Sequoia India leads $30m round for Indonesia's Bibit

Sequoia Capital India has led a $30 million investment in Bibit, an Indonesian robo-advisory app for first-time investors.

Existing backers East Ventures, 500 Startups, AC Ventures, and EV Growth also participated. EV is a joint venture between East, Yahoo Japan, and Indonesian conglomerate Sinar Mas Group. AC was formed last year through the merger of Convergence Ventures and Agaeti Ventures.

"Consumers across the world are moving their savings from low yielding assets like gold, real estate to higher-yielding financial products," Rohit Agarwal, a vice president at Sequoia India, said in a statement. "In Indonesia, Bibit has become the most trusted platform for millions of consumers with its well-balanced portfolio that offers the best risk-adjusted returns."

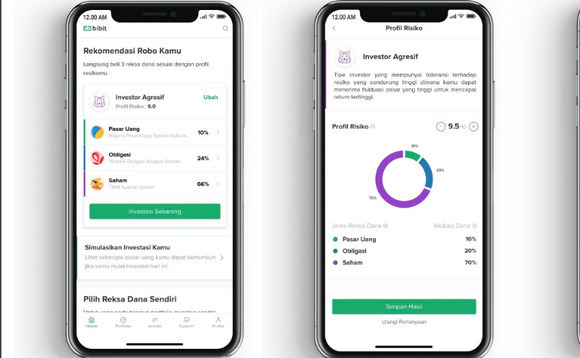

Bibit was launched in early 2019 by Stockbit, a nine-year-old start-up that began as a news and information-sharing portal for millennial investors. Bibit is said to democratize capital market investment by facilitating effortless portfolio-building for inexperienced investors. The service allows users to invest starting from as low as $1.

More than one million first-time investors have registered with the platform during the past year, 92% of whom are aged 21-40. According to Willson Cuaca, a co-founder and managing partner at East Ventures, Stockbit has been positively impacted by the pandemic, with Bibit tracking more than 10x growth in transactions during 2020.

East led a round of undisclosed size for Stockbit in 2019 with support from 500 Startups and Convergence, as well as Indonesia's IdeoSource Venture Capital, Japan's FreakOut, and the UK's Braavos Ventures. 500 Startups and IdeoSource had previously backed the company in 2017 and 2015, respectively.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.