IPO

Cashlez gains on debut after Indonesia IPO

Indonesian mobile point-of-sale solution provider Cashlez - a portfolio company of Mandiri Venture Capital - traded up on debut following an IDR87.5 billion ($5.7 million) domestic IPO.

China's Kingsoft Cloud files for US IPO

Kingsoft Cloud, China’s largest independent provider of cloud-based IT services, has filed to list in the US. Kingsoft Corporation and Xiaomi, the two largest shareholders, have indicated they will commit $75 million to the offering.

Akeso Biopharma trades up after $333m Hong Kong IPO

Akeso Biopharma, a private equity-backed Chinese drug developer specializing in treatments that use the immune system to fight cancer, saw its stock jump 50% in early trading on the Hong Kong Stock Exchange following a HK$2.58 billion ($333 million) IPO....

HighLight-backed Zentalis raises $165m in US IPO

Zentalis Pharmaceuticals, a US-based cancer drug developer, raised $165.2 million in its NASDAQ IPO, facilitating a liquidity event for Chinese healthcare investment specialist HighLight Capital.

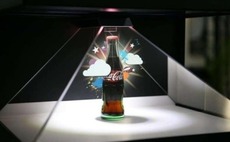

VC-backed Chinese AR start-up raises $26m in US IPO

WiMi Hologram Cloud, a PE-backed Chinese augmented reality (AR) technology developer, traded flat on its opening day on NASDAQ following a $26.1 million IPO.

Deal focus: Carlyle's SBI Cards bet pays out

The Carlyle Group achieved an 8x return through a partial exit via SBI Cards’ IPO. The private equity firm still holds a 16% stake and is a resolute believer in the growth potential of India’s credit card market

PE-backed InnoCare raises $288m in Hong Kong IPO

InnoCare Pharma, a private equity-backed Chinese drug developer focused on treatments for cancer and autoimmune diseases, has raised HK$2.24 billion ($288 million) through a Hong Kong IPO.

Carlyle secures partial exit from India's SBI Cards

The Carlyle Group has generated proceeds of approximately INR70.3 billion ($951 million) through a partial exit from SBI Cards & Payments, the State Bank of India's (SBI) credit card issuing arm, through a recent IPO.

Australia IPOs: Suspicious minds

A handful of bad experiences have made Australia’s public market investors wary of private equity-backed IPOs. This doesn’t mean offerings can’t get done, but the industry must address its profile problem

India's Barbeque Nation re-files for IPO

Indian restaurant chain Barbeque Nation has re-filed for an initial public offering that will provide an exit opportunity for its private equity investors.

PE-backed SBI Cards wins approval for India IPO

SBI Cards and Payments, the State Bank of India's (SBI) credit card arm and a Carlyle Group portfolio company, is looking to raise INR60 billion ($840 million) through a domestic IPO.

Japanese advisor matching network set for $54m IPO

VisasQ, a Japanese matchmaking platform that connects companies with relevant advisors, is looking to raise approximately JPY5.97 billion ($54 million) through a Tokyo IPO that will provide partial exits for several VC backers.

PE-backed Akeso Biopharma targets Hong Kong IPO

Chinese biotech player Akeso Biopharma has made a second attempt at filing for a Hong Kong IPO after its previous application was rejected last month for failing to meet regulatory requirements.

Advantage-owned Japanese funeral services business to go public

Advantage Partners is set to make a partial exit from Kizuna Holdings Corporation, a Japanese funeral services business it acquired for around JPY2 billion ($18 million) in 2016, through an IPO.

AVCJ Awards 2019: Firm of the Year - Mid Cap: Centurium Capital

China-focused Centurium Capital has enjoyed a productive 12 months, closing its debut US dollar fund, deploying most of the capital, and securing an early liquidity event

CITIC Capital targets OBOR deals with blank check company

CITIC Capital has launched a special purpose acquisition vehicle (SPAC) – or blank check company – on the New York Stock Exchange to pursue deals under its One Belt One Road (OBOR) strategy.

AVCJ Awards 2019: Exit of the Year - IPO: Innovent Biologics

Innovent Biologics has set a new standard for Chinese biotech, securing an innovative drug development tie-up with Eli Lilly and then completing a successful Hong Kong listing

China's Danke raises $130m in scaled back IPO

Chinese apartment rental platform Danke raised about $130 million in a smaller-than-expected US IPO that was primarily underwritten by existing private equity investors.

Asia PE fundraising falls 28% in 2019

Capital committed to Asia-focused private equity managers fell 28% year-on-year to $104.4 billion in 2019, largely due to a drop-off in activity in the pan-regional buyout and venture capital segments. Investments and exits were also down on the previous...

China's I-Mab falls on US debut after $104m IPO

China-based I-Mab Biopharma traded as much as 12% lower than initial pricing following the private equity-backed company’s $104 million IPO in the US.

China Feihe gains drive Morgan Stanley's investment revenue

Projected carried interest payments from Morgan Stanley Private Equity Asia’s (MSPEA) investment in Chinese dairy products company China Feihe were largely responsible for a near fivefold increase in annual investment revenue for the parent bank.

Timeline: 2019 by numbers

A selection of the key fundraising, investment and exit events - presented in chronological order - from the past 12 months

China's largest co-working player Ucommune files for US IPO

Ucommune, China’s largest co-working space player which is considered the local equivalent to troubled US operator WeWork, has filed for a US IPO.

Chinese drone maker EHang raises $40m in US IPO

Chinese drone manufacturer EHang traded flat on its NASDAQ debut following a $40 million IPO that priced at the bottom end of the indicative range.