Articles by Tim Burroughs

Australia's PEP ups target for latest secure assets fund

Pacific Equity Partners (PEP) has increased the target for its second Australia and New Zealand-focused secure assets fund to AUD 1.4bn (USD 949m), while pursuing a deal that would round off Fund I and fall into Fund II.

China's Moore Threads closes $218m Series B

Moore Threads, a China-based designer of artificial intelligence (AI) chips, has raised CNY 1.5bn (USD 218m) in Series B funding led by China Mobile Digital New Economy Industry Fund and Hexie Health Insurance, with participation from Dianshi Capital.

Hidden Hill joins $145m round for China's Sany Heavy Truck

Sany Heavy Truck, a subsidiary of Chinese heavy equipment manufacturer Sany Heavy Industry focused on developing new energy trucks, has raised nearly CNY 1bn (USD 145m) in Series A funding.

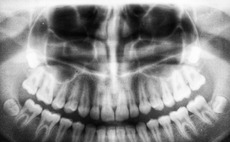

MBK buys Korea dental scanning player Medit, Unison exits

MBK Partners has agreed to buy Medit, a South Korea-based manufacturer of 3D dental scanners, for a valuation of approximately KRW 2.4trn (USD 1.88bn). The transaction facilitates an exit for Unison Capital’s Korea business.

Quadrant buys Australian healthcare equipment supplier

Quadrant Private Equity has bought a majority interest in Aidacare, an Australia-based distributor of healthcare equipment, with a view to supporting domestic and international growth.

MUFG invests $200m in Indonesia fintech player Akulaku

Akulaku, an Indonesia-based digital finance platform that has raised several rounds of venture capital funding, has received a USD 200m investment from Japan’s Mitsubishi UFJ Financial Group (MUFG).

NSSK exits Japan nursing care provider to Ricoh Leasing

Japan-based mid-market private equity firm NSSK has exited nursing care provider Welfare Suzuran to Ricoh Leasing, a Tokyo-listed leasing and finance company, for an undisclosed sum.

Asian basketball league secures Series C funding

East Asia Super League (EASL), a basketball league featuring teams from Greater China, Japan, South Korea, and the Philippines, has raised USD 40m as part of a yet-to-close Series C funding round.

China-linked EcarX, Lanvin complete SPAC mergers

EcarX, a smart mobility solutions provider backed by Chinese automaker Geely Auto Group, and Lanvin Group, a global luxury fashion platform established by Fosun Group, both completed mergers with US-listed special purpose acquisition companies (SPACs).

Anchorage buys Australian department store chain David Jones

Anchorage Capital Partners has agreed to buy Australian department store chain David Jones from South Africa-listed Woolworths Holdings (WHL).

Singapore's Doctor Anywhere raises $38m, makes acquisition

Southeast Asia-focused telehealth platform Doctor Anywhere has closed a second tranche of Series C funding worth USD 38.8m and acquired Singapore-listed Asian Healthcare Specialists (AHS).

KKR buys Japan's Bushu Pharmaceuticals from BPEA EQT

KKR has agreed to buy Japan-based contract drug manufacturer Bushu Pharmaceuticals from BPEA EQT – formerly Baring Private Equity Asia – for an undisclosed sum.

US regulator gets access to Chinese audits

The threat of delisting that has haunted Chinese companies that trade on US exchanges appears to have receded after the US regulators announced they had gained full access to the audits of these companies for the first time.

Campbell Lutyens recruits Suvir Varma as Asia chairman

Suvir Varma, formerly head of Bain & Company’s financial investor practice in Asia Pacific, has been appointed chairman for Asia Pacific at placement agent Campbell Lutyens.

AVCJ daily bulletin returns January 5

AVCJ's daily bulletin is taking a short break for the festive holiday season.

2023 preview: Buyouts

Even though debt is more readily available in Asia than in the US or Europe, financing costs are up, and buyout investors are reluctant to move for assets in an uncertain and overvalued market

2023 preview: Fundraising

Fundraising is difficult for all but the fortunate few private equity managers in Asia. GPs are delaying launches, shaking up strategies, and offering sweeteners; LPs are in no hurry to make commitments

2023 preview: Private debt

Asia-based private debt managers hope to take advantage of renewed LP appetite for the asset class, while enjoying higher returns driven by rising interest rates and widening spreads

To pastures new: Asia PE people moves

A selection of the transfers, promotions, arrivals, and departures in the private equity community in 2022

Q&A: Bain Capital’s David Gross-Loh

David Gross-Loh, a managing director and a founding member of the Asia business at Bain Capital, on expanding into Osaka, targeting large-cap carve-outs in Japan, and the availability of deal financing

Dalma Capital buys Singapore's Global CIO Office

Dalma Capital Group, a Dubai-headquartered alternative investment management platform, has agreed to buy The Global CIO Office, a Singapore-based outsourced CIO business that primarily serves family offices.

2022 in review: End of the party?

Fundraising favours the few; deployment becomes progressively slower as investors agonise about valuations, macro prospects, and financing costs; sponsor-to-sponsor deals prop up exits

Overallocation-driven secondary sales more talk than action – Coller

More LPs are considering sales of private equity positions via the secondary market as they find themselves overallocated to the asset class following sharp adjustments in public markets valuations, but Coller Capital has yet to see this translate into...

Australia's Potentia pursues two technology take-privates

Australia-based specialist B2B technology investor Potentia Capital appears to be continuing its pursuit of two listed companies – Nitro Software and Tyro Payments – despite several rejections.