India clean energy: Shock treatment

The economic fallout from COVID-19 will not spare any sector, but careful planning can ensure private equity firms can take advantage of India’s ambitious energy transition goals

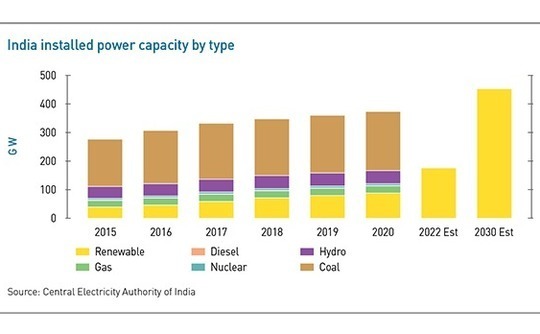

By all accounts, India is unlikely to achieve its 2022 goal to install 175 gigawatts in renewable energy capacity. As of June, the country was only halfway there. Wind and biopower are well-represented, but most of the incremental growth in recent years has involved solar.

Although peak demand has rebounded – 160.9 GW was utilized this week rising from a low of 129.2 GW in April due to COVID-19 stay-at-home measures – an anticipated recession will hit electricity consumption. Moody's Investors Service expects power demand to fall by 4.9% for the year ending in March 2021.

This will surely halt investment in the flagging coal-fired power sector where there is already more than 40 GW in stranded assets due to a pre-COVID 19 bubble. Renewable energy players and their backers hope they do not emulate that trajectory. Right now, state-run financial firms are the only sources of capital for many power plants running on coal.

"The government has been bailing out the coal energy sector for so long. I don't know for how many years they can keep promoting these non-bankable projects," states Vibhuti Garg, an energy economist at the International Institute for Sustainable Development (IISD).

Garg adds that coal's loss may not be renewable energy's immediate gain. Their main buyers are cash-strapped distribution companies, a majority of which are state-owned, and they are expected to support subsidy measures to alleviate the pain for low-income households. Lower revenue implies delayed payments. Given that supply agreements are take-or-pay arrangements, the dues will come but it's not clear when.

Starting this month, the government plans to impose custom duties for imports of solar modules as well, although there has been no official ruling yet. The goal is to kickstart domestic manufacturing a second time. Industry observers note that power providers will then have to demand increased compensation for existing or new electricity tariff agreements leading to a lot of angst for everyone involved.

"If state governments must bear the financial brunt in the form of higher electricity costs, there will be friction with the center. It might result in power purchase agreements not being signed at the pace they are being signed today," warns Peeyush Mohit, COO of O2Power, a renewable energy platform established by EQT and Temasek Holdings earlier this year. "Through a regulatory process, we should be compensated in the form of higher tariffs and we want it to be automatic, but the proof of the pudding is in the eating."

Charging ahead

Before the onset of the pandemic, renewables were breaking records. The sector received more than $1 billion from PE investors annually over the last two years. In 2019, renewable energy assets accounted for more than 70% of installed new power capacity. Granted substantial powers at federal level, India's states raced ahead at different speeds with Karnataka, Tamil Nadu, Gujarat, Maharashtra and Rajasthan amassing assets at an impressive pace.

Falling prices for solar equipment, design optimization measures such as increasing the load factor during peak sunlight hours, and improved understanding of the infrastructure requirements for farms meant solar energy became cheaper than coal-based power for the first time. However, this precludes energy storage costs.

"New energy highways need to be built in large nations like the US and India with change of energy mix towards renewable energy. It's a project that many countries in the world will soon need to grapple with as well," says Indigrid CEO Harsh Shah. "There will be widespread electrification of industries like transportation over the next decade and renewable energy will play a key role."

When COVID-19's dark shadow passes, a surge in power demand is expected, driven by rising incomes among the energy-hungry middle class. "There's runway for electricity growth for the next 20 years," says Dhanpal Jhaveri, CEO of EverSource Capital, a joint venture between UK-based Lightsource BP and Indian private equity firm Everstone Capital. It has committed capital to two renewable energy platforms.

"As people earn more, they buy more appliances and want to consume more electricity. Improved electricity access and reliability combined with additional renewable energy generation capacity will drive demand and bring down the overall cost to the consumer."

With solar energy sources unable to provide continuous power throughout the day, coal offers reliability that is hard to match. It operates as a backup source. Falling battery costs, however, suggest that a storage-and-solar energy combination could be possible in the future. In that vein, ReNew Power, the country's largest private renewable energy player, won India's first round-the-clock tender for a 400 megawatt project earlier in the year.

Given that many Indian states depend on royalties from coal, though, it's tricky to wean the country off the carbon-based energy source as quickly as desired, says IISD's Garg. Meanwhile, large-scale battery storage technology to run battery farms is not yet commercially viable.

Patience, please

Still, rising costs due to emissions regulations targeting coal and the mineral's worsening reputation means industry participants know time is on their side. They believe renewable energy will become the country's leading energy source by the end of the decade. Bharath Jairaj, an energy director with World Resources Institute India, suggests that future projects seeking to make that happen might require a rethinking of the status quo.

"With solar PV, you can actually generate and consume solar power in the same place. You can get rid of transmission and distribution losses by generating power near the area of consumption," points out Jairaj. "In many parts of India, you have 300-320 days of sunlight."

He argues that a distributed system comprising thousands of smaller projects could ultimately do a better job in meeting India's energy transition goals than a few large farms. It requires public and private sector cooperation and a carefully enumerated policy to incentivize individuals and businesses to buy from nearby renewable energy sources as well.

For now, PE-backed renewables players, like any other portfolio company, know the immediate priority is ensuring adequate liquidity at a time when bank loans are hard to come by. Moody's warns that leverage levels remain high among most of the private players in the solar energy sector as well. Equity backers may need to offer support.

That does not mean they cannot be strategic. Consolidation and bolt-on acquisition opportunities are possibilities for the best-run businesses.

Analyzing a target's asset quality will be crucial, according to Indigrid's Shah. In addition, the nature of commercial contracts must be well understood. Companies that deal with centralized bodies such as the Solar Energy Corporation of India are more likely to get paid on time than those relying on struggling state departments. Further, there are many solar energy evangelists, but it's hard to find management teams that know how to deliver.

If nothing else, the government has reasserted its desire to move away from carbon-based energy sources given the adverse impact on haze-filled metropolitan hubs in the recent past. Every Indian is familiar with scorching summers, torrential rains and regular floods by now. Progress on climate mitigation is fast becoming an annual metric for evaluating governance.

To that end, a draft amendment to the Electricity Bill was unveiled in May that promises accelerated privatization of distribution or at least partial divestments of the state-owned companies that process electricity bills. There's also a push to create an agency – the Electricity Contract Enforcement Authority – that would settle disputes over power purchase agreements. This could reduce debt loads, boost competition and impose fiscal discipline within the sector.

Local trouble

But any attempts to reform a system that works for the poor could face stiff local opposition. O2Opower's Mohit recalls that the subsidy regime came about because of the removal of a cross-subsidy. Businesses were charged artificially high prices for electricity to subsidize individual households; when this policy ended as part of liberalization efforts to boost industrial competitiveness, state intervention was required to keep prices low.

"The non-commercial principles followed by distribution companies may not serve the needs of a financial investor," says WRI's Jairaj.

He adds that solar energy companies looking to fill the void left by decommissioned coal-fired power plants will also be held to a higher standard in the coming years. ReNew Power's commitment to round-the-clock energy provision could be a model for distributors looking to get stricter on tenders. After all, they are responsible for ensuring the average Indian gets uninterrupted electricity at affordable rates.

With policy stability, the emergence of global energy companies, subsidies that target individuals rather than entire areas, and improved battery storage and smart meter technology, there is still hope yet that the country could achieve its 2030 goal of 450 GW in installed renewable capacity. It implies compound annual growth of 18%, which in turn requires an aggressive buildup of solar-powered plants by the private sector.

"We will slowly start seeing the democratization of electricity distribution and it will be almost like what happened in the telecom industry," adds EverSource's Jhaveri. "Private players will come in every part of the value chain, new business models will be developed and companies will provide electricity as a service. The reforms are clearly in the right direction to make that happen."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.