Australia's Saluda Medical raises $125m

US-based healthcare investor Redmile Group has led a USD 125m round for Australia’s Saluda Medical, a devices company focused on spinal cord stimulation.

Additional investors included Fidelity Management & Research as well as T. Rowe Price. It brings total funding to date to at least USD 175m, including an AUD 53m (USD 39m) round led by an investment arm of GlaxoSmithKline in 2017.

Saluda's technologies alter the transmission of pain signals to the brain to treat debilitating neurological disorders. It executed the first double-blind pivotal randomised controlled trial in the history of spinal cord stimulation. This resulted in almost 90% of patients experiencing long-term pain relief and clinically meaningful improvements in quality of life, according to a statement.

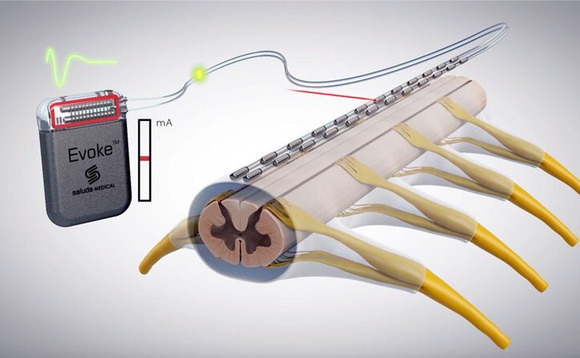

The company's first product, Evoke, is a closed-loop spinal cord stimulation system designed to treat chronic pain, a condition that affects more than 540m people globally. This is achieved by instantaneously reading, recording, and responding to the nerves' response to stimulation to provide continually optimised therapy.

Although spinal cord stimulation has been used as a treatment option for chronic pain since 1967, Evoke is the first system designed to automatically self-adjust based on a patient's unique spinal cord activity. It has investigational device status in the US and will not be available for sale in the country until it is approved by the local regulator.

Saluda will use the fresh capital to operationalise and scale the commercialisation of Evoke and advance its broader technology platform. Its previous investors include medical technology-focused VC firm Brand Capital, Biosciences Managers, a government vehicle in Australia. and OneVentures, as well as devices giant Medtronic.

Medical devices have steadily declined as an investment destination in recent years due to industry consolidation and increasing complications around regulatory hurdles, and commercialization processes. Specialist investors have continued to find value, however, in the potential to serve massive markets with relatively underdeveloped innovation ecosystems.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.