Portfolio: CBC Group and Ensem Therapeutics

CBC Group plans to allocate USD 300m from its latest flagship fund to a biotech incubation platform. Artificial intelligence-enabled drug discovery player Ensem Therapeutics is an example of what it wants to achieve.

The disruptive impact of artificial intelligence (AI) on drug development has been profound. It is increasingly used to accelerate the initial stages of the discovery process – predicting novel targets, imaging molecules, and generating compounds at speeds far beyond human capacity.

DeepMind Technology, an AI subsidiary of Alphabet, Google's parent company, has become a prominent force in this space through AlphaFold. The programme applies deep learning to understanding how chains of amino acids fold to form three-dimensional proteins. Predicting protein structure is a key aspect of drug design, typically requiring considerable time and cost.

AlphaFold launched its open-access database in 2021 and last month updated it to include the structures of around 200m proteins from 1m species, covering nearly every known protein. The resource has encouraged more start-up founders to consider AI applications in drug discovery.

Sean Cao and Kevin Chen, both investment professionals at specialist healthcare private equity firm CBC Group, made this a focus of their incubation efforts. However, they deviated from the traditional path by using AI to identify hard-to-drug oncology targets rather than accelerating mainstream development processes. This results in the establishment of Ensem Therapeutics last year.

"We believe the biggest impact will be leveraging the technology to drug the undruggable. While using AI to speed up the drug development process generates incremental value, our approach creates something from nothing," said Cao, a managing director at CBC and also CEO and co-founder of Ensem.

The strategy is partly inspired by US-based Relay Therapeutics, which became the second AI-driven drug developer to go public – following in the footsteps of acknowledged industry pioneer Schrodinger – in July 2020. Relay claims to replace traditional structure-based drug design with a motion-based process underpinned by machine learning and other hard technologies.

The key point is motion: it can be hard to distinguish between a mutant protein and a wild-type protein when they are static; it is easier when they are moving because they follow different patterns. Relay's motion-based drugs hone in quickly on mutant proteins, which minimises the toxic effects of treatment on the body. Ensem is taking a similar approach.

"In the same way, sister proteins bear similarities or even are identical in certain aspects, but some relate to pathology and others relate to normal physiology," Cao explained. "In this case, if you want to deliver precision medicine by analysing the static structure, you can't find any place to make a drug. That's why motion-based drug discovery creates value."

Sourcing ingredients

CBC is still best known for backing companies that license nascent treatments from the US and develop drugs for the China market, focusing on situations where there is a clear path to commercialisation. However, incubating start-ups that develop their own intellectual property (IP) and can potentially serve global markets, is increasingly part of the strategy.

The blueprint generally involves establishing a business model – and in some cases identifying source IP – and then recruiting industry experts to lead the execution. For Ensem, it picked Cheng Luo, a professor at the Chinese Academy of Sciences, and Qi Zhang, an associate professor at the University of North Carolina at Chapel Hill.

Luo is a specialist in computer-aided drug design. Zhang is a pioneer in nuclear magnetic resonance (NMR) spectroscopy which is used to identify proteins. Specifically, it provides a dynamic view of structural biology that captures biomolecular motions at atomic resolution. Both professors are familiar with using computational and experimental methods to find non-obvious solutions.

With Luo and Zhang joining as scientific co-founders, the next recruitment challenge was finding someone to lead Ensem. This wasn't straightforward. Many AI drug discovery start-ups focus on calculation algorithms, but CBC wanted to prioritise pipeline development because that has a greater impact on valuation and upside potential. An experienced drug developer was required.

"How a company applies technology is an important determinant of its success," said Shengfang Jin, who was named co-founder, president, and chief scientific officer of Ensem last year.

"AI companies that are more computationally focused are often disconnected from real drug discovery. Ensem, on the other hand, starts with innovative drug discovery as its foundation and integrates AI and machine learning into the process to address specific questions that are relevant and practical to drug discovery."

Jin previously headed up drug discovery biology at clinical-stage gene editing company Editas Medicine. However, the clinching factor for CBC was her earlier experience overseeing the small molecule cancer metabolism and rare genetic disease portfolios at US-based Agios Pharmaceuticals.

Agios holds the speed record for taking an entirely new drug target from discovery – identifying the correlation between target and tumour – to commercialisation. It was an eight-year process. Jin was the third employee and helped build Agios into a business with over 600 staff and USD 5bn in market cap. It has developed three first-in-class drugs; two were collaborations with Schrodinger.

Cao met more than a dozen candidates as part of the recruitment process. He didn't treat these as one-way interviews; there was also a desire to obtain feedback on the Ensem model – which was still in the early stages of conception – from industry veterans. Jin wasn't headhunted in the conventional sense. Cao was visiting a friend and it turned out that friend's wife, Jin, was a good fit.

They have lift-off

Jin's arrival in May 2021 coincided with Ensem's official launch. She expected team-building to be the major challenge, but then struck lucky when Agios announced the sale of its oncology portfolio. Jin brought five former colleagues, all vice president-level drug discovery experts, to Ensem.

"These people have not only successfully made first-in-class drugs, but they have also worked together as a team, so when they came, they progressed very quickly," Cao observed.

The Ensem team, led by drug developers with scientists contributing on the technology integration side, now numbers 20. Most focus on R&D. Jin is wary of expanding headcount too quickly for fear of undermining the culture. Near-term recruitment priorities include experts in machine learning and chemical manufacturing. The latter will oversee production of drug capsules for use in clinical trials.

Agility lends itself to swift movement. The company's pipeline features six assets, led by a cell cycle driver that targets a series of cancers with similar genetic make-up, including lung, breast, and ovarian. Animal testing has already begun. Ensem has also filed five patents relating to the discovery of novel structures for small-molecule drugs.

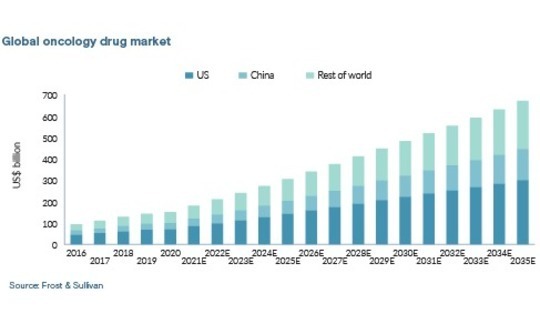

These are standard targets in global biotech. Frost & Sullivan projects the oncology market will be worth USD 670.4bn by 2035, up from USD 180.7bn in 2021, with China and the US accounting for 22% and 45%, respectively. However, CBC hopes Emsem's technology can deliver growth in areas beyond the reach of other start-ups. The initial fruits of its labours will become apparent in 2025.

"For a company like Agios, on the day we filed an IND with the FDA, we started making medicines. We didn't waste a single day. The FDA approved it on day 30, and on day 32 we had patients taking Agios medicine. That's the kind of speed you can achieve as a small start-up where you plan ahead strategically and have all ducks lined up in a row," said Jin.

Going early

CBC also recognises the merits of a concentrated and nimble approach. The firm is becoming ever larger, adding healthcare infrastructure and royalty strategies, expanding beyond China and closing its latest flagship fund on USD 1.67bn, double the previous vintage. However, Wei Fu, founder and CEO of CBC, has earmarked USD 300m of the new fund to incubate 6-8 start-ups.

"While the previous strategy was basically to incubate large platform companies with many products and R&D directions, the current incubation is more precise and focused," he said, referencing the new incubation platform, known as ABio-X.

"Under one incubation platform, we will incubate multiple companies with a clear focus on different fields. The incubation process is more like a standardised industrialisation concept."

ABio-X will centralise core corporate functions, such as human resources, business development, and capital raising. It will also bring in industry veterans with specific areas of expertise to work across the portfolio. For example, Mengdi Wang, an associate professor at Princeton University and visiting research scientist at DeepMind, signed on as a consultant in January.

Wang, who already has a PhD student working as an intern at Ensem, will help the ABio-X incubees to recruit the most appropriate AI talent. More importantly, she has also been named scientific co-founder of Ensem's next AI drug discovery project, which focuses on large-molecule treatments.

CBC has a track record of leveraging external investment to support its large platform plays as they grew in scale. Ensem will do the same. It recently closed a USD 67m Series A round featuring the likes of GGV Capital, Alibaba Group, Temasek Holdings-owned Pavilion Capital, and Japan's Mitsui & Co. CBC contributed a first tranche of USD 30m and the other investors joined a second of USD 37m.

"In the second and third quarters of last year, I reminded all our portfolios that they needed to start fundraising. Ensem closed its Series A in April, but the work began nine months before then," said Fu, with a nod to the capital-raising freeze that has afflicted biotech globally since the first quarter.

"We try to pass on our experience to first-time entrepreneurs. When the market is not good, you really need to spend carefully and only spend where you should."

Global growing pains

During the Series A process, Jin was asked whether Boston-based Ensem would relocate its headquarters to China. There are no plans to do that, given Boston's status as a biotech talent centre. Fu, for his part, believes the notion of a headquarters is outdated in a biotech industry that is increasingly borderless. To be globally competitive, talent must be sourced wherever it can be found.

That said, building a global biotech business isn't easy. Numerous Chinese companies, in life sciences and other industries, have sought to establish footprints in multiple markets only to be frustrated by an inability to recruit and retain local teams and create an integrated corporate culture. Ensem hasn't run into this problem because it is multicultural by necessity as well as by design.

"We empower every team member, so there is a sense of ownership. When we hire someone, we invite everyone else to participate in the process and voice any objections," said Jin. "We want everyone's ideas to matter because, in science, there is no age difference, no pedigree difference, no hierarchy difference. That's how we establish a corporate culture."

In this respect, the start-up reflects the investor that incubated it. CBC started recruiting globally from an early stage, stressing the importance of local talent in identifying opportunities to build businesses into and out of China. The GP claims to approach portfolio companies with a similar mindset, trusting individual teams and allowing them a high degree of autonomy.

"I hope that by the time a portfolio company is 18 months old, it can be completely independent and we become invisible," said Fu. "I don't care how many shares or how much say we have, the only goal is to make the company successful."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.