Exits

Baring, Quadrant claim firm of the year prizes at AVCJ Awards

Baring Private Equity Asia (BPEA) and Quadrant Private Equity won the firm of the year prizes at the 2021 AVCJ Private Equity & Venture Capital Awards, as KKR and NewQuest Capital Partners secured two victories apiece, and Weijian Shan received the AVCJ...

India's Nykaa trades up after $719m IPO

India-based beauty e-commerce platform Nykaa is trading at more than 100% premium to its IPO price after completing a INR53.5 billion ($719 million) offering that facilitated partial exits for TPG Capital and Lighthouse Funds.

Potentia exits Australia SaaS provider to UK strategic

Australia’s Potentia Capital has exited compliance software-as-a-service (SaaS) supplier CompliSpace to UK-based Ideagen for about A$110 million ($81 million) after a less-than-two-year hold.

Southeast Asia IPOs: Opportunity knocks

A breakthrough offering in Indonesia and regulatory progress in Singapore highlight Southeast Asia’s growing viability as a tech IPO market. It’s unclear how well this is being communicated globally

North Asia IPOs: Welcome eruptions

A steady rhythm of small and mid-sized IPOs in North Asia is now being punctuated by globally noticeable events. Valuations are up, but Korean and Japanese investors are game

Hong Kong IPOs: Winner by default

New York’s loss is expected to be Hong Kong’s gain as regulatory and political turbulence drives Chinese start-ups to look for alternative listing destinations – unless valuations become a sticking point

Singapore audience data business sold to trade buyer

US data and analytics services provider Dun & Bradstreet has agreed to acquire Singapore audience data business Eyeota, setting up exits for several private equity investors.

PE-backed Delhivery files for India IPO

India-based e-commerce logistics provider Delhivery is looking to raise up to INR74.6 billion ($1 billion) through a domestic IPO that would facilitate partial exits for The Carlyle Group, Fosun Group, SoftBank Vision Fund 1, and Times Internet.

Baring Asia buys Tricor from Permira for $2.7b

Baring Private Equity Asia (BPEA) is set to expand its corporate services provider portfolio, having agreed to buy Tricor Group from Permira for an enterprise value of $2.76 billion.

PE-owned APM Human Services set for $743m Australia IPO

APM Human Services, an Australia-based employment services provider with operations in 10 countries, is looking to raise A$986.2 million ($743 million) through a domestic IPO that will facilitate a partial exit for Madison Dearborn Partners (MDP).

SPACs: Longer menu

As the US recovers from a glut in SPAC fundraising, Asian jurisdictions are launching their own regimes. Not every start-up is a good fit for New York. Is Singapore or Hong Kong a good fit for them?

CLSA completes exit from Japan cram school

CLSA Capital Partners (CLSA CP) has sold its remaining shares in Japanese cram school operator BC Ings to Eishinkan, a major player in the segment.

Reliance Retail buys Indian fashion brand, Everstone exits

Everstone Group has exited its minority position in India-based design house Rita Kumur after domestic behemoth Reliance Industries moved to buy a 55% stake in the company.

Hahn & Co's K Car raises $285m in Korean IPO

K Car, a Korean automotive marketplace created by Hahn & Company through the merger of SK Encar and Joy Rent a Car, has raised KRW336.6 billion ($285 million) in a domestic IPO.

PE-backed Abbisko trades up after $225m Hong Kong IPO

China-based oncology drug developer Abbisko Therapeutics gained nearly 10% on its Hong Kong trading debut following a HK$1.75 billion ($225 million) IPO.

3Q analysis: India advances

India technology investment continues to ramp up as China flatlines; international payments M&A drives Asia trade sale revival, but IPOs slump; fundraising remains slow

Stonebridge Ventures targets Korea IPO

Stonebridge Ventures, a Korean venture capital firm with more than KRW700 billion ($595 million) in assets under management, has filed to list on KOSDAQ.

Eneos to buy PE-backed Japan Renewable Energy for $1.8b

Eneos Holdings, an oil company and active technology investor, has agreed to acquire Japan Renewable Energy (JRE) from Goldman Sachs Asset Management and GIC.

China in six trends

Key themes in China private equity fundraising, investment, and exits

PE-backed MicroTech Medical targets $254m Hong Kong IPO

MicroTech Medical, a China-based manufacturer of insulin pumps for diabetes sufferers that counts Lilly Asia Ventures (LAV) and Qiming Venture Partners among its investors, is looking to raise up to HK$1.98 billion ($254 million) in a Hong Kong IPO.

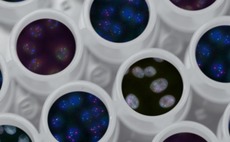

China biotech start-up LianBio files for US IPO

LianBio, a two-year-old Chinese biotech start-up incubated by life sciences investor Perceptive Advisors, has filed for a US IPO.

Allegro sells New Zealand retailer to Pencarrow

Australian turnaround investor Allegro Funds has sold The Interiors Group – a New Zealand-based home interiors retailer formerly known as Carpet Court – to Pencarrow Private Equity.

Q&A: Poema Global's Homer Sun

Morgan Stanley Private Equity Asia’s former CIO explains why he likes special purpose acquisition companies (SPACs) and what drew him to electric scooter and mobility technology player Gogoro

PE-backed Oyo targets $1.1b India IPO

Oyo, an India-focused budget hotel platform backed by the likes of SoftBank Vision Fund, is looking to raise up to INR84.3 billion ($1.1 billion) through a domestic IPO.