, no model has yet solved for the price-point conundrum in Bharat. For e-commerce to become a routine part of life in this market, items worth as little as a few rupees will need to be economically deliverable to app-using consumers. The proverbial INR 10 shampoo sachet is commonly held up as the holy grail of small-ticket delivery, and it remains an unanswered question of logistics physics.

The alternate approach to digitising consumerism in Bharat is in the financial back-end. The leader in this space is probably Khatabook, an inventory management and bookkeeping app for kiranas that raised USD 100m last year at a valuation of USD 600m. As recently as last month, Jai Kisan, operator of a banking app for farmers called Bharat Khata, raised USD 50m.

"Consumer payments have gone digital, but the rest of the line is still undigitised. So, we will start to see an adoption layer enable a lot of other products that come on top," said Vishwanath V, a general partner at 8i Ventures.

"It will not be a model that you've seen so far anywhere else that can be exported to India. It will be something for delivering a dollar's worth of goods profitably. Physical movement of goods is extremely expensive, so that will take time. That's why we're focused on the digital transaction layer."

8i has made several moves in this space, including small business payments platform Easebuzz, consumer credit provider BharatX, youth credit card Slice, and card services player M2P Fintech.

M2P is said to have 97% market share in terms of connecting card providers – including Slice – with heavyweight partners such as Visa and Mastercard. 8i made a partial exit from the company in June that generated a 36x multiple and an IRR of 415% after two years.

Engagement issues

Problems around consumers' ability to pay, under-digitisation among merchants, and logistics appear to fade away in the asset-light and low price-point consumer media space – but the cultural issues can be even more complex.

"The more you localise it and use certain words that actually make sense to those people, the higher your chance of having hit content. It can be very local, maybe 10-15 kilometres of area, where people use a different word. This is a much more complicated problem that cannot be solved by someone with a centralised content engine," said Ashish Kumar, a co-founder of Fundamentum Partnership.

Bharat is core to the Fundamentum thesis, which encompasses agriculture technology, digitising rural commerce, novel last-mile distribution, and consumer media. Its latest bet in the latter category is Kuku FM, an audio content platform that lifted its Series B round to USD 42m this month.

Fundamentum targets Bharat audiences in this space in what it calls the "knowledge" category, which is distinct from entertainment and education, although it includes elements of both. This is content such as book summaries, motivational speeches, history and business information, and self-help programs.

The idea is that Bharat listeners are primarily attracted to content that can be leveraged to make money in their own work or local government aspirations. Kumar refers to them as offline influencers, who advance their business interests in part by charming others in their community with knowledge accumulated from short-form audio content.

"One of the things that's very important with this audience – if you want to sustainably make money, you will have to solve for monetisation for your customers as well. If you do not do that, the decay on the entire platform will be reasonably fast," he added. "And we have seen that in other platforms, and as a result, their costs for customer acquisition and retention are very high."

About 60% of Kuku's content is in the knowledge category, but entertainment is considered essential for onboarding users. The company claims to be the fastest growing premium audio content platform in the country with 1.6m paid subscribers and one-fifth the customer acquisition costs of a pure entertainment platform.

For Sharechat, a messaging and entertainment media app that is operable exclusively in vernacular languages, customer acquisition and technology-related costs rose 93% between 2020 to 2021 to INR 6.1bn (USD 749m), representing 39% of total costs. The company, which raised USD 255m in June at a valuation of USD 5bn, has invested heavily in content recommendation and personalisation technology.

Gaming has significant prospects in Bharat as well, with industry leaders such as Kalaari-backed fantasy cricket app Dream Sports claiming paying user bases in the order of 100m and strong penetration in lower-tier cities.

Monetisation at scale?

It's an open question whether these models will be able to achieve sustainable profitability in Bharat given the marginal price tags involved. Kuku, for example, offers a substantial amount of free content and annual subscriptions for as little as INR 200. Dream Sports can be played for INR 10.

They are betting that knowing the customer culturally will translate into mass engagement, with the high volumes bringing economic viability. But this is unproven territory, and the stakes are high.

Fundamentum's Kumar points out that an entrepreneur's knowledge of Bharat life and consumer behaviour can inform more relevant business models. These insights can be gained to some extent by spending time in regional areas, but those who grew up at the bottom of the pyramid will be the most incisive problem-solvers. It remains to be seen if that advantage is enough to play a game this big.

"There may be Indian entrepreneurs who know the local nuances and can build a more appropriate app, but you need billions of dollars to reach mass markets and take on giants like Facebook and Whatsapp," said Kalaari's Raju.

"Without any restrictions from the government, VC and PE investors won't fund an Indian company that wants to take on Google because they know the amount of capital that has to go in, and the outcome is uncertain."

This scenario is precisely what sent Sharechat into the VC stratosphere in 2020. The prior year, the company raised a grounded USD 100m Series D. After political tensions with Beijing resulted in the banning of dozens of Chinese apps, including Tiktok, Sharechat launched its own Tiktok-like video service and raised USD 1.2bn across three rounds.

The episode is considered a one-off, however, and there are even indications that Tiktok could relaunch in India in the near term. Even with industrial nationalism rumbling in initiatives such as Make in India and Atmanirbhar Bharat, India is expected to remain an open, internationally contested market in every major consumer sector.

For now, the top 100m consumers are still interesting enough for the likes of Amazon and Netflix. But as the concept of Bharat comes into clearer focus for the global giants, they will hire hyperlocal talent, go vernacular, and go mass-volume with razor thin margins supported by robust businesses in other parts of the world. And it's not clear how much market share they'll leave for the locals.

"When you look at the next 500m users and go through the data that they are using the most, the global apps are the ones they use," Iron Pillar's Prasanna said. "I don't believe that somebody can really create something – unless the government steps in and says we need to have Bharat apps and people are not allowed to use it [a foreign app]."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.