News

Australia's AGL rejects Brookfield, Grok Ventures bid

Australia-based utility AGL Energy has rebuffed another acquisition attempt from Brookfield Asset Management and Grok Ventures, a private investment firm established by Mike Cannon-Brookes, co-founder of Atlassian.

India's CredAvenue sees 3x valuation jump in six months

Indian small business credit platform CredAvenue has raised a USD 137m round featuring B Capital Group at a valuation of USD 1.3b, up 3x in the past six months.

Korean GP Credian sponsors $200m US SPAC offering

Seoul-based private equity firm Credian Partners has teamed up with CrystalBioSciences, a captive VC unit of biopharmaceutical company CrystalGenomics, to raise USD 200m for a US-listed special purpose acquisition company (SPAC).

Asia to account for 37% of global HNWI PE commitments by 2025 - study

High net worth individual (HWNIs) contributions to private equity are growing faster in Asia Pacific than anywhere else, with the region set to account for 37% of global commitments by 2025, up from 26% in 2020, according to a study by Boston Consulting...

HarbourVest closes latest fund-of-funds at $1.6b

HarbourVest Partners has closed its latest flagship private equity fund-of-funds, which will target Asia Pacific and Europe, at USD 1.6bn, beating a target of USD 1.25bn.

Creador makes second SE Asia food investment in five months

Malaysia-based Creador has acquired a significant minority stake in local food industry supplier Custom Food Ingredients for an undisclosed sum as part of a category platform play.

Accel raises $650m for seventh India fund

Accel Partners has raised USD 650m for its seventh India VC fund, which will also make early-stage investments in Southeast Asia. The firm’s total assets under management in the region now top USD 2bn.

BGH seeks regulatory action amid battle for Australia's Virtus

BGH Capital has asked Australia’s Takeovers Panel to intervene a second time in its pursuit of Virtus Health after the fertility care business resolved to engage with CapVest Partners and not entertain BGH’s improved offer.

China 3D cell culture business secures Series B

CytoNiche, a Beijing-based provider of 3D micro-structure engineering technology used for stem cell research, has raised nearly CNY 300m (USD 47m) in a Series B led by Gaorong Capital and CICC Capital.

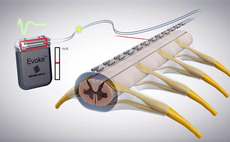

Australia's Saluda Medical raises $125m

US-based healthcare investor Redmile Group has led a USD 125m round for Australia’s Saluda Medical, a devices company focused on spinal cord stimulation.

India edtech player Filo gets $23m Series A

Filos, an India-based instant live-tutoring platform, has raised USD 23m in Series A funding led by US investor Anthos Capital. It is said to be the largest-ever Series A in India’s education technology space.

China's VC-backed Perfect Corp agrees $1bn SPAC merger

Perfect Corp, a Chinese software developer specialising in artificial intelligence (AI) and augmented reality (AR) solutions that allow consumers to experience brands, has agreed to merge with a US-listed special purpose acquisition company (SPAC) at...

CLSA acquires Japan childcare operator

CLSA Capital Partners (CLSA CP) has acquired a majority stake in Japanese childcare facility operator Task-Force for an undisclosed sum.

Headline leads Series B for Australian payments start-up Zeller

Australian payments provider Zeller has closed an AUD 100m (USD 73m) Series B round led by Headline, a US venture capital firm, and supported by domestic superannuation fund Hostplus.

China logistics player Jumeng raises $100m

Fortuna Capital has led a USD 100m investment in Shanghai truck-based logistics platform Jumeng Logistcs, described as the third tranche in a Series B round. IDG Capital also took part.

China's Qiming recruits partner from LACERA

David Chu, formerly of Los Angeles County Employees Retirement Association (LACERA), has become a partner at China-based Qiming Venture Partners with responsibility for fundraising and investor relations.

China 5G chip designer Cygnus raises $100m

Chinese 5G chip design company Cygnus Semiconductor has raised USD 100m in Series A funding and an extended pre-Series A round led by Matrix Partners China and Wofo Capital.

China e-commerce SaaS player secures $100m Series C

China-based e-commerce software-as-a-service (SaaS) provider Dianxiaomi has secured a USD 100m Series C round led by Tiger Global Management and Huaxing Growth Capital.

Australia's BGH closes Fund II on $2.6b

BGH Capital has closed its second fund on approximately AUD 3.6bn (USD 2.6bn) after fewer than six months in the market. It represents the largest-ever private equity vehicle raised for deployment in Australia and New Zealand.

Singapore's Volopay gets $29m Series A

Singapore’s Volopay, a B2B financial technology provider specialising in cross-border transactions, has raised USD 29m in Series A funding led by Justin Mateen, co-founder of Tinder.

Hong Kong's Future Fund to set up tech investment pool

A HKD 5bn (USD 640m) strategic tech fund will be established under Hong Kong’s Future Fund as part of an initiative to make direct investments that underpin the territory’s status as a hub for finance, commerce, and innovation as well as generate returns....

Crescendo closes third Korea fund on $910m

Korean middle-market private equity firm Crescendo Equity Partners has confirmed a final close of USD 910m on its third flagship fund, beating a target of USD 700m.

Sequoia, Legend back China autonomous driving player Inceptio

Sequoia Capital China and Legend Capital have led a USD 188m Series B extension for Inceptio, a Chinese autonomous driving technology developer that specialises in line-haul trucking.

Baring Asia completes $386m recap of CitiusTech

Baring Private Equity Asia (BPEA) has completed a USD 385.9m dividend recap and refinancing of loans tied to its 2019 acquisition of India-based healthcare IT services business CitiusTech.