Carlyle buys Japanese X-ray equipment maker

The Carlyle Group has acquired a majority stake in Rigaku Corporation, a Japanese manufacturer of X-ray equipment, for an enterprise valuation of approximately JPY100 billion ($970 million).

Financial details of the transaction were not disclosed. AVCJ was informed of the valuation by a source close to the situation. The PE firm has purchased all outstanding shares in Rigaku, with Hikaru Shimura, the company's president and CEO, taking a 20% interest in the acquisition vehicle. The objective is to pursue an IPO "in the coming years," according to a statement.

The investment comes from Carlyle's fourth Japan fund, which closed in March 2020 at JPY258 billion, more than twice the size of its predecessor.

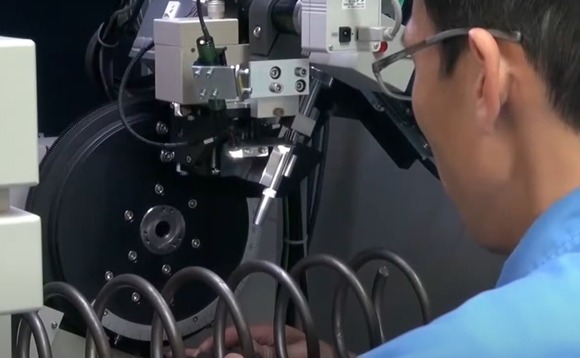

Founded in 1951, Rigaku claims to be Japan's leading player in X-ray analysis, measurement and testing instruments. Areas of expertise include general X-ray diffraction and X-ray fluorescence spectrometry. It serves over 10,000 customers, including academic and research institutions, as well as corporates across semiconductors, electronic devices, pharmaceuticals, steel, and cement.

Annual revenue is approximately JPY44 billion, of which two-thirds is generated outside of Japan. There are expectations of robust growth in global demand for X-ray equipment, driven by increased sophistication and volumes in industries such as semiconductor and electronic components.

Carlyle will help the company expand its international customer base, launch new products with improved analytical performance, usability and wider applications, and augment its management team. Shimura, who has led the business since 1971, will continue to play a role at the management level, as well as remaining a shareholder.

"This is an optimal deal for Carlyle in terms of supporting the globalization of a large owner-managed company. We believe we will see more of these types of deals in the future, which we will proactively pursue in addition to corporate carve-outs," said Takaomi Tomioka, deputy head of Carlyle Japan.

The PE firm's other recent Japan investment activity includes a proposed JPY37 billion buyout of Japan Asia Group (JAG), the Tokyo-listed holding company for several environment-related businesses, and two key subsidiaries. The deal reportedly faces opposition from activist investors, with funds run by family members of Yoshiaki Murakami building up a stake in JAG.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.