Region

Chinese CRO player Yaoyanshe raises $86m

Yaoyanshe, a Chinese contract research organization (CRO) for novel drugs, has raised RMB600 million ($86 million) across two rounds in the past eight months.

India cosmetics brand MyGlamm acquires content platform

MyGlamm, an online Indian cosmetics brand, has agreed to acquire POPxo, a women-focused content platform, for an undisclosed sum. Both companies have several VC backers.

MUFG launches Singapore venture debt business

Japan’s MUFG Bank has set up a Singapore-based venture debt business alongside Israeli financial technology start-up Liquidity Capital. Its debut fund has been set up with an initial $80 million.

India clean energy: Shock treatment

The economic fallout from COVID-19 will not spare any sector, but careful planning can ensure private equity firms can take advantage of India’s ambitious energy transition goals

China clean energy: Policy power

China’s aggressive renewable energy development targets are creating opportunities for investors in various points along the supply chain, but inconsistent regulation remains a concern

Australia's PEP closes Fund VI at $1.8b

Pacific Equity Partners (PEP) has reached a final close on its sixth Australia and New Zealand-focused buyout fund at the hard cap of A$2.5 billion ($1.8 billion).

BGH to buy Australia's Village Roadshow for $543m

BGH Capital has agreed to acquire Australian cinema and theme park operator Village Roadshow for A$758 million ($543 million).

Actis acquires two solar assets in India

Actis Capital has acquired a 400 megawatt portfolio of operating solar projects in central India from Acme Solar.

Chinese EV manufacturer Xpeng pursues US IPO

Xpeng Motors, a Chinese electric vehicle (EV) manufacturer backed by Alibaba Group and several PE and VC firms, has filed for a US IPO.

Chinese chip design company Brite raises $50m

Chinese integrated circuit (IC) design company Brite Semiconductor, has raised a RMB350 million ($50 million) Series D round led by Haitong Securities and sector specialist Sunic Capital.

PAI Capital invests $212m in Chinese video display business

PAI Capital, a Hong Kong and London-based asset manager that primarily caters to high net worth individuals (HNWIs), has paid RMB1.45 billion ($212 million) for a 24.22% stake in Vtron Group, a Shenzhen-listed video display systems manufacturer.

VinaCapital completes exit from Vietnam dairy producer

Vietnam’s VinaCapital and Japan’s Daiwa PI Partners have sold the remainder of their interest in Vietnamese dairy producer International Dairy Products (IDP).

China Resources consortium buys Hong Kong's City Super

A consortium led by China Resources Capital (CR Capital) has agreed to acquire a 65% stake in Hong Kong retail and supermarket operator City Super Group.

India used car platform Spinny acquires rival Truebil

Indian online used car marketplace Spinny has acquired local counterpart Truebil, setting up several venture capital exits.

Huagai leads $43m round for China antibiotics developer

China-focused private equity firm Huagai Capital has a led a RMB300 million ($43 million) Series D round for antibiotics developer MicuRX Pharmaceuticals.

Globis joins $32.6m round for Japan's Photosynth

Globis Capital Partners has joined a JPY3.5 billion ($32.6 million) Series C round for Photosynth, a Japanese internet-of-things (IoT) developer specializing in smart locks for office buildings.

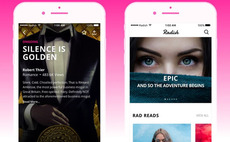

Korea, US-based serialized fiction app gets $63m

SoftBank Ventures Asia and Kakao have led a $63.2 million Series A round for Radish, a Korea and US-based producer and broadcaster of serialized fiction for mobile devices.

India's Byju's acquires online coding school

Byju’s, an Indian online learning platform backed by several PE and VC firms, has acquired WhiteHat Jr, a platform that helps students learn to code.

Tencent leads $360m round for China fresh produce retailer

Chinese fresh produce retailer Yipin Shengxian has raised a RMB2.5 billion ($360 million) Series C round led by Tencent Holdings and Capital Today. Eastern Bell Venture Capital re-upped.

Sustainable food: Forces of nature

Environmental considerations are intrinsic to food innovation investment strategy, not a public relations bonus. Science, society, and myriad motivations color a range of perspectives

Q&A: PAI Partners' Cornelia Gomez

Cornelia Gomez, head of ESG and sustainability at PAI Partners and global coordinator for the International Climate Initiative, discusses carbon footprinting, scenario analysis, and regulation

GPs & climate change risk: Material matters

Climate change risk is becoming a broader debate within private equity, taking in the long-term impact of floods, droughts, and fires on portfolios. Most GPs have yet to turn thought into action

Gobi backs Singapore e-commerce acquisition

China’s Gobi Partners is leading a consortium that will acquire the e-commerce services business of Singapore-based Synagie for S$61.6 million ($44.8 million).

BRI invests Indonesia fintech player Ayoconnect

BRI Ventures, the newly launched VC unit of Bank Rakyat Indonesia, has joined a $5 million pre-Series B round for local financial technology provider Ayoconnect.