Region

Bow Wave joins $175m round for Philippines-based GCash

Bow Wave Capital Management, a US-based private equity investor in mobile payment ecosystems globally, has participated in a $175 million round for Philippines-based mobile wallet GCash.

China HR software start-up raises $190m

WorkTrans, a Chinese human resources services provider, has raised $190 million through two tranches, a Series C of $50 million and a Series D of $140 million.

Chinese fitness app Keep raises $360m

Keep, a Chinese mobile app that provides fitness training programs, has raised $360 million in Series F funding led by SoftBank Vision Fund.

China's Firstred closes debut renminbi fund on $1b

Firstred Capital, a Chinese growth and buyout investor in healthcare, consumer products and services, and industrial technology, has closed its debut fund with RMB6.8 billion ($1 billion) in commitments.

Sequoia leads $150m Series B for China's Visen Pharma

China’s Visen Pharmaceuticals, a drug developer targeting glandular conditions such as dwarfism and growth deficiency has raised a $150 million Series B round led by Sequoia Capital China.

Adamantem sells Australia's Servian to US strategic

Australia’s Adamantem Capital has agreed to sell its position local data analytics consultancy Servian to US counterpart Cognizant for an undisclosed sum.

China smart storage player Hive Box raises $400m

Hive Box, a China-based self-service package drop-off and pick-up operator, has received $400 million in funding from Trustbridge Partners, Asia Forge, Sequoia Capital China, Redview Capital, and All-Stars Investment. The pre-money valuation is $3 billion....

Goldman leads $50m round for China's Perfect

Perfect Corp, a Chinese developer of online beauty apps, has raised a $50 million Series C round led by Goldman Sachs.

China's Horizon Robotics raises $400m

Horizon Robotics, a Chinese developer of microprocessors that support artificial intelligence (AI) technologies, has raised $400 million in the second tranche of a Series C round led by Baillie Gifford, Yunfeng Capital, CPE, and electric vehicle battery...

Carlyle leads $123m Series D for China's Abbisko

The Carlyle Group - investing through its Asia growth fund - has led a $123 million Series D round for Chinese cancer-focused biotech developer Abbisko Therapeutics.

India's Z3 Partners hits first close on debut VC fund

India venture capital firm Z3 Partners has reached a first close of INR1 billion ($13.6 million) on its debut fund, which will invest in early-stage technology start-ups.

China's Primavera launches consumer-focused SPAC

Primavera Capital Group has joined the trickle of Asia-based private equity investors launching special purpose acquisition companies (SPACs) in the US, targeting a $300 million capital raise for consumer deals.

Hillhouse leads $28m round for China's DataCloak

DataCloak, a Shenzhen-based start-up that helps companies install data security systems on devices used by employees, has raised a $28 million Series B round led by Hillhouse Capital.

Hidden Hill leads $110m round for China's Baibu

Chinese B2B fabrics trading platform Baibu has raised $110 million in an extended Series D round led by Hidden Hill Capital, the private equity platform of logistics giant GLP.

Hong Kong proposes 0% carried interest tax rate

The Hong Kong government has moved to placate private equity industry fears regarding the tax treatment of carried interest by proposing a 0% levy.

India B2B marketplace Udaan raises $280m

Udaan, an India-based B2B marketplace, has raised $280 million from an investor group that includes existing backers Lightspeed Venture Partners, Tencent Holdings, DST Global, GGV Capital, and Altimeter Capital.

India's Endiya closes second fund at $75m

India’s Endiya Partners has closed its second early-stage venture capital fund with about $75 million in commitments.

Japan's J-Star confirms two exits

Japan’s J-Star has confirmed trade sale exits of healthcare coverage specialist NHS Insurance and fire safety equipment supplier Yokoi Manufacturing.

Carlyle buys Japanese X-ray equipment maker

The Carlyle Group has acquired a majority stake in Rigaku Corporation, a Japanese manufacturer of X-ray equipment, for an enterprise valuation of approximately JPY100 billion ($970 million).

Goldman, Anchor commit $100m to China car park operator

Goldman Sachs and Anchor Equity Partners have led a $100 million Series B round for Sunsea Parking, a China-based car parking management company.

China AI chip player Enflame raises $279m Series C

Enflame Technology, a Chinese artificial intelligence (AI) chip designer, has raised a RMB1.8 billion ($279 million) Series C round led by CPE, China Capital Investment Group, and Primavera Capital.

Thiel, Pacific Century launch second Southeast Asia SPAC

Peter Thiel (pictured), co-founder of PayPal, Palantir Technologies and Founders Fund, and Richard Li, son of Hong Kong billionaire Li Ka-shing, are launching another special purpose acquisition vehicle (SPAC) that will target new economy assets in Southeast...

VC-backed Chinese e-cigarette company targets US IPO

Relx Technology, a Chinese e-cigarette producer backed by Source Code Capital and Sequoia Capital China, has filed for an IPO in the US.

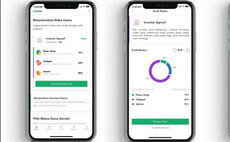

Sequoia India leads $30m round for Indonesia's Bibit

Sequoia Capital India has led a $30 million investment in Bibit, an Indonesian robo-advisory app for first-time investors.