China's Moore Threads closes $218m Series B

Moore Threads, a China-based designer of artificial intelligence (AI) chips, has raised CNY 1.5bn (USD 218m) in Series B funding led by China Mobile Digital New Economy Industry Fund and Hexie Health Insurance, with participation from Dianshi Capital.

The company, formed in late 2022 by a team from Nvidia, has now closed four funding rounds. Its Series A of CNY 2bn in late 2021 was led by Shanghai Guosheng Capital, 5Y Capital, and a BOC International fund. Its angel and Series A rounds amounted to several billion renminbi. The pre-Series A in February 2021 was led by Sequoia Capital China, GGV Capital, and Shenzhen Capital Group.

Other investors include CCB International, Qianhai Fund of Funds, China Merchants Securities, and Hubei High-Quality Development Industry Fund.

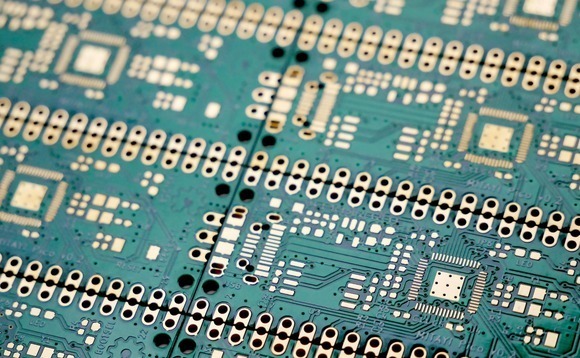

Moore Threads specialises in graphics processing unit (GPU) chip design, often referred to as AI chips. GPU is a general platform for visual computing and AI computing. It is used in autonomous driving, image recognition, big data analysis, and financial transactions.

The company has released two multi-functional GPU chips based on its Musa unified system architecture – Sudi and Chunxiao – as well as a series of GPU software stacks and application tools, which have been integrated into a variety of graphics cards. Application scenarios include desktop computing, edge computing, and data centres.

According to a statement, Moore Threads and several original equipment manufacturing (OEM) partners have won large purchase orders for desktop computing solutions from central state-owned enterprises and state-owned banks.

The company has also signed cooperation agreements with China Mobile Cloud and China Telecom Research to explore landing scenarios of multi-functional GPUs in cloud computing, metaverse-related new infrastructure, and ecological construction.

Beijing China Mobile Digital New Economy Industry Fund noted that intelligent computing will account for 70% of all computing power by 2030, with GPU-driven computing the most significant portion of this. Improved computing infrastructure is required across all scenarios, from cloud to game development to video and animation, to the metaverse.

It added that the multi-functional GPU developed by Moore Threads has "a wide range of platform versatility and full-stack computing capabilities, high technical barriers and difficult research and development, and is most likely to achieve technological breakthroughs and widely used."

The fundraise comes on the back of a challenging year for China's semiconductor industry. Although private equity and venture capital investment in the space increased over 2021, many smaller players went bust. On a broader level, the industry was also blighted by the ongoing China-US chip war and scandals linked to debt-laden Tsinghua Unigroup, China's one-time semiconductor pioneer.

"The semiconductor boom that started in 2019 attracted investors with no domain expertise, and this drove up valuations, but now that phase of high valuations has ended. This year and next year will be vintage years for semiconductor investment," said Raymond Yang, founding and managing partner of deep tech-focused WestSummit Capital, told AVCJ in September 2022.

He added that leading companies in the space are now raising capital at around half their targeted valuations; meanwhile, second-tier players are raising down rounds, if they can secure capital at all.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.