Sustainable food: Forces of nature

Environmental considerations are intrinsic to food innovation investment strategy, not a public relations bonus. Science, society, and myriad motivations color a range of perspectives

There are innumerable motivations for getting involved in food innovation but only one fundamental reason that the sector exists.

In decades past, early iterations of vegetarian burgers and other foodstuffs were mostly driven by concerns around animal welfare and personal health; they failed to inspire a mass movement or widespread creation of wealth. It is not an incidental discrepancy that the $10 billion alternative protein phenomenon today, which is said to be growing at 12% a year, ultimately owes almost everything to the global environmental imperative.

Clarity on this point can be easily lost when considering the muddled agendas of the various stakeholders.

At the individual level, factors such as taste, price, healthiness, curiosity, and the influence of marketing tactics like celebrity endorsements dominate decision-making. There is evidence, however, that increasingly social media-connected populations are demonstrating greater environmental awareness and practicing consumerism as a way of demanding improved transparency and accountability. Large food corporates are primarily investing as a way of meeting demand related to these shifts in customer priorities.

At the national level, food security is the strongest motivator for food innovation, but it only exists as a political response to an underlying environmental driver.

Countries where crops are at risk of more frequent extreme weather will pull back food exports to secure domestic consumption, complicating supply options for less productive nations. Singapore is a standout example. It plans to increase home-grown food supply from around 5% to 30% in 2020 by shifting people to plant-based nutrition. Europe and Asia are seen as leading regions in adopting alternative meat policies. Others continue to subsidize animal protein.

Investors often claim a double bottom line of financial returns and environmental impact, although the sector has seen a clear correlation between rising participation and big-dollar events. Danone's acquisition of WhiteWave Foods for $12.5 billion in 2016 was a landmark moment, as was Beyond Meat's $240 million IPO in 2019 that valued the company at about $4 billion. It is currently worth $8.4 billion. Still, the fundamental reason that food innovation is bankable is the fact that it represents the only workable future for planetary habitability.

"We are looking for companies that have the potential to become platforms with products and technologies that have global appeal because you get the biggest impact from a climate perspective by shifting as many people as possible toward the better-for-the-planet products," says Andrew Ive, founder and managing general partner of US and Singapore-based Big Idea Ventures. "If we achieve that, those companies will also become quite significant in terms of revenue and wealth generation."

Ive's personal motivation for establishing Big Idea was a desire to make a difference in climate change through food without trading abundance for abstinence. A debut fund launched earlier this year with a target of $50 million, winning support from the likes of Tyson Foods and Buhler, a Swiss food processing machinery supplier that plans to open a plant-based food R&D facility in Singapore later this year. Plant-based and cell-based protein companies are the core focus.

Opportunity by numbers

According to MarketsAndMarkets, the global alternative protein market is now worth $10.3 billion and set to hit $14.5 billion by 2025. In the US alone, The Good Food Institute has tracked sales growth rates of more than 90% for the 2017-2019 period in the categories of plant-based creamer and yogurt.

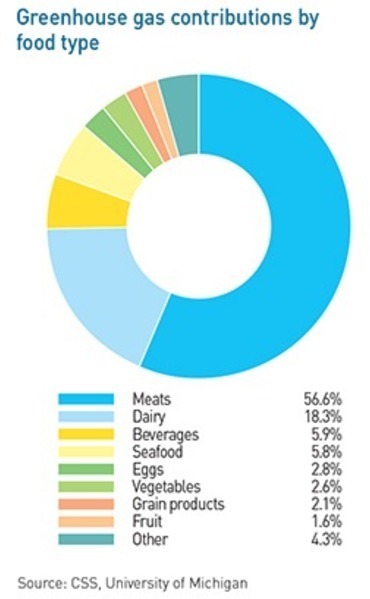

The only other set of statistics with enough gravitas to explain this momentum is on the climate change side of the equation. The food industry accounts for 26% of global greenhouse gas emissions, according to an Oxford University study, and more than half of that comes from animal products. The Center for Sustainable Systems at the University of Michigan attributes up to 30% of the average household carbon footprint to food. Two-thirds of that is meat, 18% is dairy, and 9% is seafood and eggs.

"Nobody is going to change eating habits if it comes at the cost of the taste and if it puts too much pressure on the budget," says Decitre. "Some individuals are more sensitive to climate, but as soon as you start thinking about that, you probably have to consider ethics, and then it gets more complex. Intense fish farming, for example, generates much less contamination than traditional fish farming, but there are people who find it obscene to have so many fish swarming in one place."

Food tech specialists – Bid Idea and ID Capital included – typically do not have formal frameworks for assessing the environmental impact of their investments despite this being a pillar of their mission statements.

The thinking is that there is little consistency in the methodologies and standards of third-party diligence providers and that the operational decision-making of management is impossible to closely monitor over a multi-year period. As a result, the industry has adopted an interesting brand of risky conservatism: the environmental upside for prospective investments must be so obvious from a holistic perspective that an inability to quantify the benefits can be overlooked.

Environmental agendas can also be secured through understanding founders. Motivations here are occasionally rooted in intellectual curiosity and the desire to meet a scientific challenge. But for those who achieve traction in the commercial sphere, there are almost always strong personal drivers around sustainability. Universities are fertile ground for sustainability-minded food tech talent but introduce a number of complications around technology-ownership, regulatory blocks, and a lack of commercial skills.

JBI Equity, a UK-based agriculture innovation-focused private equity firm with a strong presence in Asia, tackled this issue in 2016 by setting up Roslin Technologies, a livestock genetics platform with ties to the University of Edinburgh. Areas of interest include Vietnam's $4 billion shrimp industry, where existing breeding know-how could improve production fourfold but there has been little success rolling out the relevant techniques.

"We're trying to unleash university-developed technologies that are underutilized and not well understood and get them out into industry," says Glen Illing, a partner at JBI and CEO of Roslin. "We can have a massive impact on inefficiency in agriculture by improving the performance of animals and reducing disease through quantitative genetics and genomics. If there's less waste, there's less carbon and greenhouse gasses."

JBI has a presence in China but sees the country's major agricultural operators as too risk-averse for rapid adoption of new technologies. Southeast Asia is considered more amenable although the small scale of most operations in the region means uptake will continue to be incremental. Roslin's latest move on this front is an investment in Protenga, a Singaporean insect farming company that aims to create circular animal feed systems on a modular basis.

Even a small slice of the traditional animal feed market – estimated to reach about $615 billion by 2023 – is a worthwhile target for food tech developers from an environmental perspective, especially given that about 80% of global crops are used to feed animals for the meat industry.

Microbe mission

There are serious roadblocks to carving out market share here with insect-based products, however. The biggest challenges are in aquaculture, which requires a fishmeal equivalent with 70% protein content. Insect meal typically ranges around 40-45% protein. Furthermore, insect operations may be difficult to economically and sustainably industrialize in markets with regulations against the use of post-consumer biomass inputs such as kitchen scraps.

String Bio, an Indian company that makes food by combining methane, nitrogen, oxygen and inorganic salt, thinks it has found the solution. The company, which has a number of VC and corporate backers, compares its process to beer fermentation, but in this case, the substrate is gas, not barley. Fishmeal for the aquaculture industry is the main target, although there are plans to make products for human consumption in the future.

String Bio claims its process requires only 15-20 liters of water per kilogram of product compared to 4,000 liters per kilo of soybean meal. The environmental benefit of preventing methane from entering the atmosphere will be limited, however, due to the relatively low-volume gas requirements of the technology and expectations that much of the ingredient will be sourced from gas deposits that are already safely locked underground.

"Only when insect players use waste food can they bring down costs and really make it a circular solution," says Ezhil Subbian, CEO of String Bio. "The industry will have to overcome that before insect meal becomes very scalable. One of the key advantages of fermenting microbial proteins is it can be scaled to very large volumes."

There are only a handful of players in this space globally, including Sustainable Bioproducts, a PE-backed company that makes alternative meat and dairy products from bacteria found in volcanic springs. But for many investors and consumers alike, manufacturing edible proteins from non-animal and non-plant sources tests the limits of their imagination, risk tolerance, and the appetite.

Microbe and cell-based proteins are likely to eventually prove cleaner than plant-based products due to their lack of reliance on traditional agricultural processes. The trouble with targeting these areas from a sustainability perspective is that technical challenges and psychological barriers are expected to slow scaling and commercialization. A large return financial return could well be achieved from fast growth of a headline-making start-up, but the environmental impact will remain negligible.

"We also need to think of traditional proteins," observes ID's Decitre, who also heads the start-up support platform Future Food Asia. "It's important not to wipe it out on the grounds that this is a dirty business and we should all be on a plant-based diet, especially if you buy into the idea that it's not going to happen anytime soon."

The social element

These views call into question the wisdom of the investment community's apparent preference for approaching climate change and pollution as scientific rather than social problems.

Abillionveg, a Singapore-based vegan restaurant app backed by 500 Startups and several food-focused VCs, best crystallizes the idea of sustainable food as more public movement than market trend. The user-generated content service helps people find vegan dining options in 130 countries and prompts restaurants to ramp up their vegan offerings by sharing reviews and data on customer demand. This is hoped to empower the broader food innovation ecosystem.

"We want to see the Silicon Valley approach [of throwing money at technology] be successful, but we are aware that this approach, while it sounds nice to investors, may not win alone," says Vikas Garg, founder of Abillionveg. "Part of the Silicon Valley approach is that people don't change, you need to keep feeding them what they love, and the attitude that you can do whatever you want. I think that's flawed, but that's where a lot of the money is being spent."

This is a direct challenge to the idea that at the shop level, consumers make purchase decisions almost entirely based on personal factors such as price, taste, and nutrition. The emergence of companies like Abillionveg suggests that the social connectivity among digital natives represents a chance to advance sustainability agendas simply by popularizing them. Interestingly for a restaurant app, the company has recorded its best quarters amid COVID-19 lockdowns.

"Consumers are increasingly thinking about sustainability – it's a massive megatrend. Within this movement, science can only push things so far," Garg says. "Ultimately, consumers and consumer adoption needs to really take hold for these technological advances or alternatives to create impact. It comes down to people, so we built a very people-first platform."

The social factor may be particularly relevant to investors as brands become increasingly identity-connected marketing propositions and consumers move toward products that align with their personal values.

According to Nielsen, 73% of global consumers say they would definitely or probably change their consumption habits to reduce their impact on the environment. Meanwhile, 41% are highly willing to pay more for products that contain all-natural or organic ingredients, and 88% believe it was extremely or very important that companies implement programs to improve the environment.

"There's been a democratization of information and products over the last 5-10 years, where people have more choice and they are much more aware of who they're supporting when they make a consumption decision and how those companies treat the planet." says Big Idea's Ive. "People are becoming quite conscious of how they vote with their dollars, and I think a lot of that has to do with the rise of social media."

Ticking clock

At the same time, the moods of the masses – as well as government food security policies – represent a tidal shifting in priorities that offset awkwardly against the urgency of the environmental question, not to mention a private equity time horizon.

Eshchar Ben-Shitrit, co-founder and CEO of Israel's Redefine Meat, sees the need for a new food paradigm as too pressing to emphasize gradual social fixes in favor of fast technological progress. His company, backed by food tech specialist CPT Capital, claims to have developed the world's first 3D-printed plant-based steak by layering carefully calibrated proteins that mimic the texture and moisture of the real thing.

"No matter what the motivation, the world must change the way it consumes meat, and new technology is the only way to make a meaningful change quicker," says Ben-Shitrit. "We know that education, lobbying and other forms of advocacy takes a lot of time, whereas giving consumers tasty products that are also good for the environment is a much more efficient way to achieve the same, or even better, impact."

Nick Cooney, founder of alternative proteins-focused Lever VC, sees the social aspect of environmental motivation not only as compatible with a timely financially-driven agenda but essential to making it work because it implies dedication and familiarity with food innovation themes. Lever has raised about $29 million across two funds, including a China-focused alternative protein vehicle, both of which remain open.

The plan is to partner with a number of Chinese food companies and Hong Kong accelerator Brinc to test a theory that Chinese consumers are more interested in and experienced with alternative proteins than consumers in most other countries; and that Beijing is doing more to encourage the industry than most governments.

"Lever VC is a traditional, return-driven fund, but I and several other of our team members got interested in the space because we recognized many years ago the huge value of alternative protein for society and the planet, as well as the financial opportunity," Cooney says. "It's that passion for the sector that helps fuel the work ethic and rigor we bring to our investment process. It gives us that extra drive to work to truly understand the sector, pick the best players, and help our portfolio companies succeed in a big way."

SIDEBAR: Food packaging - Ditch the dump

Most of the environmental damage caused by the food supply chain comes from the production processes of the food itself. Transport and packaging, by comparison, are minor culprits in the industry's carbon footprint.

Still, improvements in food packaging are expected to go some way in reducing the 300 million tons of plastic produced globally every year, 79% of which goes into landfills or natural areas, according to the UN. Momentum in this area is also useful in illustrating the mounting pressure on consumer-facing brands to put their best foot forward.

"Suppliers of food products have started putting their products on the shelves in both non-sustainable packaging at the recommended retail price and in a sustainable packaging option that is slightly more expensive – and the sales volumes are really similar," says Jackson Rowland, a director at New Zealand's Akina Foundation. "Consumers are starting to expect to see that."

Akina is addressing this space in partnership with New Zealand's Impact Ventures and New Ground Capital, which have jointly backed local sustainable packaging supplier Grounded via the Impact Enterprise Fund (IEF).

Grounded sources sustainable packaging pouches, wrappers, and bags for a primarily food industry clientele in New Zealand, Australia, the US, and UK. Much of the offering is bio-based or recycled, including non-toxic inks and home-compostable laminates and films.

"Every package that they sell is diverting a petrochemical package from landfill, and a lot of their products are home compostable," says Chris Simcock, founder of Impact Ventures. "You can take something that would sit in landfill for 500 years releasing a lot of toxic chemicals and replace it with a product that disappears in your home compost in 90 days."

IEF's research in the sustainable packaging space revealed heavy competition in the e-commerce segment, some activity in takeaway food items such as coffee cups, but only one company, Grounded, in the flexible food packaging market.

This is part of IEF's thesis for growth but also part of the challenge more broadly. As more players come into the market, Grounded's head start is expected to translate into a leadership position. In theory, the company will scale its impact as it scales operations.

The catch is that flexible food packaging is a depopulated space due to significant technical hurdles. The products have to use organic materials able to decompose in ground conditions but maintain their integrity when in prolonged contact with food. This could result in a consolidated market that is slower to innovate than its e-commerce cousin.

"Some manufacturers will use chemicals that break down in the ground but they also leach into the food," Rowland says. "So, it's more important to have high-quality products versus the mailer space, where you can be less robust with you use because it's not going in someone's mouth."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.