North America

US logistics AI start-up gets $100m for Asia entry

US-based Altana Technologies, an artificial intelligence (AI) and analytics provider for the logistics industry, has raised USD 100m in Series B funding with plans to open a Singapore office in early 2023.

GP selection: Discriminating customers

Sizeable LPs are hardening their criteria for fund commitments in reaction to a tougher investing environment. But going with fewer, deeper relationships is an uphill climb

Deal focus: GPs pile into US-India tech corridor

US and India-based Accion Labs continues to collect private equity backers as it further globalises its IT services offering. Incoming investors don’t want to shake up the winning formula

Brookfield commits $500m to carbon recycling specialist LanzaTech

Brookfield Renewable, a business controlled by Brookfield Asset Management, has agreed to invest USD 500m in LanzaTech, a US carbon recycling specialist with a significant Asia presence.

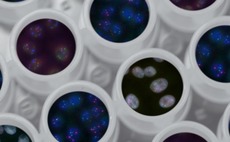

China's Neushen Therapeutics gets $20m pre-Series A

China’s Neushen Therapeutics, a biotech developer focused on central nervous system (CNS) disorders, has raised USD 20m in pre-Series A funding led by local VC firm Lapam Capital.

India's True North buys stake in TA-backed Accion Labs

Indian middle market private equity firm True North has acquired a significant minority position in US and India-based IT provider Accion Labs from TA Associates for USD 93m.

China semiconductor: Casualties of war

Private equity investment in China’s semiconductor industry continues unabated despite intensifying US regulatory action. While start-ups are not explicitly targeted, many are feeling the heat

Bessemer closes latest global VC fund on $3.85b

US-based Bessemer Venture Partners, which is currently expanding a longstanding presence in India, has closed its latest global VC fund with USD 3.85m in commitments.

Q&A: Unitus Ventures' Surya Mantha

Indian returns-focused impact investor Unitus Ventures is sharpening its thesis around jobs as it celebrates its 10-year anniversary. Surya Mantha, a managing partner at the firm, traces the evolution

Fund focus: Cherubic continues to scale

Early-stage investor Cherubic Ventures initially struggled to get traction with its idiosyncratic Greater China-US strategy, but the firm sees its USD 110m haul for Fund V as validation of the thesis

Prosperity7 backs China-founded unstructured data specialist Zilliz

Prosperity7 Ventures, a venture capital fund established by Saudi Arabia state oil giant Saudi Aramco, has led a USD 60m Series B extension for China-founded open-source software developer Zilliz.

CPPIB puts $236m into Asia co-investments in second quarter

Canada Pension Plan Investment Board (CPPIB) defied the recent slowdown in Asia private equity investment to deploy more than CAD 300m (USD 236m) across five deals alongside portfolio GPs between April and June.

US private debt player Waterfall launches in Hong Kong

Waterfall Asset Management, a US alternatives manager primarily active in the private debt space, has established an Asia presence with the opening of an office in Hong Kong.

India's CleverTap raises $105m Series D

India and US-based customer engagement platform CleverTap has raised a USD 105m Series D round led by Caisse de depot et placement du Quebec (CDPQ).

Singapore's Capital Square revises StarTek take-private bid

Singapore-based private equity firm Capital Square Partners is continuing its bid to privatise US-listed outsourced customer engagement platform StarTek, having revised its targeted valuation downwards in the wake of market volatility.

Carlyle CEO Kewsong Lee steps down

Kewsong Lee has resigned as CEO of The Carlyle Group just over two years since assuming the role on a solo basis, with co-founder Bill Conway taking over in an interim capacity.

Portfolio: CBC Group and Ensem Therapeutics

CBC Group plans to allocate USD 300m from its latest flagship fund to a biotech incubation platform. Artificial intelligence-enabled drug discovery player Ensem Therapeutics is an example of what it wants to achieve.

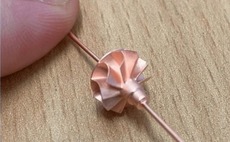

Deal focus: China start-up mines 3D printing's micro potential

Supported by a string of Chinese investors, Boston Micro Fabrication has carved a niche serving global manufacturers that want 3D printing solutions for very small components

Affirma supports Korea's NPX in Terapin Studios deal

Affirma Capital has confirmed a USD 38m investment in Terapin Studios, a US-based media platform controlled by Korea’s NPX Capital focused on bringing Korean digital comics to global markets.

Shenzhen Capital leads Series C for miniature 3D printing player

Shenzhen Capital Group has led a USD 43m Series C round for China and US-based Boston Micro Fabrication (BMF), which specialises in microscale 3D printing systems.

India's ChrysCapital adds US-based operating partner

India's ChrysCapital Partners has appointed Sanjay Jalona, formerly CEO of the IT division of Indian engineering conglomerate Larsen & Toubro, as an operating partner based in the US.

B Capital raises $250m for global early-stage fund

Los Angeles and Singapore-headquartered B Capital Group has closed its first dedicated early-stage fund with USD 250m in commitments. It will target the US and Asia.

Deal focus: SJL fills Korea's cross-regional gap

Steve Lim launched SJL Partners to help Korean corporates pursue M&A in the US and Europe, having seen global GPs pass on such opportunities. Meridian Bioscience is the latest addition to the portfolio

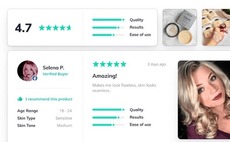

Australia customer reviews specialist gets $26m Series A

Okendo, an Australia-founded customer review platform for e-commerce brands, has received USD 26m in Series A funding led by US venture capital firm Base10 Partners.